A viral thread on X suggests that the debate over a possible “purchase” of Greenland by the United States is not mere political noise but a strategic move with military, industrial, and supply chain implications. The tone of the text is deliberately dramatic and blends real facts with negotiation conjectures. To understand what is behind (and what is not), it’s helpful to separate three levels: verifiable facts, structural interests, and plausible scenarios.

1) What is confirmed (beyond the thread)

a) The idea of “buying Greenland” is not new in Washington.

There is a historical precedent: after World War II, the US formally inquired about acquiring Greenland from Denmark, in a context of strategic consolidation in the Arctic.

b) Greenland’s military importance is real and does not depend on a purchase.

The island is located in a key position between North America and Europe for surveillance, early warning, and operations in the Arctic. Moreover, the US has maintained a military presence in Greenland for decades, and its space/missile warning and tracking infrastructure are central to its strategic value.

c) The novel aspect, if its political trajectory is confirmed, is the explicit use of economic levers.

The most “operational” part of the thread is not geography but economic pressure: public discussions of tariffs or other measures to force concessions (though the final scope depends on negotiations and institutional checks).

2) Why Greenland matters: geography, defense, and the opening Arctic

The thread hits on an important idea: Greenland is not just “a block of ice”. Its location gains significance through three reinforcing dynamics:

- Defense and early warning: the logic of polar routes and the interest in surveillance capabilities in the High North. This doesn’t mean the territory is “defenseless,” but it does mean the Arctic presents challenges in coverage, infrastructure, and reaction times.

- Great power competition in the Arctic: as the environment becomes more accessible (and contested), incentives grow to “secure” presence, agreements, and logistical capabilities.

- Alliance ecosystem: any move concerning Greenland strains the US–Denmark–NATO triangle and, by extension, relations with Europe.

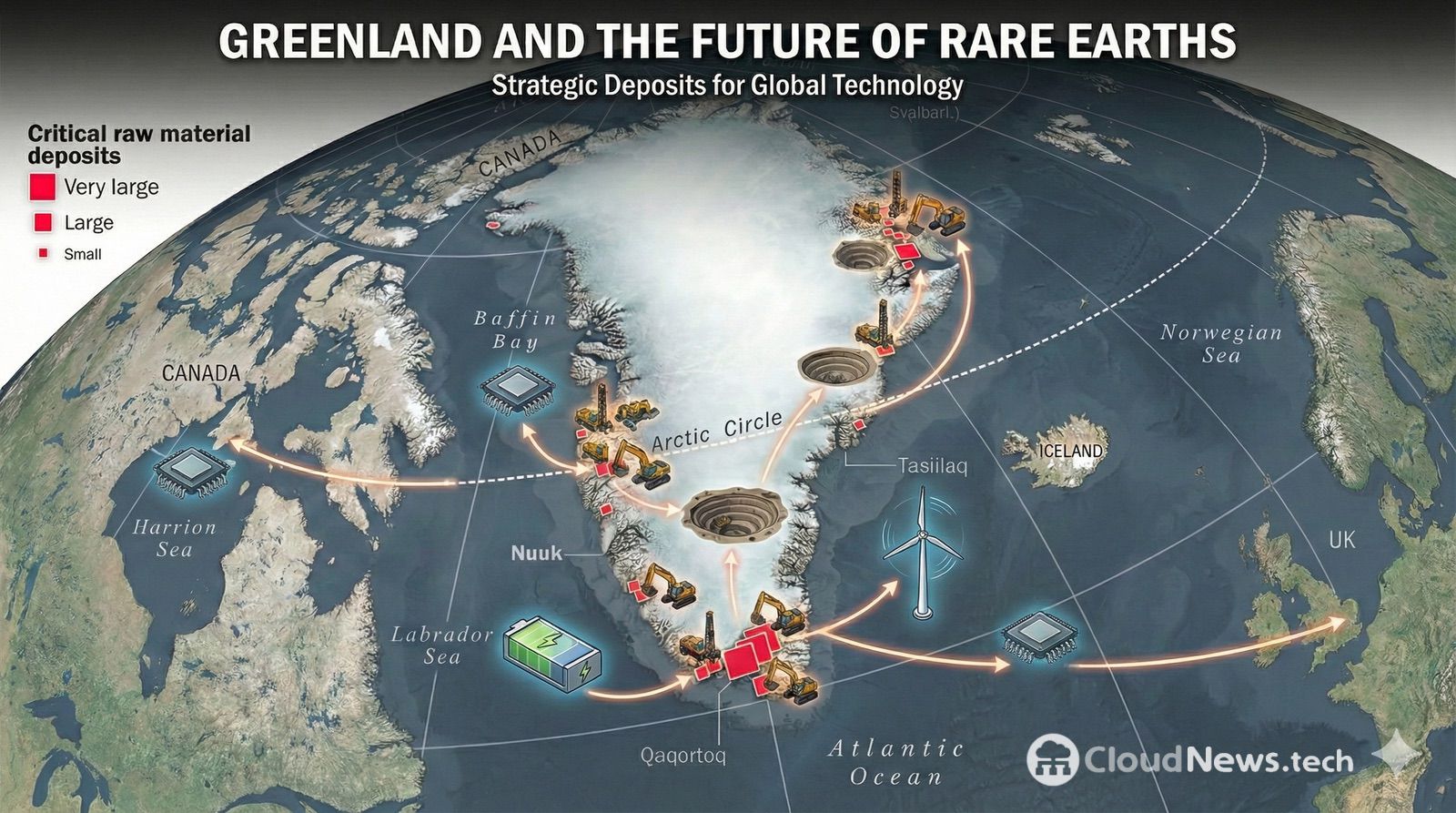

3) Resources: potential yes; “immediate treasure,” not necessarily

It’s also reasonable to highlight the interest in critical minerals (including rare earth elements) in Greenland. But the thread simplifies a key step: “having resources” doesn’t automatically mean “producing them.”

In practice, converting deposits into supply involves:

- Permits and social consensus,

- Investment and logistics (in extreme conditions),

- Economic viability (costs, energy, transportation),

- And regulatory stability.

Furthermore, Greenland has shown political and environmental sensitivities in managing extractive projects, which introduces uncertainty and long timeframes. Meanwhile, Arctic hydrocarbon potential exists geologically, but its development depends on climate, costs, and political decisions.

4) Purchase vs. leasing vs. “more bases”: which scenarios are more plausible

From a political-legal perspective, a purchase is the scenario with the most friction: Greenland is part of the Kingdom of Denmark with a significant degree of self-governance and its own political identity. Therefore, serious analyses often consider it more realistic for Washington to pursue functional outcomes (greater access, presence, preferential rights, security/infrastructure agreements) rather than an outright sovereignty transfer.

Table: scenarios and signals to watch

| Scenario | Relative likelihood | What would trigger it | Early signals | “Real” outcome (even without purchase) |

|---|---|---|---|---|

| Formal territory purchase | Low | Significant political shift in Denmark and Greenland | Referrals to referendum, constitutional changes, open sovereignty negotiations | Legal control directly exercised (unlikely in the short term) |

| Long-term leasing / expanded concessions | Medium | A “face-saving” agreement for all parties | Investment packages, defense agreements, extended usage rights | De facto operational and logistical control without changing sovereignty |

| Reinforced status quo + economic pressure | High | Hard negotiations with threats of tariffs or other measures | Gradual announcements, deadlines, public conditions, messages to allies | Enhanced military/industrial presence in Greenland without touching sovereignty |

5) Market perspective: volatility first, fundamentals later

The thread advises “not to panic” and suggests rotating investments toward defense, energy, and critical minerals. While this may happen in the short term due to narrative and positioning, it’s important to remember:

- Tariffs (or credible threats) often lead to volatility and risk premiums, especially if they affect allies and trigger response cycles.

- Mining or energy projects in Greenland, if they advance, are long-term stories; they move expectations but take years to generate actual flows.

- The decisive factor will be the nature of any agreement: whether it remains rhetoric, results in operational concessions, or escalates to an economic clash with Europe.

Frequently Asked Questions

Can the US legally “buy” Greenland today?

It would be extremely complex: it would require sovereign decisions by the Kingdom of Denmark and, practically, a political fit with Greenland’s self-governance and democratic legitimacy.

What role does Pituffik (former Thule) play in all this?

It’s a key node for early warning missions and surveillance related to space domain and long-range defense threats in the Arctic axis.

Can Greenland break free from China’s dependence on rare earths?

It has potential in critical minerals, but moving from potential to production requires permits, investment, infrastructure, and time. It’s not a short-term “switch.”

What real impact would tariffs linked to Greenland have?

It depends on design, scope, and European response. Even without full implementation, the threat can increase uncertainty and affect trade and investment expectations.

via: X @Banbo_Insight