Yangtze Memory Technologies Co. (YMTC), the leading Chinese NAND flash memory manufacturer, is doubling down on technological self-sufficiency amidst escalating US trade restrictions. According to DigiTimes, the company plans to begin pilot production in the second half of 2025 of a fully equipped manufacturing line utilizing solely Chinese-made tools—an unprecedented milestone in China’s semiconductor ecosystem.

Since December 2022, YMTC has been on a US Department of Commerce restricted entities list, limiting its access to advanced lithography and wafer processing equipment. Rather than scaling back, the company has pursued an aggressive expansion plan, aiming for a production capacity of 150,000 wafers per month before year’s end and targeting 15% of the global NAND memory market by the end of 2026.

Focusing on Domestic Tools: Challenge and Opportunity

This experimental production line, which will operate using exclusively domestically developed tools, is viewed by analysts as a critical test to determine if China’s industry can match the technological prowess of sector giants like ASML, Applied Materials, or KLA. While local companies such as AMEC, Naura, and Piotech have demonstrated capabilities in etching and chemical vapor deposition, lithography remains a significant bottleneck, with China still heavily reliant on imports.

However, YMTC is at the forefront of localization efforts. Morgan Stanley estimates that it has replaced 45% of its equipment with domestically produced versions—more than the approximate 20% substitution rate seen at firms like Hua Hong and CXMT. Even the country’s largest foundry, SMIC, has a localization rate of only 18-22%, well below YMTC’s pace.

Cutting-Edge Production with Layered Stacking and 2TB Chips

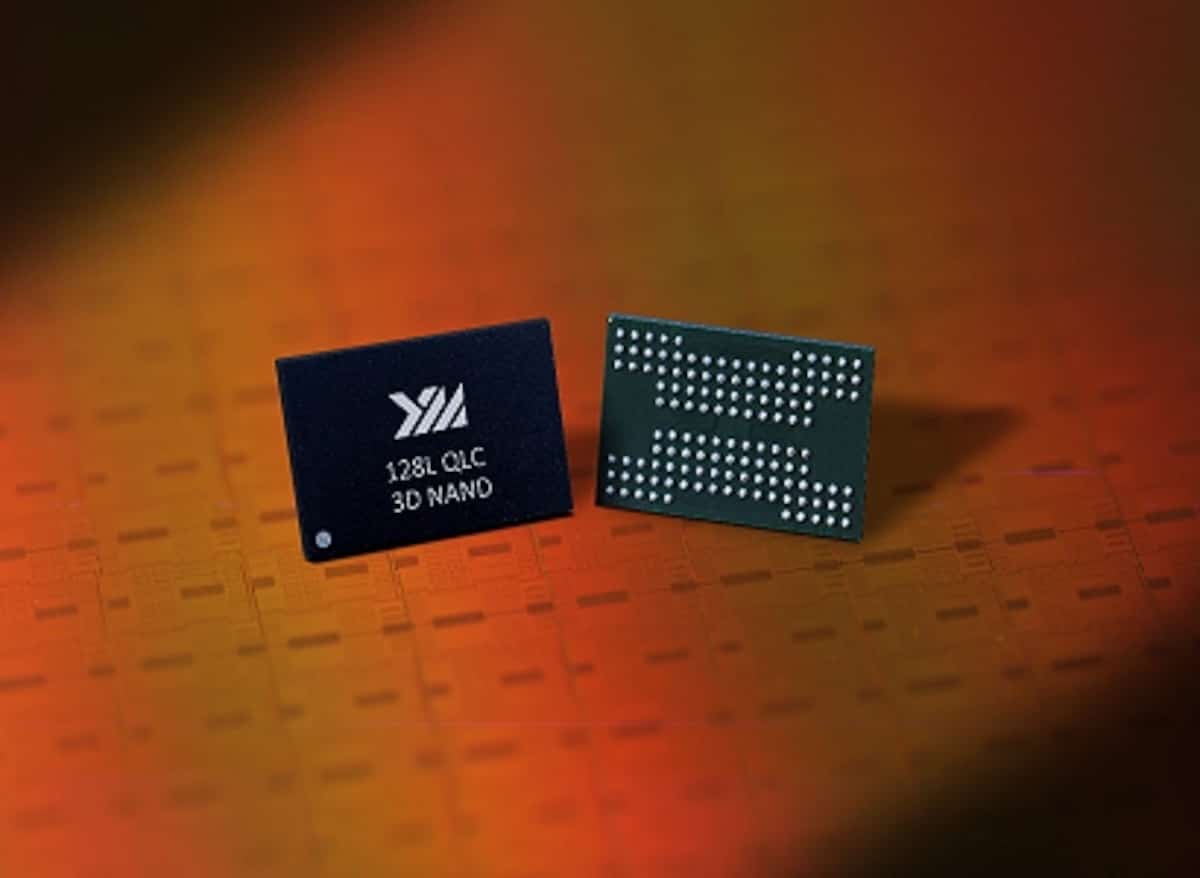

YMTC currently mass-produces its X4-9070 3D TLC NAND chip, which features 294 active layers—an architecture combining structures of 150 and 144 layers. The company also plans to launch a QLC version, the X4-6080, this year. By 2026, YMTC anticipates releasing the X5-9080 with 2TB capacity and the X5-6080 QLC model with an interface transfer rate of up to 4,800 MT/s, approaching the performance levels of Samsung and Micron.

Utilizing stacking techniques such as string stacking has allowed YMTC to partly circumvent US-imposed restrictions, which currently prohibit the export of equipment for chips exceeding 128 layers, though they do not restrict how layers are stacked. This has enabled YMTC to continue innovating, sometimes even using American tools acquired before the sanctions.

Ambitious Goals and Reasonable Doubts

Despite its strides, many analysts view the 15% global market share target for 2026 as optimistic. Even if YMTC were to boost its capacity beyond 200,000 wafers per month, technical challenges related to yield and production stability with domestically produced equipment remain significant.

A sector expert told DigiTimes, “The national production line is a proof of concept. If successful, it could scale up, but there’s no guarantee they can produce at the same efficiency as competitors on a mass scale.”

Further, the covert financing of local tool and material manufacturers through non-listed entities or intermediaries, along with the removal of branding labels from equipment—strategies to avoid attracting sanctions—highlight how quietly China is attempting to advance.

A Race Against Time and Restrictions

While international manufacturers are scaling back due to waning demand, YMTC is taking the opposite approach. Its aggressive growth forecast of over 10-15% annual increase in bits produced through 2025 reveals a geopolitically motivated strategy: securing domestic supply amid potential future tensions.

The YMTC case exemplifies one front in the broader technological contest between China and the US. The stakes extend beyond memory market dominance to control of future digital infrastructure. In this contest, the success or failure of a “made-in-China” production line might be decisive.