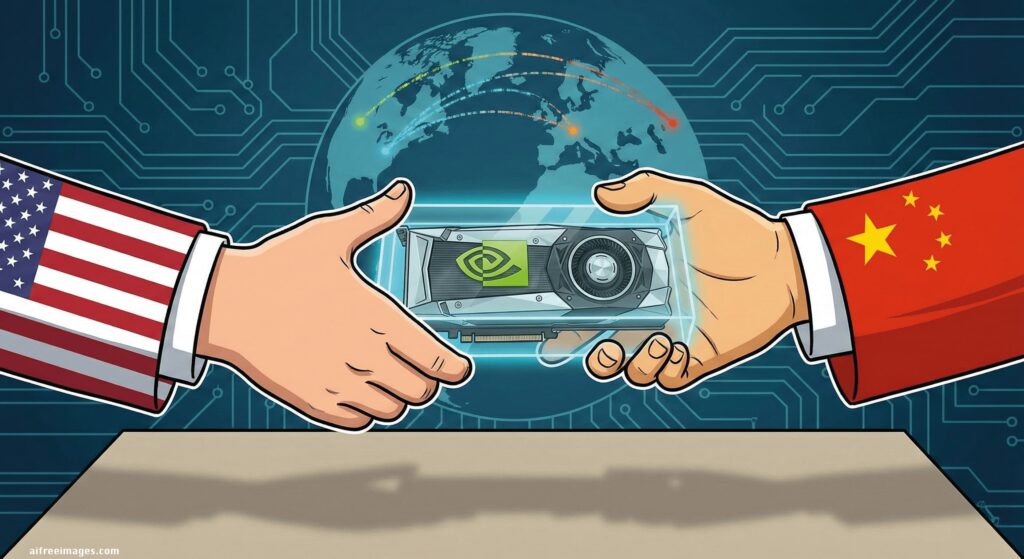

The United States has taken an unexpected turn in its tech war with China. President Donald Trump announced that he will permit NVIDIA to export its H200 accelerators — one of its flagship AI chips — to approved clients in China and other countries, in exchange for 25% of the revenue from those sales going directly to the U.S. Treasury.

This move, announced by Trump on his social media platform, comes after months of intense pressure from NVIDIA, which was concerned that export restrictions to China threatened one of its most important markets. At the same time, the White House aims to balance two difficult-to-reconcile objectives: maintaining U.S. leadership in AI and safeguarding national security against a strategic rival like Beijing.

What exactly did Trump announce?

In his message, Trump stated that he had previously informed Chinese President Xi Jinping that the U.S. would allow NVIDIA to ship its H200 products to approved Chinese customers “under conditions that maintain solid national security.” In return, 25% of the sales volume will go to the U.S. as a kind of “tax” or mandatory royalty.

The president also claims that this logic will extend to other U.S. chip companies such as AMD and Intel, criticizing the Biden Administration for forcing companies to produce “diluted” products for China that “nobody wanted,” referring to scaled-down versions of AI GPUs created to comply with export restrictions.

Excluded from the agreement are NVIDIA’s latest architectures:

- Blackwell, which is already starting to deploy among major U.S. clients.

- Rubin, the next generation, still in development.

According to Trump himself, these architectures are not part of the deal and will remain subject to stricter restrictions.

What is the H200 and why does it matter so much?

The H200 is an evolution of the H100, the chip that has dominated the generative AI market in data centers so far. It is designed specifically to train and run large language models and AI systems at scale, with memory bandwidth and performance levels far superior to consumer GPUs.

For China, legally accessing the H200 means reducing reliance on less advanced domestic solutions or “grey market” hardware imported through third countries. For NVIDIA, reopening this channel means reclaiming a multi-billion-dollar business at a time when global demand for AI chips continues to grow.

From total ban to the “25% tax”

Until now, the prevailing rule in Washington was clear: export ban on advanced AI chips to China for national security reasons. Under the Biden Administration, the Commerce Department expanded restrictions to successive generations of NVIDIA and other manufacturers’ GPUs, specifically limiting hardware capable of training high-level AI models.

Meanwhile, “controlled” exceptions had been made, such as for the H20 chip — a scaled-down version for the Chinese market — which was allowed for export with a 15% share of sales returning to the U.S. The agreement with the H200 goes a step further:

- It applies to a much more powerful and strategically relevant chip.

- It increases the American share to 25% of revenues.

Trump describes this approach as a way to protect national security, maintain AI leadership, and simultaneously boost U.S. employment and manufacturing. Critics, however, see it as a dangerous opening that gives China more computing muscle than necessary for civilian and military advancements.

Potential winners and losers

NVIDIA

- Gains access to a key market for a product that is no longer “cutting-edge” (with Blackwell and later Rubin above), allowing it to maximize monetization of its catalog.

- In return, it must forgo a significant portion of revenues but compensates with volume and the opportunity to continue investing in new architectures.

U.S. Government

- Secures a direct revenue stream tied to the AI boom without raising taxes or new internal tariffs.

- Reinforces the narrative that U.S. industrial policy supports local manufacturing and qualified employment.

- However, bears the political risk of being seen as softening red lines with China.

China and its major tech companies

- Gain access — under license and supervision — to one of the most advanced AI chips available, which will accelerate cloud projects, foundational models, and local AI services.

- Although they still can’t buy the latest (Blackwell, Rubin), the leap from less advanced local hardware is significant.

AMD, Intel, and other U.S. manufacturers

- If the model is replicated, they might benefit from a similar scheme: selling to China with a surcharge for the U.S., instead of being completely shut out.

- This would keep U.S. manufacturers — rather than alternative suppliers — at the center of the Chinese AI ecosystem.

A move amid the silicon war

This decision comes in a context of heightened tension in the so-called “chip war” between the U.S. and China. Washington has used export controls as a geopolitical tool for years. Meanwhile, Beijing is accelerating its own efforts in chip design and manufacturing to reduce reliance on foreign supply.

In parallel, U.S. congressional initiatives, backed by senators from both parties, are calling for even stricter controls, aiming to block any export of advanced AI chips to China for years. How this new agreement fits into that political climate, and how much resistance it may face from security hawks, remains to be seen.

China has also taken steps: its internet regulator has tried to restrict the use of certain foreign chips in strategic sectors, promoting homegrown solutions from companies like Huawei and Alibaba. The authorization to import the H200 reopens — at least partially — a door that seemed shut.

What might happen next

Practically, Trump’s announcement marks a new phase of tech realpolitik:

- The U.S. accepts that it’s better to control and tax some chip flows to China than leave that market to non-Western alternatives.

- China seizes the opportunity to continue advancing in AI with U.S. hardware, even if it’s not the latest generation available.

- And NVIDIA, along with other manufacturers, can monetize already amortized assets and reserve their most advanced chips for domestic clients and allies.

All under the crucial condition that the Commerce Department will determine which clients, volumes, and conditions are approved for export licenses. The balance between business interests and security remains fragile.

Frequently Asked Questions (FAQ)

What’s the difference between the H200 and the new Blackwell or Rubin generations?

The H200 is an evolution of the H100 and is part of NVIDIA’s current data center GPU lineup, offering high performance for training and inference of AI models. Blackwell and Rubin are next generations, with more power, efficiency, and AI-specific capabilities. These new architectures are excluded from Trump’s announced deal.

Does this mean China will have free access to the most advanced AI chips?

No. The agreement is limited to H200 and approved “licensed” clients under the U.S. Commerce Department. Cutting-edge ranges — Blackwell, Rubin — remain under much stricter restrictions, and any export of advanced AI hardware to China will continue to face heavy regulatory scrutiny.

Why does the U.S. keep 25% of sales?

This percentage acts as a kind of “strategic levy” with multiple purposes:

- Compensate for the risk of allowing export of an advanced chip.

- Generate revenue for the U.S. economy tied to the AI boom.

- Send a political message that these exports benefit taxpayers and employment in the U.S.

How might this move affect global AI competition?

In the short term, NVIDIA maintains its dominance by keeping China as a customer, even if for older products. In the medium term, the deal could delay China’s own chip development but also give Beijing more time and resources to push forward with its hardware efforts. The ongoing balance between technological leadership, business, and national security will remain a key debate of the decade.

via: Truth Social