NVIDIA is preparing to push one of its most delicate moves in the Chinese semiconductor market: turning the H200 into an “overly attractive” option so that major buyers will overlook it. The key, according to various market sources, isn’t so much in promising the newest GPU — as the industry is already eyeing later generations — but in reducing the price friction so that switching from the H20, the export-controlled variant, becomes an almost automatic decision for clients.

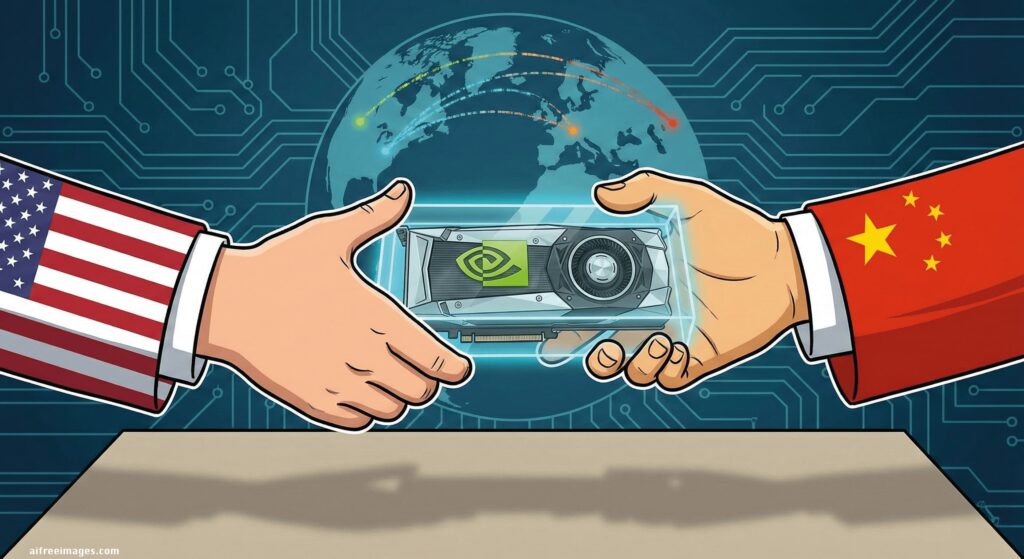

The context is both geopolitical and commercial. By the end of 2025, Donald Trump’s administration announced that the United States would allow exports of the H200 to China, applying a 25% tariff on these sales — a shift from previous restrictions. This announcement opened the door to a scenario that until then was unlikely: China could again purchase, on a large scale, an advanced chip from the Hopper family.

A “nearly identical” price to the H20 despite performance jumps

The centerpiece of the strategy would be the price. Chinese media, cited by analysts and industry publications, suggest that an 8-chip H200 cluster could be priced around $200,000, similar to equivalent configurations with H20.

If that range is confirmed, the message to buyers is clear: pay almost the same for hardware with more muscle and fewer operational limitations. Reuters, reporting on this new export scenario, noted that the H200 can deliver around six times the performance of the H20 — precisely the kind of difference that makes price a decisive factor.

Why the H200 remains attractive: memory and bandwidth as marketing weapons

Although the H200 isn’t from the latest generation, NVIDIA has long argued that its value lies at a critical point for modern Artificial Intelligence: memory and bandwidth. According to the company’s official specifications, the H200 features 141 GB of HBM3e memory with 4.8 TB/s of memory bandwidth — a leap designed for increasingly large models and workloads where memory is the bottleneck.

For major Chinese buyers — seeking large-scale training and inference capacity — this combination offers a practical advantage: more models can fit on a GPU, reducing the need to partition workloads and improving performance in intensive tasks. This isn’t a minor point in a market where demand for infrastructure for language models and AI services keeps growing.

Schedule: shipments planned for mid-February… but with two key approvals pending

The plan, however, doesn’t depend solely on NVIDIA’s willingness. Reuters reports that the company aims to start shipments to China by mid-February 2026, with an initial batch of between 5,000 and 10,000 modules (equivalent to 40,000 to 80,000 chips, according to the same report), but all subject to pending approvals.

At this point, two regulatory layers come into play:

- United States: where the political announcement does not necessarily eliminate licensing procedures and reviews related to advanced chips.

- China: which must also approve imports and, according to Reuters, may consider conditions to limit the impact on its local ecosystem.

China looks to its domestic industry: the “package” hypothesis with local chips

One of the most revealing details of the current moment is that Beijing isn’t just debating whether to allow the H200 entry, but how to do it without discouraging the purchase of domestic accelerators. Reuters indicated that Chinese officials are considering requiring that H200 purchases include the acquisition of domestic chips — a “combined buy” approach — to balance demand with industrial policy.

This potential condition explains why, despite the US announcement, the market doesn’t assume shipments will proceed smoothly without obstacles. It also reflects a structural tension: China aims to reinforce its own technological stack while simultaneously needing competitive computing power to sustain its AI deployment pace.

The interest of tech giants: inquiries and pressure for capacity

Meanwhile, early signs of demand are emerging. Reuters reports that ByteDance and Alibaba have inquired about purchasing the H200 from NVIDIA following the “green light” from Washington, according to informed sources.

This interest isn’t just about performance; timing matters too. In AI business, having the right infrastructure ahead of competitors can be the difference between leading and lagging in iteration speed.

However, NVIDIA faces an industrial limitation: its production capacity is increasingly aligned with later-generation platforms, and the market itself acknowledges that H200 supply isn’t unlimited. In this context, the company may attempt to cover initial demand with inventory and ramp up new orders later, according to Reuters.

US political controversy: pressure to disclose licenses and approvals

The developments around the H200 are also causing friction in Washington. Reuters details that Democratic lawmakers have asked the Department of Commerce to disclose license reviews and possible approvals related to H200 sales to China, demanding transparency and raising strategic and military concerns.

This political element adds uncertainty: even with an announced policy, public and congressional scrutiny can lead to increased controls, delays, or additional conditions. For NVIDIA, this means that the success of its strategy in China depends not just on an attractive price point but on navigating a rapidly changing diplomatic landscape.

An uncomfortable conclusion: price as leverage to reopen a key market

In summary, NVIDIA’s H200 move in China relies on a simple idea: if the chip is seen as “last generation,” the way to neutralize that perception is to make the opportunity cost too high. If the H200 costs nearly the same as H20 but offers a significant performance leap, the debate boils down to permits, availability, and timing.

The market also reads this strategy clearly: the AI compute race isn’t just about architecture; it’s also about trade policy, export controls, and pricing strategies capable of moving billions in infrastructure investments.

Frequently Asked Questions

What’s the difference between NVIDIA H20 and H200 in the Chinese market?

H20 is a variant designed to meet export requirements, while H200 is a higher-capacity Hopper chip that, if fully authorized, can significantly boost performance for training and inference.

Why is the HBM3e memory of the H200 so relevant for language models?

Because it increases capacity (141 GB) and bandwidth (4.8 TB/s), enabling large models to run with fewer bottlenecks and less dependence on data transfer outside the GPU.

When could shipments of the H200 to China begin?

According to Reuters, NVIDIA aims for mid-February 2026, though the start depends on regulatory approvals and conditions in both the US and China.

What role does the 25% tariff announced by the US play in these sales?

The tariff is part of the policy framework announced to allow H200 exports to China and has renewed debates in Washington about licensing, controls, and strategic risks.

via: wccftech