The mobile industry is entering an uncomfortable phase for traditional chip suppliers. Selling the “best SoC of the year” is no longer enough: increasingly, brands want to control their own silicon roadmap to differentiate themselves, optimize costs in the long term, and reduce dependencies. And Xiaomi, according to recent reports, is determined to take that strategy much further than many expected.

The move is based on a simple idea: if hardware becomes the bottleneck — in performance, energy, or availability — the manufacturer that controls its chip controls the product. In this context, the XRing project (its family of proprietary processors) is beginning to look like more than just a one-off experiment.

From a “star” chip to a complete family

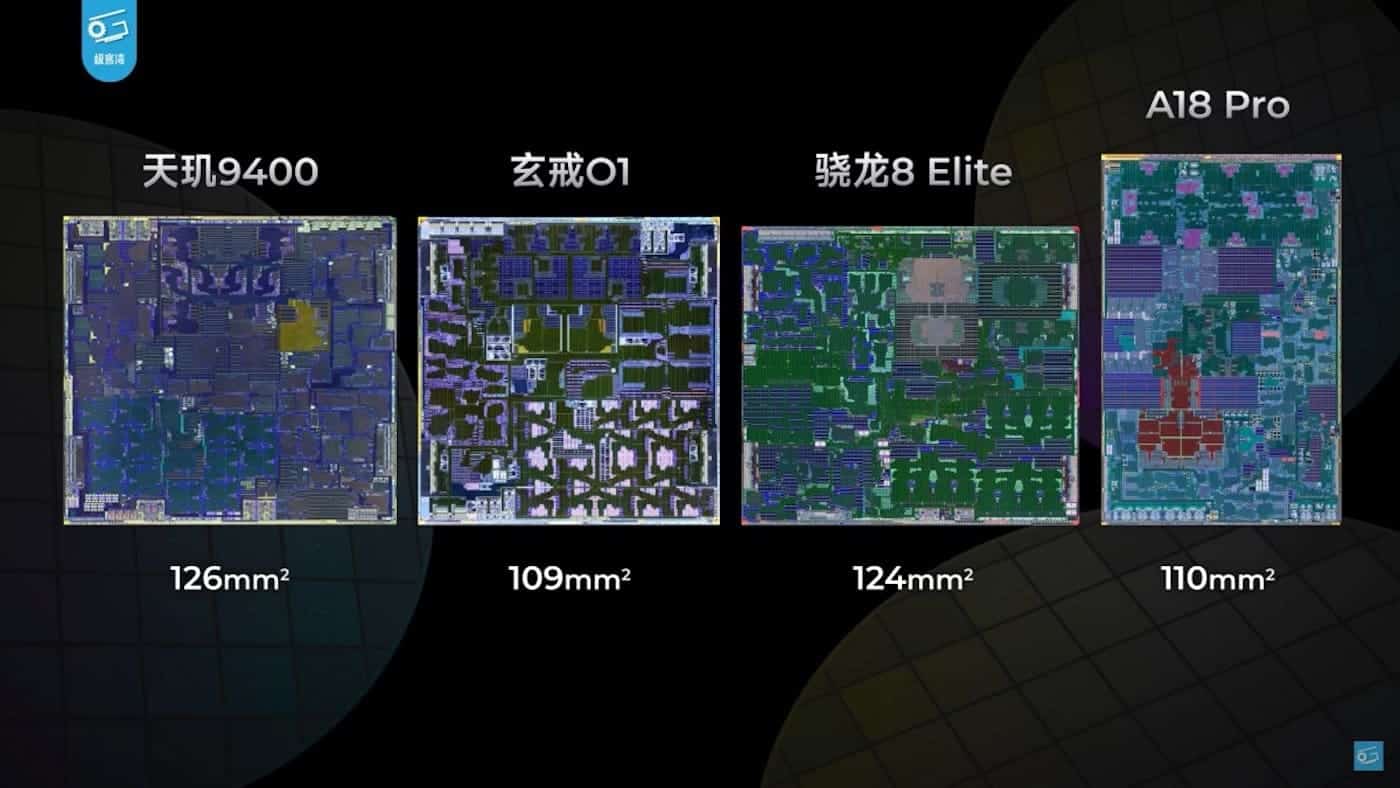

Xiaomi confirmed in 2025 that it would launch its own advanced mobile chip, the Xring O1, manufactured by TSMC on 3 nm and based on Arm architecture, as part of a serious push into high-end processor design. The company had previously toyed with proprietary chips (Pengpai S1), but had scaled back ambitions due to costs and complexity; now it returns with a clearly premium and strategic focus.

However, what’s most relevant is not just the O1. Industry sources suggest that Xiaomi is expanding the “XRing catalog” and that, beyond the smartphone line, it plans to extend these processors to non-telephone products (wearables and other ecosystem devices), which — if materialized — would change the game: it would no longer be “a chip for a mobile,” but a transversal silicon platform.

Why does this pressure MediaTek and Qualcomm?

Because the mobile chip business isn’t just about technology: it’s about volume, predictability, and high-end control.

- Qualcomm dominates much of the Android premium range with Snapdragon, and Xiaomi is (historically) one of its major clients in China and abroad. If Xiaomi incrementally shifts more high-end devices onto its own silicon, Qualcomm loses some of its most profitable share… or is forced to negotiate prices/terms to retain contracts.

- MediaTek, which has climbed significantly in mid-to-high-end ranges, could also be affected if Xiaomi decides to “close” more layers of the stack (CPU/GPU/NPU) internally, using external chips only where it makes sense.

That said, a full transition is very challenging. In smartphones, modems, RF, certifications, drivers, ISPs, and global compatibility work all represent a major hurdle. The most probable scenario (at least short-term) is a hybrid model: Xiaomi uses XRing for certain flagship, special edition, or regional markets, while continuing to rely on Qualcomm/MediaTek for the rest.

The next step: XRing O2 at TSMC N3P?

This is the part generating headlines: discussions about an XRing O2 as an evolution of the O1, supposedly aimed at improving performance/efficiency and manufactured on a more advanced TSMC node (referred to as N3P, a 3 nm iteration). This information has been attributed to “market sources” in Asian industry press and should be read as unofficial, unconfirmed information from Xiaomi, but aligns with the logic of a second-generation chip.

The regulatory context also weighs in: the US has tightened restrictions on advanced chips for certain uses in China, though the smartphone sector has generally been less affected than data center AI accelerators. Reuters, in fact, noted that restrictions have limited AI chip production for Chinese companies at advanced nodes, while smartphone chips continue to progress on that front.

The “non-smartphone” strategy: where movement could be faster

Adoption could be more agile in the ecosystem: watches, tablets, connected home devices, etc. Here, the bar for global compatibility and telco validation may be lower (depending on the product), and vertical integration offers clear advantages:

- Battery optimization and real performance (not just benchmarks).

- System integration (HyperOS and services).

- Differentiation through “on-device” functions (local processing).

- Less dependence on external schedules.

If Xiaomi manages to make XRing the “foundation” for multiple devices, the impact on suppliers wouldn’t be an immediate sales plunge but a more subtle shift: loss of negotiating power and gradual erosion in margins where profits are critical.

Quick table: what’s known (and what’s rumor) about XRing

| Chip | Node/Manufacturing | Focus | Status |

|---|---|---|---|

| XRing O1 | TSMC 3 nm | Premium smartphone | Confirmed (announced by Xiaomi) |

| XRing O2 | Mentioned TSMC N3P | Next-gen mobile + expansion | Reported by sources (not official) |

| XRing in “non-smartphone” | — | Wearables / ecosystem | Reported by industry press |

What’s coming: two likely scenarios

- Conservative scenario (more likely in 2026): Xiaomi uses XRing in a limited part of the high-end range (for learning, branding, and control), and maintains strong deals with Qualcomm/MediaTek for global volume.

- Ambitious scenario (2027+): if the O1/O2 chips mature and the ecosystem grows, Xiaomi could push XRing into more product lines, making it a “pillar” of the business, similar (though less integrated) to Apple with Apple Silicon.

In both cases, the message to the supply chain is clear: Xiaomi wants more control, prompting Qualcomm and MediaTek to act: more differentiation, better commercial packages, and possibly more focus on modems, connectivity, on-device AI, and developer tools.

Frequently Asked Questions

What does Xiaomi gain by designing its own XRing chips instead of using Snapdragon or MediaTek?

Control over schedule, deeper hardware/software optimization, genuine product differentiation, and in the medium term, higher margins with less dependence on third parties.

Does this mean Xiaomi will stop using Qualcomm or MediaTek?

Not necessarily. A hybrid approach is typical for years: proprietary chips for certain models, external chips for the majority, especially where modem and global compatibility are crucial.

What does the mention of TSMC N3P for XRing O2 imply?

That Xiaomi is trying to stay at the frontier of efficiency/performance within 3 nm. But for now, it’s based on information from industry sources, not an official announcement.

Why does this concern MediaTek and Qualcomm?

Because even a small percentage of “own silicon” in the premium range can reduce volume and, most critically, weaken the supplier’s negotiating power over prices and terms.