Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest contract chip manufacturer, has decided to cease its 6-inch (150 mm) wafer business within the next two years. This move is part of an operational optimization strategy aimed at concentrating resources on more advanced and efficient technologies, consolidating production on 8-inch (200 mm) and 12-inch (300 mm) wafers.

The company assures that the transition will be carried out in coordination with its clients to ensure supply continuity during the changeover and minimize disruptions in the supply chain. According to TSMC, this measure will not impact its sales forecast for 2025, which has already been revised upward, with an estimated 30% year-on-year growth in U.S. dollars driven by global demand for artificial intelligence applications.

A farewell to an iconic but less profitable technology

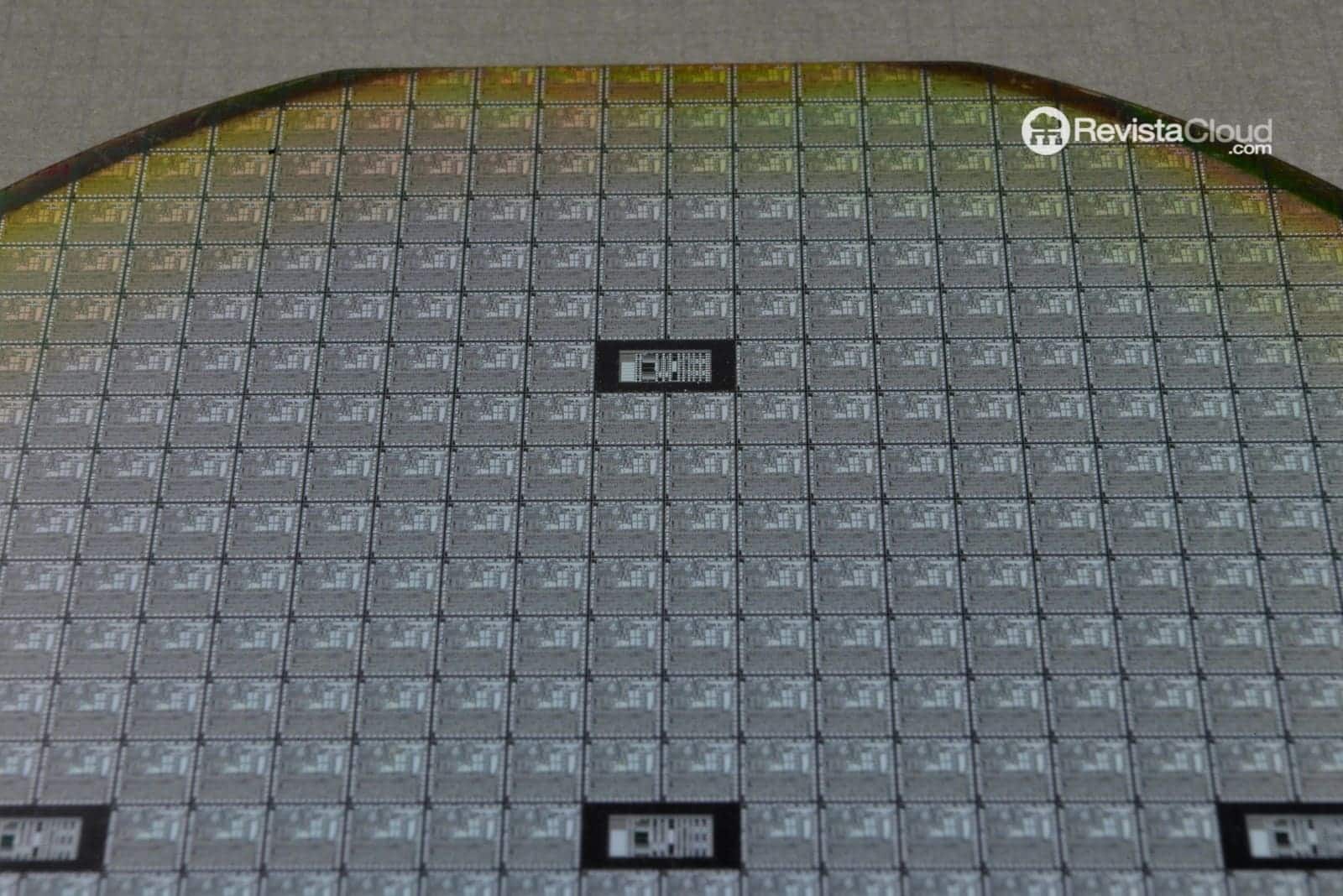

Manufacturing on 150 mm wafers, used for decades in mature and niche semiconductors, has become less competitive compared to larger sizes that yield more chips per production cycle. The industrial shift initially moved toward 200 mm wafers and later to 300 mm wafers, which are much more efficient for volume manufacturing.

In this context, TSMC has decided to close its last 6-inch plant in Taiwan. Local media such as Liberty Times report that Fab 2 and Fab 5, located in Hsinchu, will cease operations around 2027. These are relatively small facilities compared to the massive 300 mm “giga-fabs” the company runs elsewhere.

Reconversion for the AI era

While TSMC has not publicly detailed the future of these plants, Taiwanese media suggest they could be repurposed into advanced IC packaging centers. This shift would respond to the growing demand for packaging technologies in high-performance chips, particularly for high-performance computing (HPC) and AI applications.

This decision comes at a time when advanced packaging has become a key differentiator in the semiconductor market. With competitors like Intel and Samsung strengthening their capabilities in 3D packaging and chiplets, TSMC aims to maintain its leadership in a sector where efficiency depends not only on the process node but also on how components are integrated and connected.

Record investments and capacity expansion

Meanwhile, TSMC’s board has approved $20.66 billion in capital investments to expand its advanced technology production capacity, install new packaging lines, develop mature and specialty nodes, and build new factories with related infrastructure systems.

Additionally, the company will issue up to NT$60 billion (about $1.998 billion USD) in corporate bonds to finance its expansion and sustainability projects. It has also authorized an injection of up to $10 billion into TSMC Global, its international subsidiary, to reduce currency coverage costs.

Historic dividends and record profits

The second quarter of 2025 marked a record for TSMC, with net profits of NT$398.27 billion, driven by strong demand for chips used in AI, smartphones, IoT, and consumer electronics. The company will pay a dividend of NT$5 per share, matching the previous quarter’s level. TSMC President C.C. Wei will receive approximately NT$34.12 million from his shareholding.

Taiwan’s National Development Fund, the company’s main shareholder with a 6.38% stake, will collect NT$8.27 billion in dividends thanks to its ownership.

Frequently Asked Questions (FAQs)

Why is TSMC discontinuing 6-inch wafer production?

For efficiency and profitability reasons: larger wafers produce more chips per batch, reducing costs and increasing capacity.

Will this affect the availability of mature chips?

TSMC plans to transfer current clients’ production to its 8- and 12-inch plants, ensuring supply during the transition period.

What will happen to the factories that are closing?

While no official confirmation has been made, they are likely to be repurposed into advanced packaging centers for AI and high-performance computing chips.

Will this reduce TSMC’s revenue?

No. The company expects 30% growth in 2025, fueled by demand for AI and advanced technologies, and will continue investing in more profitable manufacturing capacities.

via: computerbase