Here’s the translation of your text into American English:

The supply chain for the GB200 from NVIDIA, a rack-mounted solution designed for artificial intelligence (AI) workloads and high-performance computing (HPC), still requires additional time for optimization and tuning, according to the latest report from TrendForce. The complexity of the GB200 specifications, such as its high thermal design power (TDP) and high-speed interconnection interfaces, has led to production and distribution delays. As a result, the peak in shipments will not be reached until the period between the second and third quarters of 2025.

High Power and Technical Complexity

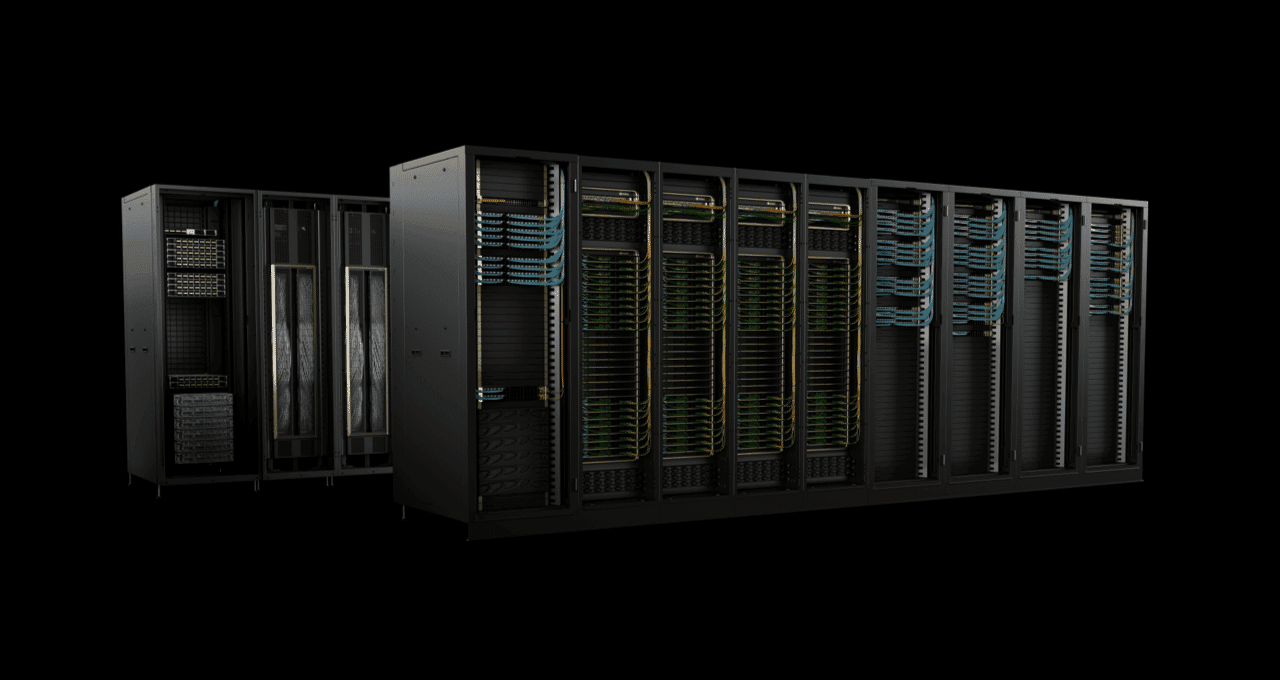

NVIDIA’s GB series, which includes the GB200 and GB300 models, is primarily aimed at large cloud service providers (CSPs) and second-tier data centers, academic institutions, and national sovereign clouds that require advanced systems for AI and HPC.

The GB200 NVL72 model is expected to dominate the market in 2025, accounting for up to 80% of total deployments as NVIDIA accelerates its market rollout. The key to its performance lies in the use of fifth-generation NVLink, a interconnection technology that doubles the bandwidthBandwidth is the maximum transfer capacity of a network… compared to PCIe 5.0, the current industry standard.

However, the GB200 presents challenges in terms of power and cooling:

- The current rack TDPs in the HGX series, which dominate the AI server market, range from 60 kW to 80 kW.

- In comparison, the GB200 NVL72 has a TDP of 140 kW, which doubles the energy demands.

Liquid Cooling: An Imperative Need

Traditional air cooling proves insufficient for managing these extreme thermal loads. The adoption of liquid cooling solutions is rapidly increasing:

- Chilled Distribution Units (CDU): Manufacturers are enhancing efficiency through optimized cold plate designs. Current side CDUs can dissipate between 60 kW and 80 kW, but future developments promise to double or triple this capacity.

- Inline Liquid Cooling Systems: Advanced designs already achieve exceeding performance of 1.3 MW, with further improvements expected as computational power demands increase.

Supply Chain Outlook

Despite these challenges, TrendForce asserts that the production of Blackwell GPU chips is progressing as anticipated, although shipments in Q4 2024 will be limited. Production will gradually ramp up starting in Q1 2025, but due to adjustments in the supply chain for AI server systems, end-of-year shipments will not meet industry expectations.

The supply chain is expected to be optimized by mid-2025, allowing the peak in shipments to occur between the second and third quarters of the year.

Conclusion

The NVIDIA GB200 represents a significant advancement in server technology for AI and HPC, but its implementation presents unique challenges in terms of power and cooling. The widespread adoption of liquid cooling and improvements in the supply chain will be key to meeting market demand. Mass shipments will not materialize until the second half of 2025, as manufacturers optimize the necessary infrastructure capabilities to support these innovative NVIDIA solutions.