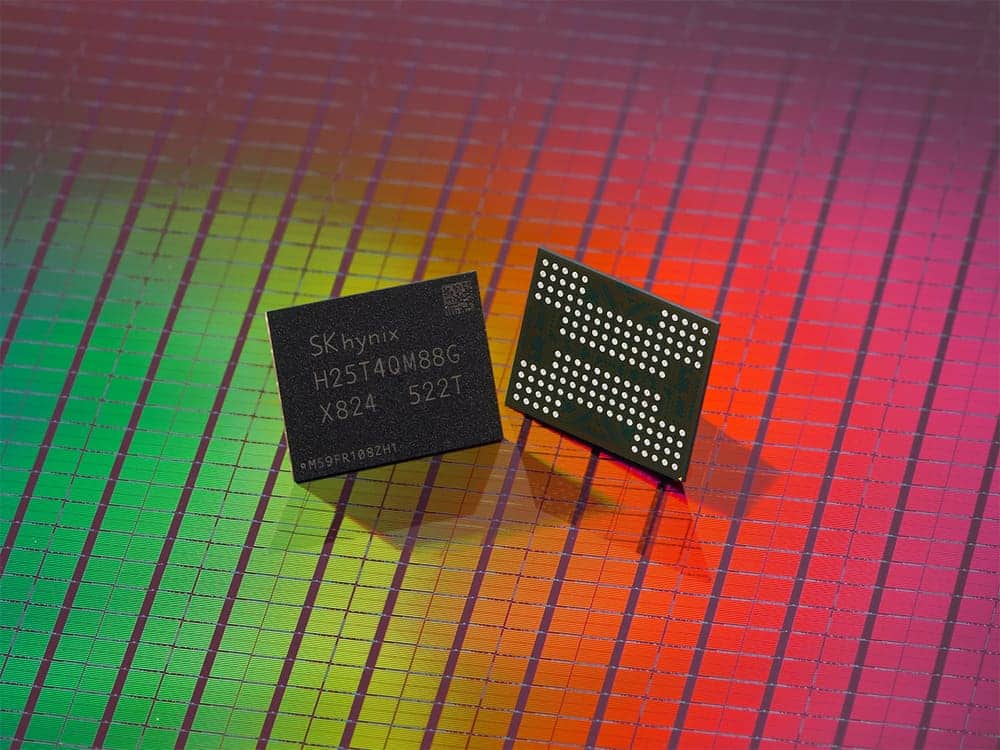

The NAND flash memory shortage—driven largely by the investment cycle around Artificial Intelligence (AI) and the pressure on critical supply chains—is reshaping the storage market for data centers. The result is a price divergence that just a couple of years ago would have seemed extreme: high-capacity enterprise SSDs are increasing in price much faster than HDDs, reigniting the debate over hybrid architectures versus “all-flash” deployments.

A price jump that’s hard to absorb in “closed” budgets

According to an analysis published by Blocks & Files based on VDURA data, the price of a 30 TB enterprise TLC SSD rose from $3,062 USD in Q2 2025 to $10,931 USD in Q1 2026, a 257% increase in less than a year. Meanwhile, the HDD price increased by approximately 35% during the same period. With this trend, the cost disparity per capacity between SSDs and HDDs expanded from 6.2 times (Q2 2025) to 16.4 times (Q1 2026).

For infrastructure managers, the immediate practical effect is clear: budgets based on quotes from just a few months ago are now obsolete, and projects designed as “all-SSD” are suddenly exercises in cost containment and redesign.

The return of “tiering”: SSD for hot data, HDD for mass storage

In this context, VDURA compared the total cost of ownership (TCO) over three years between a hybrid (SSD + HDD) storage server fleet and an all-SSD alternative. The results, according to this model, are compelling: $5.99 million USD versus $25.20 million USD over three years—meaning the hybrid deployment would cost roughly a quarter of the equivalent “all-flash” setup.

Beyond the numbers, the message is clear: with a double-digit price differential, the design is once again centered around “hot/warm/cold data”:

- SSD for cache, metadata, indexes, read/write acceleration, and latency-sensitive workloads.

- HDD for capacity, retention, large datasets, and “warm/cold” storage where cost per terabyte matters most.

It’s not “free”: HDDs are also feeling the pressure

However, the shift back to hybrid architectures comes with a caveat: HDDs are not immune to demand pressure. recently, Tom’s Hardware noted that the surge in AI is driving orders and may lead to very long lead times for enterprise disks, even up to two years in certain segments.

On the financial side, analysis like Barron’s (citing Citi) suggests a favorable cycle for HDD manufacturers, since the data growth linked to AI keeps high demand for high-capacity storage alive for years.

Practical implications for companies and data centers

In this landscape, the impact goes beyond just “paying more” or “adding more HDDs.” What changes is the way planning is done:

- Redesign capacity and performance models: if the project was justified by IOPS/latency, you’ll need to separate “critical” requirements from “massive” data needs.

- Design with service level objectives (SLOs) by layer: user experience is one thing, historical data repositories are another.

- Secure procurement and schedule planning: combining expensive SSDs with long lead times for HDDs makes logistics part of the design process.

- Reassess retention policies and backups: extensive “all-flash” retention policies become harder to justify; tiered storage regains importance.

What the “all SSD” debate means for 2026

The “all-flash” narrative doesn’t disappear, but it becomes more constrained to cases where performance and latency justify the added cost (ultra-transactional databases, analytical workloads with critical windows, certain data pipelines). For the rest—especially environments with significant capacity growth—economics dominate: hybrid as the foundation, SSD where it adds real value.

Frequently Asked Questions

Why are enterprise SSD prices rising so much compared to HDDs?

Because the NAND market and manufacturing capacity for enterprise SSDs are under strain, and demand (including from AI-related cycles) is pushing prices higher. Meanwhile, HDD prices are increasing at a slower pace, maintaining a clear cost advantage per terabyte.

Does it make sense to have an “all-flash” data center with SSDs 16 times more expensive than HDDs?

Only in workloads where performance justifies the premium. In many scenarios, a hybrid architecture (SSD for cache/metadata + HDD for capacity) offers a more stable cost-performance balance when the price differential is so high.

What are the risks of switching to HDD if “cheap” drives become a bottleneck?

The main risks include supply delays and limited availability of enterprise units, plus potential price hikes if demand continues to grow. It also requires redesigning to avoid degrading performance in latency-sensitive layers.

How long might this pricing situation last?

There’s no definite date, but signals indicate that pressure could persist if demand remains high. The VDURA/Blocks & Files analysis suggests tensions may extend into 2027 and beyond.

via: tomshardware