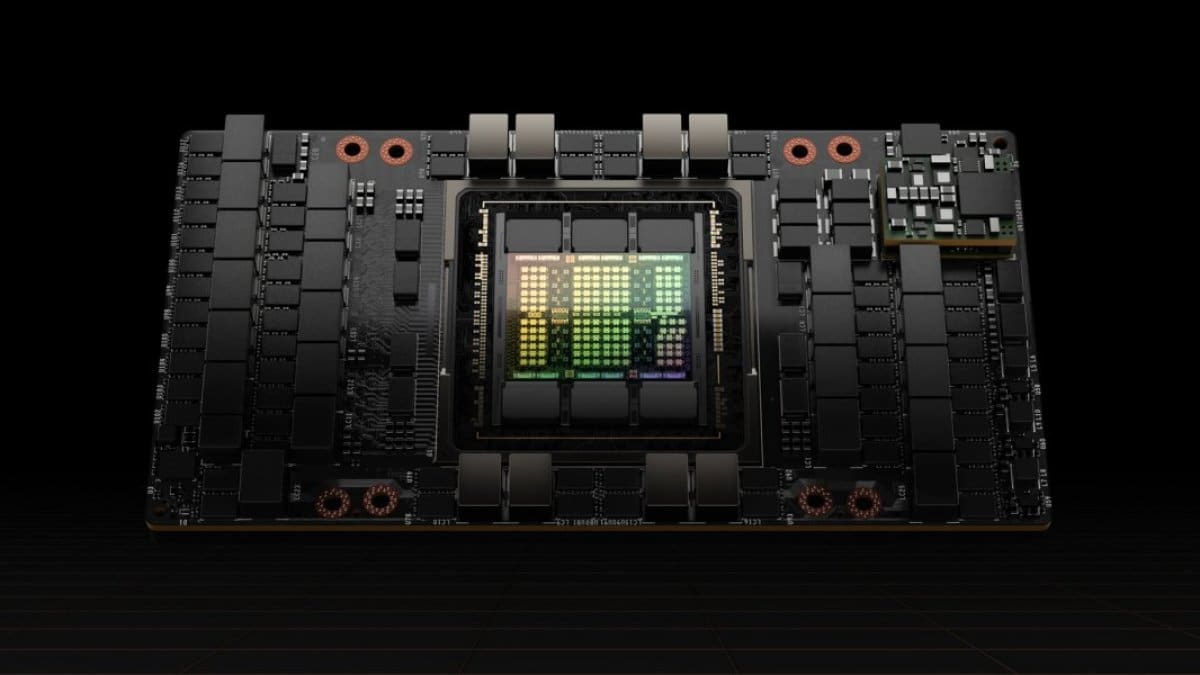

Artificial intelligence has reignited a high-stakes technological race, with NVIDIA once again at the center of the contest. Following the recent lifting of export restrictions imposed by the United States, the company led by Jensen Huang has requested TSMC to produce an additional 300,000 units of its GPU H20 for AI, joining the 600,000 to 700,000 units already planned for this year. Far from fading due to sanctions, the Chinese market is setting a new demand record.

An unexpected reopening reactivates the market

For over a year, China faced severe restrictions on acquiring high-performance chips for AI model training and inference—a strategy driven by the US government to slow China’s technological progress. Despite this, China managed to source chips through alternative routes, such as purchasing from third countries and using cut-down versions of NVIDIA GPUs like the A800 and H800, which met Washington’s technical limitations.

However, these variants were also banned at the end of 2023. That left the Chinese market virtually frozen—until now. The recent decision by President Trump to reopen exports of NVIDIA and AMD chips to China—aimed at easing trade tensions and facilitating a face-to-face meeting with Xi Jinping—has unlocked a long-dormant demand.

China becomes a key player for NVIDIA again

The response was immediate. Sources close to the supply chain report that NVIDIA has activated massive orders with TSMC to increase production of the H20 chip, specifically designed for the Chinese market under the new performance restrictions. If shipments materialize, total units could reach around one million in 2024, bringing China back into NVIDIA’s key revenue markets.

This scenario shift not only eases financial pressure on the US tech company but also allows it to reinclude the Chinese market in its quarterly projections—a move it had avoided recently due to regulatory uncertainty.

Pending licenses and political pressures

Despite industrial optimism, the legal framework remains unresolved. NVIDIA still lacks the official export license from the US Department of Commerce and has asked its Chinese partners and clients to prepare all necessary documentation to facilitate the process. The company aims to avoid future sanctions amid ongoing geopolitical tensions dominating the tech trade agenda.

Internal US government pressures persist as well. Over 20 former US officials have warned in a letter that allowing China access to chips like the H20 is a “strategic mistake that endangers US military and economic advantage in artificial intelligence.”

TSMC once again a key player in the chip war

NVIDIA’s order again positions TSMC as the indispensable hub of global advanced semiconductor manufacturing. Although Samsung recently signed an agreement with Tesla to supply AI6 chips, Taiwan’s leadership in fabricating 5nm and 3nm processes remains unchallenged—especially for high-performance products such as generative AI hardware and large language models.

And now what?

While US-China negotiations shift to forums like Stockholm, the market acts independently. China continues to demand chips, now on a large scale. Investments in data centers, sovereign AI platforms, and robotics are multiplying. The partial reopening of tech trade could trigger a new industrial expansion cycle in Asia, with NVIDIA as one of the main beneficiaries—at least while the truce lasts.

With this latest wave of orders, it’s clear that AI hasn’t hit a ceiling, and key players aren’t willing to stay out of the game. Despite ongoing review processes and lingering diplomatic tensions, the race for AI leadership continues. For now, NVIDIA has scored another win.