As the popularity of AI servers reaches a stabilization phase, global attention is shifting towards a new technological frontier: humanoid robots. Industry analysts and executives from major companies agree that this sector could become one of the largest industrial drivers of the 21st century, with a market potential up to ten times that of electric vehicles (EVs).

According to estimates from Digitimes, humanoid robots will make up about 2% of the global market by 2030, valued at around 12 billion Taiwanese dollars (approximately 360 million euros). However, Morgan Stanley goes much further in its forecasts, projecting the market could reach $5 trillion by 2050, with more than a billion units in operation worldwide.

TSMC president C.C. Wei (魏哲家) supported this vision during an investor call, saying, “The humanoid robot market will be ten times larger than that of electric vehicles. I look forward to seeing it grow.”

From Theory to “Version 0.5”

While enthusiasm is palpable, widespread adoption is still a long way off. Current costs remain prohibitive, which will initially give rise to an intermediate generation, dubbed “version 0.5.”

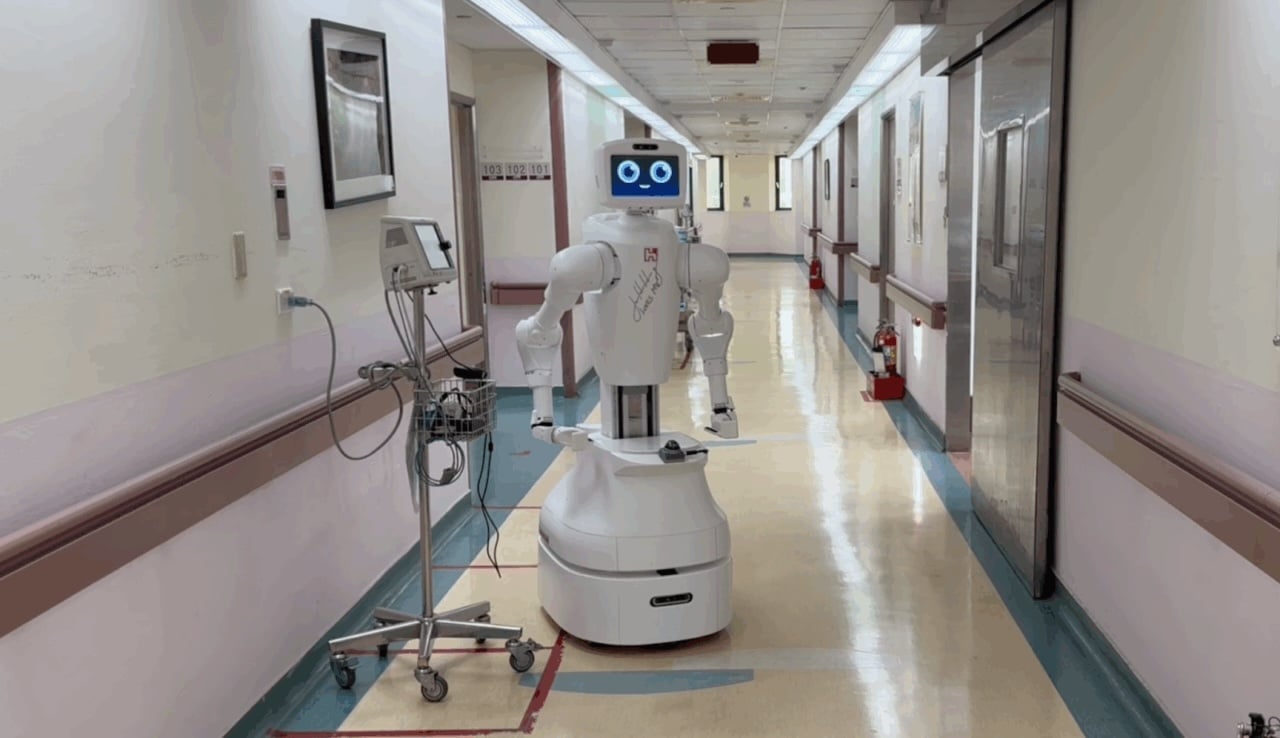

These robots won’t be fully humanoid: they will have dual gripping arms or suction devices but will continue to move on wheels rather than walk. Their initial applications are already clear: warehouses and factories.

An example is DHL’s announcement in May, confirming the purchase of 1,000 units of Boston Dynamics’ Stretch robot, capable of unloading 700 boxes per hour. This exemplifies how semi-humanoid robots are already entering logistics chains at scale.

Digitimes predicts that by 2025, humanoid robots will account for just 0.2% of the market, but as hardware costs decrease and AI models improve, their share could multiply tenfold within five years.

Touché Solutions: The Taiwanese “Electronic Skin” Taking Over the World

In this scenario, Taiwan isn’t necessarily aiming to lead in full robots but is focusing on critical components such as safety sensors and interaction modules. One of the most promising companies is Touché Solutions, founded by a team spun off from the Industrial Technology Research Institute (ITRI).

Its flagship innovation is the “T-skin,” an electronic silicone skin embedded with sensors capable of detecting pressure, temperature, and hardness. Thanks to this technology, a robotic arm moving at 1.5 meters per second can stop instantly if it detects human contact exerting as little as 10 newtons (roughly 1 kg of force).

The goal is clear: equip robots with the necessary sensitivity to interact safely with humans.

Having competed in more than ten international competitions, the startup caught the attention of Kawasaki Heavy Industries, which invested in 2018 and helped it obtain certifications such as ISO and the European CE mark. Today, Touché Solutions supplies its technology to Kawasaki and Denso, with applications ranging from semiconductor packaging and biotech to agriculture—where electronic skin can help determine fruit ripeness to apply just the right pressure during harvesting.

Its CEO, Chang-he Liu, explains that their ambition is to replicate what E Ink achieved with electronic paper: to become a global standard.

A “Blue Ocean” for Taiwan

The island faces a challenge: developing complete humanoid systems may be more difficult amid competitors with greater resources like the US, China, or Japan. However, specializing in critical components such as safety sensors or AI interaction modules opens new opportunities in what is called a “blue ocean” of innovation.

The stakes are high: the global market for humanoid robots isn’t limited to logistics or industry, but also encompasses agriculture, healthcare, elder care, and advanced manufacturing. With aging populations in Asia and Europe, demand for robots that fill labor shortages and assist with personal care could surge over the next two decades.

Tech Bubble or New Industrial Revolution?

Some analysts warn that after the AI and data center boom, enthusiasm for humanoid robots might become overly inflated in its early stages, repeating bubble patterns. However, unlike other emerging technologies, humanoid robots rely not only on cloud computing but also on the maturation of sensors, materials, batteries, and control algorithms.

The challenge, experts say, is converting fascination into profitable and scalable applications. Otherwise, the promise of a market ten times larger than EVs could prove to be just another technological mirage.

Frequently Asked Questions

1. Why are humanoid robots expected to have a larger market than electric vehicles?

Because their applications span multiple industries—logistics, agriculture, healthcare, manufacturing, and personal care—and it is estimated that over a billion units could be in use by 2050, compared to a more limited adoption of EVs.

2. What does “version 0.5” of humanoid robots mean?

It’s an intermediate stage where robots don’t yet walk but mimic certain human capabilities like using arms, grips, and sensors. They are primarily used in warehouses and factories.

3. What’s Taiwan’s advantage in this new market?

While Taiwan might not lead in complete robots, it excels in critical components such as safety sensors, AI modules, and interaction technologies—strengthening its role in the global supply chain, similar to its position in semiconductors.

4. What is Touché Solutions’ T-skin and why is it important?

It’s an electronic skin embedded with sensors that allow robots to detect pressure, temperature, and hardness. This ensures safe human-robot interactions and broadens their application scope in industry and everyday life.