The tech industry is constantly changing, and Samsung, one of the global giants, is currently facing serious challenges in its semiconductor foundry division. According to recent reports, the company has decided to cut its investment in foundry facilities by more than 50% by 2025, a decision that raises questions about its long-term strategy and its ability to maintain competitiveness against rivals like TSMC and SK Hynix.

Investment Reduction: Context and Details

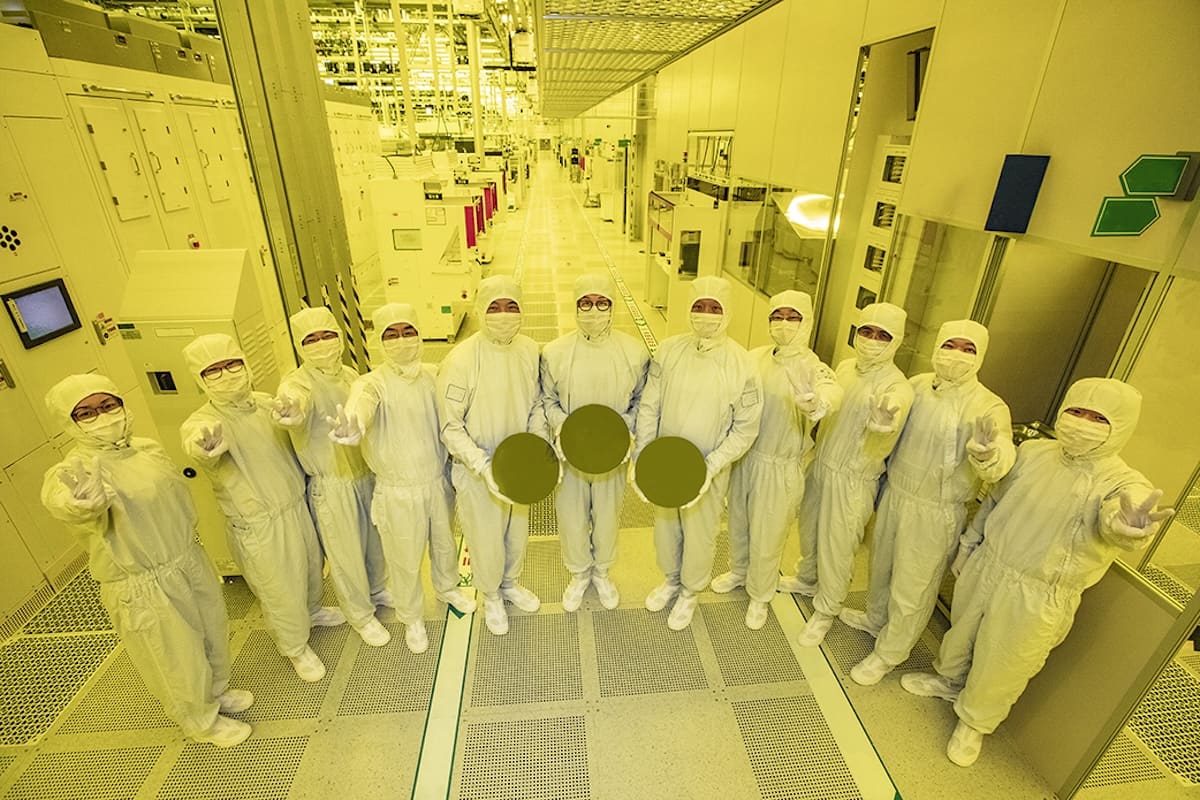

Samsung Foundry, the division responsible for custom semiconductor manufacturing, will allocate 5 trillion won (approximately 3.5 billion euros) for investments in 2025, significantly lower than the 10 trillion won it invested in 2024 and the even higher figures of up to 20 trillion reached between 2021 and 2023. This reduction reflects a significant shift in Samsung’s strategy, which has led the sector for years with aggressive investments in plants like the Pyeongtaek facility.

Ongoing Investments:

- S3 Plant (Hwaseong): A transformation from a 3nm line to 2nm is underway, a change that does not require a complete machinery overhaul, only specific adjustments.

- P2 Plant (Pyeongtaek): Installation of test lines for 1.4nm nodes, with an initial capacity of 2,000-3,000 wafers per month.

- Infrastructure in Taylor, Texas: Small complementary investments in the plant located in the United States.

Although Samsung has chosen to prioritize the optimization of its existing facilities, this move also reflects the pressure it is facing due to the slowdown in orders from key customers, technical issues in the development of advanced nodes, and increasing competition from rivals like TSMC and SK Hynix.

Unequal Competition: TSMC’s Advance

Samsung’s decision to cut its foundry investment contrasts sharply with the approach of TSMC, its main competitor, which allocated approximately 42 trillion won (about 32 billion euros) for investments in 2024, more than four times the amount invested by Samsung in the same period.

This disparity underscores the growing gap between the two companies. TSMC dominates the global semiconductor market thanks to its focus on advanced technologies, such as the 3nm and 2nm nodes, and its ability to attract customers like Apple, AMD, and NVIDIA. Samsung, on the other hand, has struggled to compete in terms of performance and costs, limiting its ability to capture new contracts.

Technical Issues: Samsung’s Achilles’ Heel

Samsung’s delay in the development of advanced lithographic nodes, particularly in DRAM and HBM (High Bandwidth Memory), has been a significant barrier. While SK Hynix advances toward the production of HBM4HBM4 is the next evolution in memory technology,…, Samsung still faces issues with the production of HBM3e, a delay that has generated distrust among its customers, including NVIDIA, a key player in the artificial intelligence market.

What Went Wrong?

- Simultaneous development of multiple nodes: Samsung attempted to develop nodes 1a, 1b, and 1c simultaneously, resulting in slow progress and performance issues.

- Talent drain: The company has lost nearly 200 highly qualified engineers who migrated to SK Hynix, further weakening its innovation capacity.

The Challenge of Maintaining Second Place Globally

The reduction in investments and technical issues have raised alarm bells in the industry, as Samsung risks losing its position as the second-largest custom semiconductor manufacturer in the world. While the company still holds a significant market share, its inability to close the gap with TSMC and the rapid advancements of SK Hynix pose an existential challenge for its foundry division.

Conservative Strategy: A Long-Term Bet

Although the situation seems alarming, Samsung has communicated that its approach for 2025 will be to maximize the efficiency of its existing facilities rather than aggressively expand. This could be seen as a pragmatic measure in the context of a global economic slowdown and uncertain demand in the semiconductor market.

Is This a Sustainable Strategy?

- Samsung plans to focus its efforts on improving the competitiveness of its 2nm nodes and advancing towards the development of 1.4nm, critical areas to secure its relevance in the future.

- The company is also looking to diversify its product and customer portfolio, which could help reduce its dependence on contracts from large tech firms.

The Role of the United States and China in Global Competition

Another factor to consider is the growing influence of geopolitical policies in the semiconductor industry. The United States has increased pressure on tech companies to reduce their dependence on Chinese manufacturers, which could benefit Samsung in its international operations. However, competition in Asia remains fierce, with China investing heavily in the development of its own production capacity.

Is This the End of Samsung’s Dominance?

Though the current situation is concerning, it is premature to declare the end of Samsung as a relevant player in the semiconductor industry. The company has demonstrated resilience in the past and has the necessary resources to adapt and recover its competitiveness. However, to achieve this, it must:

- Solve technical issues in its advanced nodes.

- Retain and attract qualified talent.

- Rebuild trust with its key customers.

Conclusion: The End or a New Beginning?

The reduction in Samsung’s investments in its foundry division reflects both the immediate challenges and long-term opportunities facing the company. While its market position is in jeopardy, focusing on optimization and the development of advanced nodes could be a wise strategy to ensure its survival in an increasingly competitive industry.

Time will tell if this decision was a necessary step back to take a leap forward or an indication of deeper issues within the South Korean tech giant. For now, Samsung must act swiftly to prevent its rivalry with TSMC and SK Hynix from becoming a definitive defeat.

Sources: El chapuzas informático and Sedaily