Samsung has notified its major customers of a price increase of up to 30% in DRAM and a 5–10% rise in NAND flash for Q4 contracts. This move, first reported by the Korean media Newdaily, responds to an supply adjustment driven by reduced production of older ranges and an rising demand in segments such as high-end smartphones, AI PCs, and data centers. Meanwhile, Micron reportedly announced increases of 20–30%, and SanDisk a 10% increase in NAND, signaling a coordinated market shift.

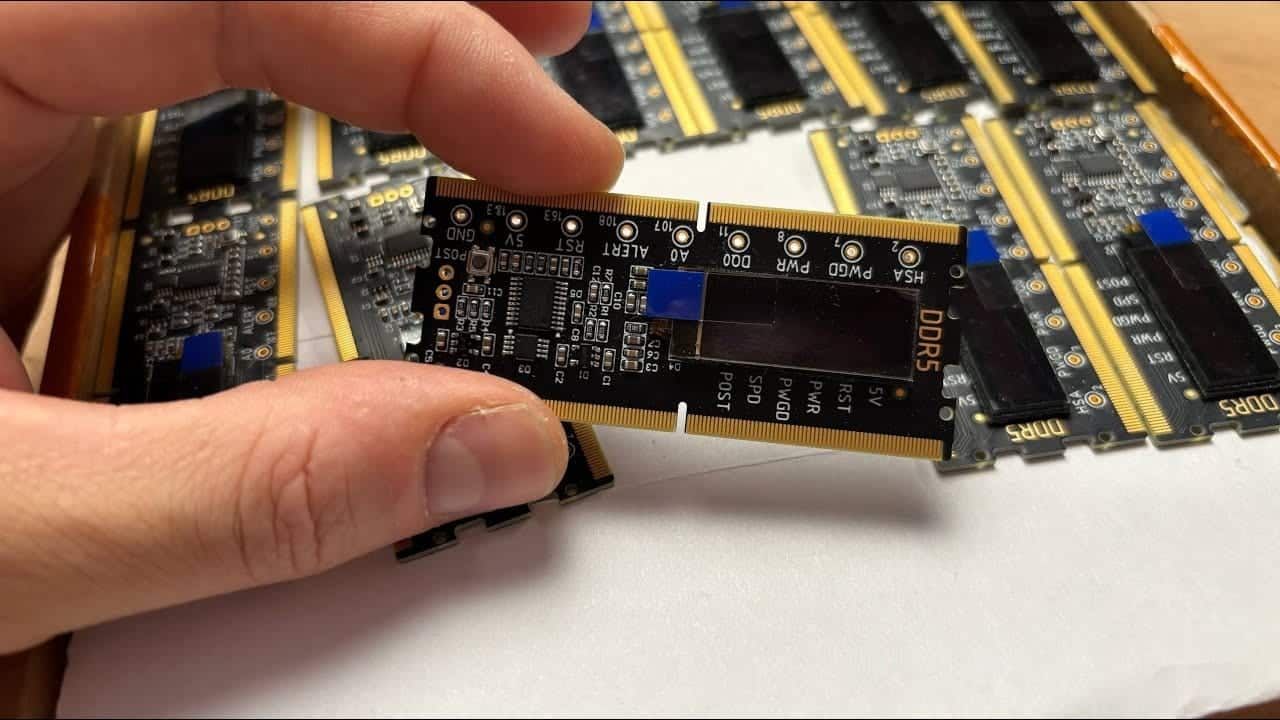

The price hikes target products like LPDDR4X, LPDDR5, and LPDDR5X DRAM, as well as eMMC and UFS in mobile NAND storage. The background is clear: manufacturers are reorienting capacity toward more profitable and more in-demand technologies — DDR5 and primarily HBM for AI accelerators — while gradually phasing out DDR4 and LPDDR4X. With demand surging toward the end of the year — coinciding with smartphone and PC launches, now boosted by generative AI features — the supply chain is under strain.

A turning point arriving amid a hot market

Samsung is no minor player. The company holds around 32.7% share in DRAM and 32.9% in NAND, positions that mean any adjustment can have a ripple effect across the industry. South Korea’s firm has led LPDDR cycles, with milestones like LPDDR5 (2018) and LPDDR5X (2021). Development of LPDDR6 is already underway, with initial designs expected to debut by the end of the year. This technological leadership exists alongside an industry landscape where HBM has become central: all major DRAM makers prioritize supply to NVIDIA, AMD, and other AI acceleration vendors, further tightening availability for consumer memories.

In storage, a similar story unfolds. The rise of AI has disrupted data centers, with orders of high-capacity SSD replacing HDDs where lower performance was previously acceptable. The result is an unprecedented demand surge for server NAND, competing with the needs of mobile and PC markets for the same wafer supplies.

From DDR4’s “demise” to an unexpected resurgence

The retreat from legacy products has consequences. Mid-year, DDR4 experienced a rare episode: its average monthly price skyrocketed by up to 50%, temporarily surpassing DDR5. The cause isn’t technical superiority — DDR5 remains the newer standard — but market mechanics: fewer lines dedicated to DDR4 and a persistent demand from installed base and mid-range replacements that doesn’t vanish. Samsung initially planned to phase out DDR4 and LPDDR4 mid-year; first delayed and now extended until late next year to maintain supply for its clients.

This timing shift also affects AI PCs, the industry’s new mantra. Many new devices with “co-pilot” or “native AI” features adopt LPDDR5/5X for their energy efficiency and bandwidth, further increasing demand for these families. Ironically, Samsung’s price hikes are impacting exactly those segments, where differentiation is strongest.

The consensus: less supply than demand expected in 2025

The scarcity narrative is supported by some data. Financial estimates project deficits in supply versus demand in 2025: around -1.8% for DRAM and -4% for NAND, with scenarios reaching as high as -8% for NAND in the most challenging case. Against this backdrop, Samsung’s 15–30% increases in LPDDR and 5–10% in eMMC/UFS prices for Q4 act as pressure valves to rationalize orders and maintain margins in a cycle where HBM profits remain delayed, still awaiting full revenue realization.

Some analysts suggest that Samsung’s semiconductor (DS) segment could see significant profitability improves in Q4, with projections of over 6 trillion won in operating profit — up from 2.9 trillion in the same quarter last year — provided pricing discipline and product mix hold.

Who bears the cost? Vertical impact analysis

Smartphone manufacturers.

Flagship models at year-end and those with AI features on device — such as real-time translators, video editing, and contextual assistants — typically use LPDDR5/5X and UFS. A 5–10% increase in mobile NAND and up to 30% in DRAM might not directly translate to higher retail prices, but it reduces margins on high-volume models. Price elasticity varies: higher-end devices with strong differentiation can absorb some cost increases, while mid-range OEMs may need to adjust configurations (RAM/storage) or stagger launches.

PCs and AI-enabled PCs.

Demand for LPDDR5/5X and the surprisings surpass of DDR4 encourage integrators to accelerate the adoption of DDR5 as a cost-performance standard. In ultralight laptops and devices with NPU — branded as “AI PCs” — soldered LPDDR5/5X memory is already standard, limiting end-user ability to customize after purchase.

Data centers.

The escalation in high-density NAND SSDs is driven by AI demand and a change in data center mix, accelerating wafer consumption. Prioritization of HBM in DRAM lines further increases costs and strains RDIMM supplies used in servers. This cycle prompts operators to plan procurement earlier and scale expansion phases more finely.

End consumers and channels.

The DDR4 episode urges retailers to monitor inventories: where DDR5 is compatible, it becomes not just a “future” choice but often the more economical—especially in mid- and high-end storage lines. Entry-level storage may see price hikes in NVMe drives, while SATA options could be less affected.

The driving force: AI everywhere

The main trend is driven by AI. Short-term, manufacturers are redirecting capacity toward HBM for training and inference cycles; in the medium-term, smartphones and PCs are being repositioned as “AI devices”, which increases memory and storage demand across mainstream consumers. Samsung’s plan for LPDDR6 — offering more bandwidth and less power — aims to meet the needs of premium mobiles and ultraportables with NPU. If this standard launches before legacy supply normalizes, price pressure could extend into 2025.

Why prices are rising: an overview of mix-shift dynamics

- Finite capacity. Memory fabs are not quickly convertible; shifting to DDR5/HBM reduces DDR4/LPDDR4X availability.

- Seasonal demand + AI. Q4 is traditionally strong (smartphones and PCs); in 2025, the AI layer adds to this boost.

- NAND-consuming data centers. The SSDification of data centers accelerates wafer absorption.

- Inventory discipline. Post-2023 downturn, manufacturers are avoiding stock buildup and prefer pricing over volume in legacy segments.

Key signals to monitor in upcoming months

- LPDDR6 announcement timing. A formal launch would spark flagship launches in 2026 and intensify pressure on LPDDR5X.

- HBM validation and orders. If Samsung secures key validations, supply pressures on consumer DRAM might ease in H2 2025.

- DDR4 evolution. Although the +50% peak was exceptional, a resurgence of DDR4 could occur if reverse channel demand surpasses expectations.

- Capex patterns of hyperscalers. Cloud giants’ storage capex will shape the trajectory of NAND in 2025.

Advice for procurement and purchasing teams

- Smartphones and PCs: wherever possible, prioritize DDR5/LPDDR5 for availability and cost trajectory; avoid over-specifying storage capacity if not needed.

- Channel and OEMs: phase orders, diversify suppliers to mitigate price swings; evaluate DDR5 kits versus DDR4 even in mixed-platform environments.

- Businesses: review refresh schedules and framework agreements for SSDs and memory modules; consider early purchases for critical Q4–Q1 projects.

- End users: during home upgrades, check compatibility with DDR5; for laptops, note that LPDDR is often soldered — plan accordingly.

Samsung’s current positioning

The Korean giant has openly expressed its ambition for HBM: seeking validations with NVIDIA and gearing up its LPDDR6 line. At the same time, it adjusts its phased withdrawal from DDR4/LPDDR4 to avoid gaps in installed capacity. With 32.7% in DRAM and 32.9% in NAND, any such moves ripple through the entire sector — Micron responding with +20–30%, and SanDisk with +10% — confirming a new year-end price step.

Conclusion: Less Legacy, More AI… and Short-Term Higher Memory Prices

The cycle shift in memory fundamentally boils down to a mix adjustment: moving away from legacy, embracing new standards, and giving priority to HBM. This, combined with a price increase in LPDDR and mobile NAND, balances finite capacity with rising demand. The market will accept this new equilibrium if the launch season plays out well and data center orders stay robust. Looking to 2025, the hope is that LPDDR6 and a normalization of HBM supply will ease the pressure on consumer DRAM and NAND. Until then, smartphones, PCs, and SSDs will face a costly quarter.

Frequently Asked Questions (SEO)

Why is Samsung raising memory prices by up to 30% for DRAM and 5–10% for NAND?

Due to an imbalance between supply and demand: reduced DDR4/LPDDR4X production, prioritization of DDR5 and HBM for AI, and seasonal peaks in smartphones and PCs that increase demand for LPDDR5/5X and UFS.

Which memories are affected most, and in which products will prices increase first?

Mobile DRAM (LPDDR4X/5/5X) sees the largest impacts (up to +30%). The first effects will be noticed in smartphones, laptops with soldered memory, and the channel selling modules for PCs.

Is it advisable to buy DDR4 now or switch directly to DDR5 for a new PC?

With episodes where DDR4 prices surged by +50%, DDR5 often makes more sense for price and future support. In compatible platforms, upgrading to DDR5 reduces the risk of short-term price hikes.

How will SSD and storage for data centers and end users be affected?

The increase in high-capacity SSD orders for AI is straining NAND. Expect a rise in mid-to-high-range NVMe drives and longer lead times for data center deployments; entry-level storage may be less affected but not immune.

Source: biz.newdaily.co.kr