Virtualization, long considered the “stable ground” upon which data centers and private clouds were built, has entered a phase of deep reevaluation. It’s no longer just about swapping one hypervisor for another but about rethinking the entire operational model: where workloads reside, how they are managed, how they are protected, and especially how to prepare for a new reality defined by Artificial Intelligence, performance pressures, and unpredictable costs.

This is the central thesis of a new research report from HPE: more than two-thirds of companies plan significant changes to their virtualization strategy within the next two years, yet only 5% feel fully prepared to execute them. This statistic paints a picture of a rapidly evolving market and highlights a gap in execution that concerns CIOs and IT teams: the intent to transform is there, but it’s not always backed by sufficient plans, resources, and capabilities.

From Planning to Action: Critical 12 to 24 Months

HPE identifies the upcoming 12 to 24 months as a turning point: the shift from “planning” to “active transformation.” The survey—conducted across nearly 400 global organizations—depicts an environment where virtualization is no longer a static decision but a component that must evolve in tandem with business needs and AI adoption.

In this “great reset,” the report challenges a simplistic narrative from recent quarters: license costs wouldn’t be the only driver. In fact, only 4% of surveyed companies cite licensing costs as the primary catalyst. Instead, the strongest push comes from preparing for AI, the need for hybrid flexibility, and aligning performance, operations, and security in increasingly complex environments.

Barriers: Budget, Complexity, and Migration Risks

Transformation sounds appealing in presentations but becomes difficult when critical workloads need moving. HPE identifies the main barriers: budget constraints (28%), technical complexity (24%), and migration risk (21%), closely followed by skills gap (20%).

The implicit message is straightforward: many organizations recognize the need to change but fear the actual cost—both financial and operational—and the risk of disruptions. Ultimately, virtualization is too integral to many services to rush without careful planning.

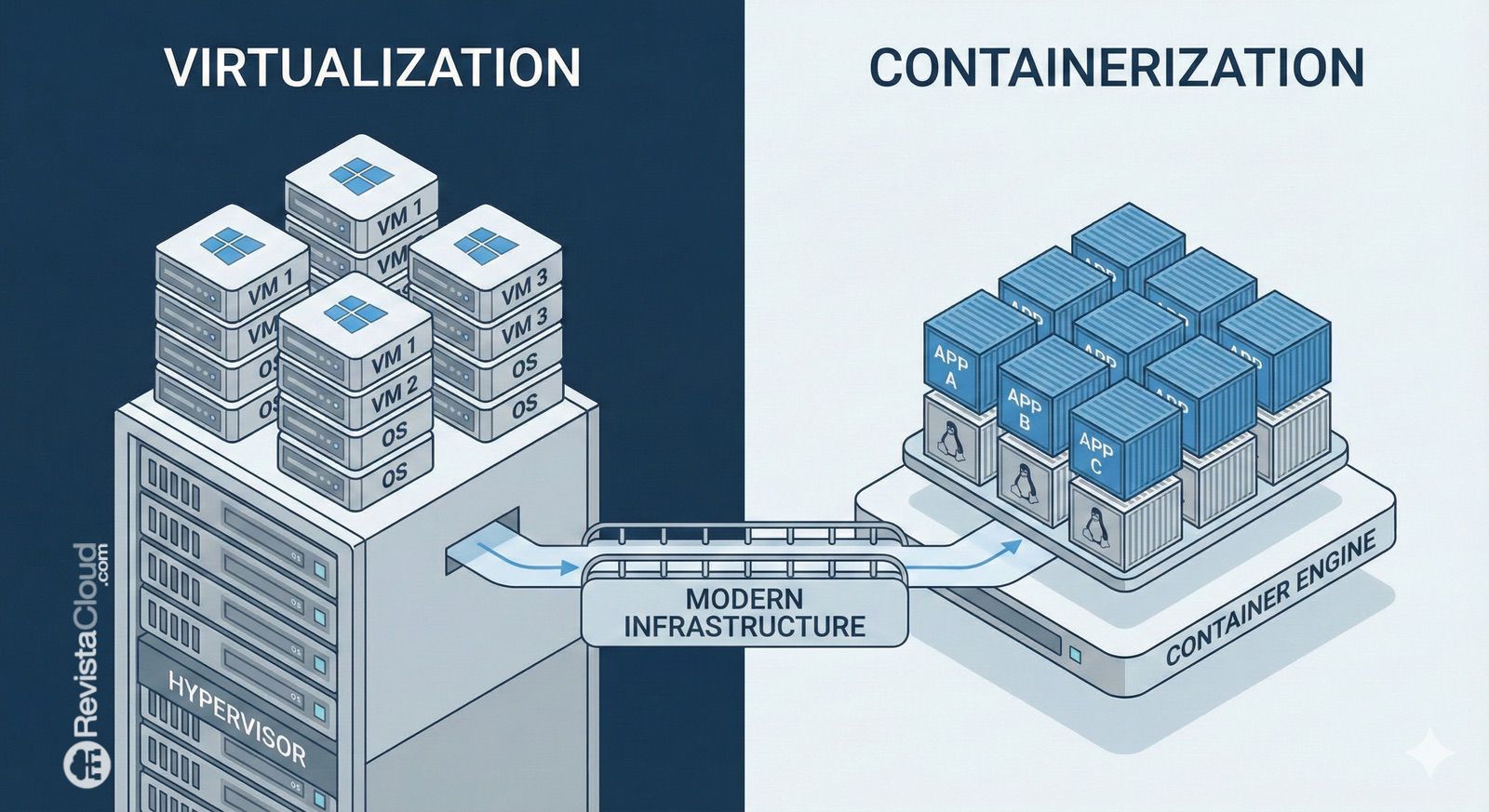

It’s Not Just a Hypervisor Swap: It’s a Change in Operating Model

Another relevant point is the approach: 57% of companies say they will adopt a phased strategy to “future-proof” their infrastructure. The report describes the hybrid model as the preferred destination—especially for meeting performance demands tied to AI.

Furthermore, the study provides a snapshot of deployment across various environments (not mutually exclusive): 78% in public cloud, 61% in virtualized clusters, 48% in private cloud, and 32% at the edge. The takeaway is clear: the “where” matters, but “how you operate” is even more crucial when workloads are distributed across multiple domains.

Security, Observability, and Data Protection: What’s Rising to the Top

If the hypervisor is no longer the sole focus, what takes center stage? HPE highlights three pillars that organizations consider essential in their modern virtualization strategy:

- Unified Backup and Cyber Resilience (70%).

- Cross-Platform Governance (61%).

- Integrated Observability and AIOps (55%).

In other words: the conversation is shifting towards resilience, visibility, and comprehensive control. This aligns with the pressures of AI: more data, more services, more dependencies, and higher costs when things go wrong.

Brian Gruttadauria, CTO of Hybrid Cloud at HPE, summarizes this tension by stating that companies are “reassessing their IT assumptions” to balance cost predictability, AI readiness, and performance—all pointing to a move away from accelerated replacement towards a more flexible and simplified model.

Danfoss, Morpheus, and the “Stability for the AI Era” narrative

The HPE report also features testimonials from clients and partners. Danfoss, for example, views the strategy shift as an opportunity to streamline operations for a simpler cloud model and to prepare for the AI era within the framework of HPE Private Cloud Enterprise with HPE Morpheus. While these examples often serve marketing purposes, they provide context: the market no longer focuses solely on consolidating VMs but on building a “stable” operational foundation where virtualization is a means, not an end.

The European Angle: Open Alternatives and the Push for Proxmox

Alongside these movements, the “reset” of virtualization is opening space for open ecosystem alternatives. Among them, Proxmox VE is increasingly featured in conversations among CIOs and infrastructure leaders due to its combination of virtualization, management, and community/business approach.

In Europe, vendors like Stackscale (Aire Group) are capitalizing on this trend: on one hand, promoting the shift to Proxmox VE as a way to gain flexibility and reduce reliance on a single vendor; on the other, offering migration support and deployment services on bare-metal infrastructure aimed at Proxmox environments.

This ties back to HPE’s main message: the market isn’t just looking for “another hypervisor,” but a way to regain control—of costs, operations, and resilience—while continuing to innovate. And that’s precisely where organizations prioritize capabilities like backup and recovery, cross-platform governance, observability, and automation.

A “Reset” Requiring a Methodical Approach

The takeaway from the study is as straightforward as it is demanding: 2026 and 2027 could mark a pivotal point for virtualization, but success will depend less on the product chosen and more on the methodology. Mapping dependencies, assessing risks, training teams, phased planning, strengthening cyber-resilience, and building genuine observability are decisions that matter more than the hypervisor brand.

Because if only the software changes but the operational model does not, the reset remains incomplete.

Frequently Asked Questions

What is the “Great Virtualization Reset” and why will it impact many companies by 2026?

It’s the process through which organizations rethink their virtualization strategies to adapt to licensing changes, cost pressures, and especially new performance and operational demands driven by AI and hybrid models.

What are the main risks when migrating virtual machines to another virtualization platform?

The primary risks include service disruptions, network and storage incompatibility, dependencies on backup/monitoring tools, and lack of internal skills; hence many companies choose phased migrations and pilot environments.

What capabilities should a company prioritize when modernizing virtualization for AI?

Beyond the hypervisor, focus areas include unified cyber recovery and backup, cross-platform governance, observability, and automation/AIOps to manage distributed workloads with control and resilience.

Why is Proxmox emerging as an alternative in the virtualization “reset”?

Because it offers an open, flexible approach compatible with hybrid strategies and is gaining traction in European projects aiming to reduce dependency on a single provider and strengthen operational control.