SpaceX has set the date, figures, and spacecraft for its next leap in satellite internet. Elon Musk’s company has unveiled Starlink V3, a new generation of “Starship-sized” satellites that, according to the company itself, will tenfold the performance of V2 and enable, for the first time on the network, gigabit connectivity for users. Public specifications highlight two striking numbers: 1,000 Gbps of download and 200 Gbps of upload per satellite (1 terabit per second of downlink), and 60 terabits per second of additional downward capacity per launch when these satellites are deployed from Starship. The company’s target timeline is early 2026.

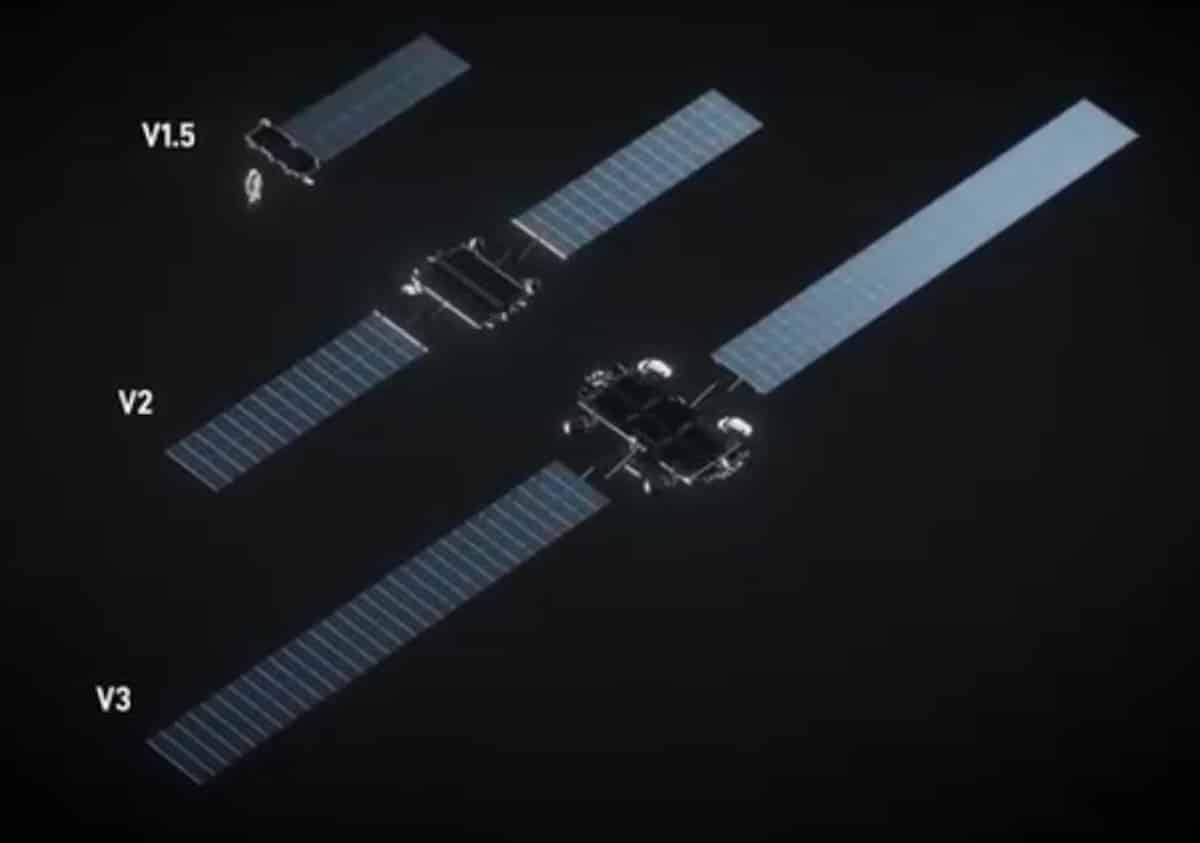

The announcement follows five years of deployments that have brought more than 6,000 Starlink satellites into orbit since the first 60 in 2019, along with an intermediate iteration — V2 Mini, launched with Falcon 9 — which accelerated coverage while preparing logistics for its heavy-lift spacecraft. With V3, the company shifts scale: mass per satellite around 2,200 kg (compared to <600 kg for V2 Mini and approximately 300 kg for V1) and launch capacity vastly increased: ≈60 V3 satellites per Starship flight, which — if realized — would mean more than 20 times the capacity added per batch compared to V2 Mini.

What do 1,000/200 Gbps per satellite and “60 Tbps per launch” mean?

The 1,000 Gbps download and 200 Gbps upload are aggregate capacities per satellite (total throughput the satellite can offer, distributed among many users and beams/feeder links), not the speed received by an individual customer. The “gigabit connectivity” mentioned by SpaceX for end users refers to roughly 1 Gbps per terminal under favorable conditions, which the system hadn’t promised before.

The figure of “60 Tbps per launch” is interpreted as the sum of downlink capacity that approximately 60 V3 satellites deployed from Starship in a single flight would provide. Since each satellite targets 1 Tbps of downlink, this order of magnitude aligns with information provided by the company. This, along with the greater mass and size of V3, explains why SpaceX emphasizes that they are “made for Starship” satellites.

From V1/V2 to V3: from Falcon 9 “batch launches” to Starship “bulk lots”

Until now, Starlink’s growth depended on Falcon 9: many launches with relatively lightweight “packages” of satellites (V1 ~300 kg, V2 Mini <600 kg). With V3, SpaceX is betting on fewer launches, but much more heavily loaded thanks to Starship‘s capacity. If the heavy-lift spacecraft achieves a high and steady cadence — the big question mark — the network capacity ramp-up could significantly accelerate starting in 2026.

What is all this capacity for? From rural users to backhaul and mobility

Satellite internet has transitioned from a Plan B to a real alternative where fiber can’t reach or where mobile coverage is poor. With V3, Starlink aims to close the gap between that alternative and urban gigabit broadband experiences:

- Home and business in remote areas: the promise of gigabit per terminal brings performance closer to what HFC and FTTH offer in cities.

- Backhaul for mobile networks: increased throughput via satellite supports feeding antennas for 4G/5G in isolated spots or expanding capacity during bust times (events, disasters, agricultural campaigns).

- Mobility (maritime, aeronautical, road): the aggregate capacity is vital for aircraft and vessels with hundreds of concurrent users.

- Businesses and agencies: backup links (resilience) and temporary connections for construction, mining, energy, etc.

In all cases, latency and congestion matter as much as peak rates. With satellites in LEO, Starlink has an advantage over geostationary systems in the first point; in the latter, capacity per cell/beam and traffic management will be practical test cases for V3.

Starship as the key: mass, volume, and “20× per batch”

The fact that each V3 satellite weighs around 2,200 kg explains the dependence on Starship: Falcon 9 can carry a certain number of V2 Mini satellites, but the V3 scale requires heavy-lift spacecraft capabilities. SpaceX claims that a Starship flight could insert ~60 V3 satellites into orbit, instantly adding ≈60 Tbps of downlink capacity; more than 20× what a batch of V2 Mini on Falcon 9 can provide. Whether this ratio translates into usable user capacity will depend on factors not yet detailed: beam count per satellite, bandwidth per beam, trunk link rings, and dynamic allocation.

Competition with fiber? Expectations and limits

Fiber optics will remain unbeatable in high-density environments and with ultrastable low latency, but V3 narrows the speed gap in segments where fiber won’t reach (or will take years): dispersed rural, mountainous areas, islands, remote vessels. The benefit isn’t just the 1 Gbps peak; it also lies in how increased capacity reduces congestion during peak hours and sustains high speeds with many users simultaneously on the same satellite/cell.

What SpaceX has not detailed (but should be watched)

- User terminals: it’s unclear whether current hardware can deliver 1 Gbps or if new antennas/routers will be needed for V3.

- Pricing and plans: increasing capacity doesn’t automatically mean lower prices; no commercial announcements about V3 pricing yet.

- Timeline: the “early 2026” window depends on Starship’s high and regular cadence, and regulatory approvals.

- Spectrum and coordination: more capacity and power require spectrum management, international coordination, and compatibility with astronomy and light/radar debris mitigation (an ongoing debate since V1).

A recap of the context: from 2018 to the “Starship decade”

- 2018–2019: first launches, V1; 2019 marks the milestone of the first 60 satellites in orbit.

- 2020–2023: proliferation of batches with Falcon 9 and entry into commercial service in dozens of countries.

- V2 Mini (Falcon 9): a bridge of capacity and coverage while preparing Starship.

- V2 (full deployment): associated with mobile connectivity plans in some markets.

- V3 (2026): satellites made for Starship, with 10× performance over V2, 60 Tbps of downlink per launch, and a goal of gigabit for the user.

Potential impact: economy, digital divide, and resilience

If V3 arrives on time and as planned, the digital divide in broad rural areas could narrow: telecommuting, remote education, connected healthcare, and commerce are better supported when the connection ceases to be the bottleneck. On a macro level, cheaper satellite backhaul with greater capacity enables 4G/5G deployments where the numbers don’t otherwise add up. In terms of resilience, having independent groundless links provides redundancy against wildfires, floods, or terrestrial infrastructure outages.

Critical points: orbit, brightness, and coexistence in the sky

Capacity is not everything. The proliferation of mega-constellations presents challenges: orbital congestion, collision risk, space debris, and light pollution for the astronomical community. SpaceX has iterated (visors, surface treatments) to mitigate brightness, but the leap to V3 will require new measures and international coordination. Maintaining deorbiting cadence of decommissioned satellites and adhering to end-of-life standards will be as crucial as Gbps figures.

What could change for the average user

- Peak speed: in areas where the cell isn’t saturated, achieving ≈1 Gbps could shift from exception to design goal.

- Peak-hour stability: more capacity per satellite = less shared congestion.

- New service profiles: if hardware supports it, plans aimed at small businesses, content creators or remote tourism SMEs could emerge.

- Mobility: ships and aircraft might increase bandwidth for passengers and crew with little penalty during peak demand hours.

Conclusion: V3, a bold move… with Starship acting as a hinge

Starlink V3 is the “made for Starship” version: larger satellites (≈2,200 kg), more capable (≈1 Tbps / 200 Gbps), and more concentrated per launch (≈60/60 Tbps). On paper, it delivers a 10× improvement over V2 and brings gigabit per satellite to users for the first time on SpaceX’s network. The practical translation of this promise will depend on three factors: Starship’s cadence and reliability, availability of terminals capable of leveraging the jump, and capacity management in high-demand scenarios.

If these components align, 2026 could be the year satellite internet stops being “what’s available if fiber doesn’t arrive,” becoming a competitive option in both price and performance where fiber won’t get there.

Frequently Asked Questions

What’s the difference between “1,000 Gbps per satellite” and “gigabit for the user”?

The 1,000 Gbps download and 200 Gbps upload are the total capacity of each satellite, distributed among many users and beams. “Gigabit for the user” refers to approximately 1 Gbps peak speed at an individual terminal when signal and congestion conditions are favorable.

When will the first V3 satellites launch, and with what rocket?

SpaceX targets early 2026 and has indicated V3 will debut from Starship. The actual cadence will depend on Starship’s maturation and regulatory approvals.

Will I need a new antenna to reach 1 Gbps?

SpaceX has not provided details about user hardware for V3. Until clarified, it’s unknown whether current terminals will suffice or if new equipment will be required.

Will V3 eliminate congestion during peak hours?

More capacity per satellite helps reduce congestion, but the final outcome will rely on how many users share each cell, traffic management, and geographical demand distribution. In any case, V3 provides a margin that V2/V2 Mini lacked.