With the upcoming summit between the United States and South Korea on the immediate horizon, industry eyes are squarely on Samsung Electronics. The South Korean company, which already announced a multimillion-dollar investment in the U.S., may be preparing an additional move that blends business pragmatism with political gestures toward Washington. Central to the speculation are two key names: Intel, the symbol of American semiconductors, and Amkor, a giant in chip packaging.

Trump pushes to “rescue” Intel

U.S. President Donald Trump has made restoring semiconductor manufacturing capacity a strategic priority. For his administration, Intel’s survival is critical not only economically but also geopolitically. In this context, Samsung’s participation in a cooperation or investment scheme that bolsters the historic Californian firm isn’t out of the question.

Facing financial and management difficulties after years of technological delays, Intel has seen various support proposals—from joint ventures with TSMC to partial acquisitions by groups like Broadcom. The most notable move has been SoftBank’s recent investment of $20 billion (around €27.78 billion) in stocks of the company.

Industry analysts suggest that a potential collaboration with Samsung—already a partner in producing certain chipsets through its foundry division—could allow the Trump administration to present a “united front” to restore U.S. technological self-sufficiency, while Samsung would find a business opportunity and legitimacy in the North American market.

Amkor, the packaging bet

The second scenario involves Amkor Technology, a U.S.-based multinational specializing in assembly and testing of semiconductors (OSAT), as a key partner. Amkor is establishing its first advanced packaging plant in Arizona, expected to become operational by 2027.

Amkor’s importance lies in a critical point: although Samsung leads in manufacturing processes with 2-nanometer lithography, it still lags behind TSMC in packaging capabilities. This has been a decisive factor for companies like Apple and NVIDIA, which tend to prefer the Taiwanese manufacturer offering more mature, comprehensive solutions.

Partnering with Amkor would bolster Samsung’s position in this part of the supply chain, aligning with Trump’s priorities of attracting investment and know-how to the U.S. Bridge the gap in packaging and enhance local infrastructure, while capitalizing on political pressures to keep manufacturing stateside.

A strategic recalibration

Samsung had previously announced a $44 billion investment plan in the U.S., later scaled back to $37 billion. Now, expectations are that the company will restore the original commitment or even extend it, aiming to solidify its standing in the country and strengthen its political ties with Washington.

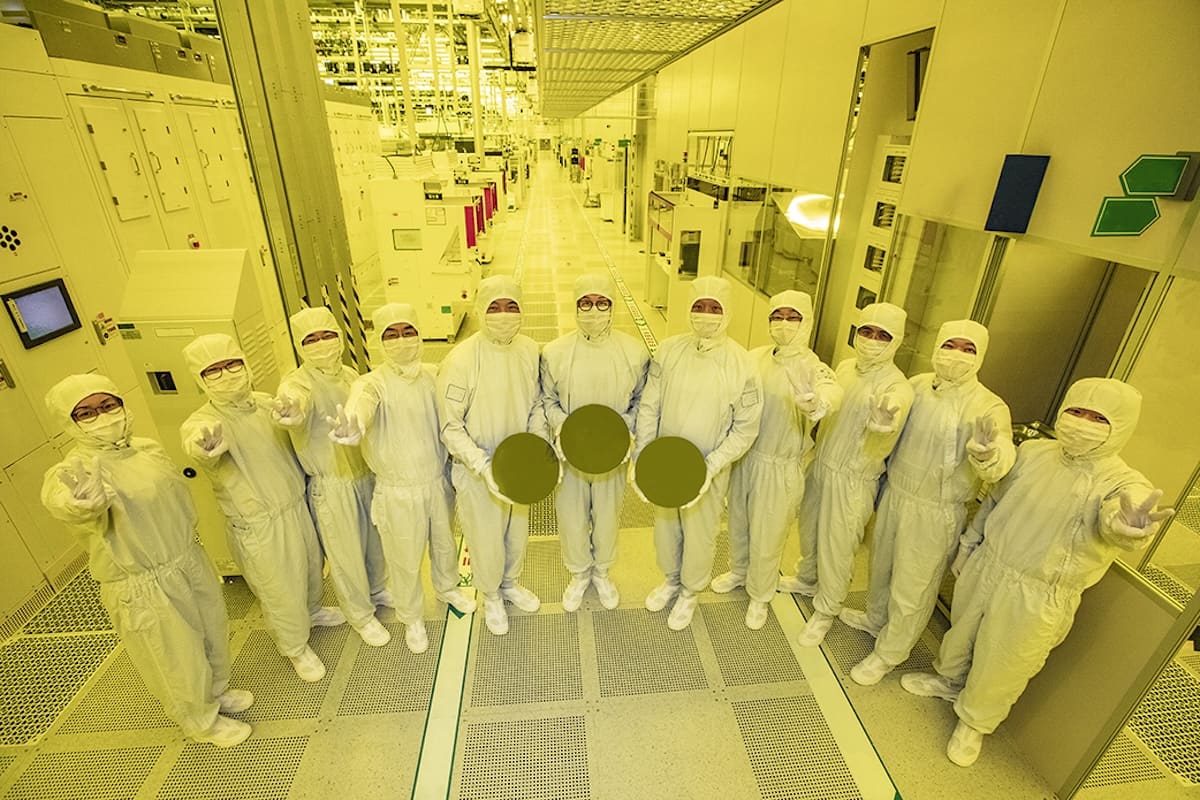

The company is building a mega-factory in Taylor, Texas, projected to be one of the largest advanced production complexes worldwide. Recently, Samsung secured a contract with Tesla to manufacture 2nm chips for autonomous vehicles and humanoid robots, opening pathways to top-tier strategic clients.

Samsung’s crossroads

The decision isn’t straightforward. Investing with Intel would send a clear message of alignment with the U.S., potentially leading to shared foundry contracts. However, Intel remains a direct competitor in multiple areas, raising questions about the true alignment of interests.

On the other hand, choosing Amkor would help Samsung address its most evident weakness—packaging—without risking conflicts related to process node rivalry. It would also reinforce U.S. infrastructure and fulfill Trump’s expectations of bolstering the local value chain.

Regardless of the choice, what seems certain is that Samsung will not limit itself to its initial investment. Political pressures and the allure of new contracts at the heart of the global tech economy are pushing the company toward deeper commitments on U.S. soil.

Frequently Asked Questions (FAQ)

1. Why might Samsung invest in Intel?

Because Intel is a strategic asset for the U.S. and a potential partner in foundry services. An investment by Samsung would demonstrate alignment with Trump’s political priorities and open the door to technological collaborations.

2. What role does Amkor play in Samsung’s plans?

Amkor is a global leader in semiconductor packaging, an area where Samsung is relatively weaker. A partnership would allow Samsung to bridge its gaps versus TSMC and attract major clients like Apple and NVIDIA.

3. What is the current status of Samsung’s investment in the U.S.?

Samsung reduced its initial $44 billion plan to $37 billion but is now expected to recover or even surpass that figure through new alliances or projects, especially in Texas and Arizona.

4. How does this impact competition with TSMC?

If Samsung enhances its packaging technology and maintains leadership in advanced 2nm processes, it can compete more aggressively with TSMC in contracts with Silicon Valley giants.