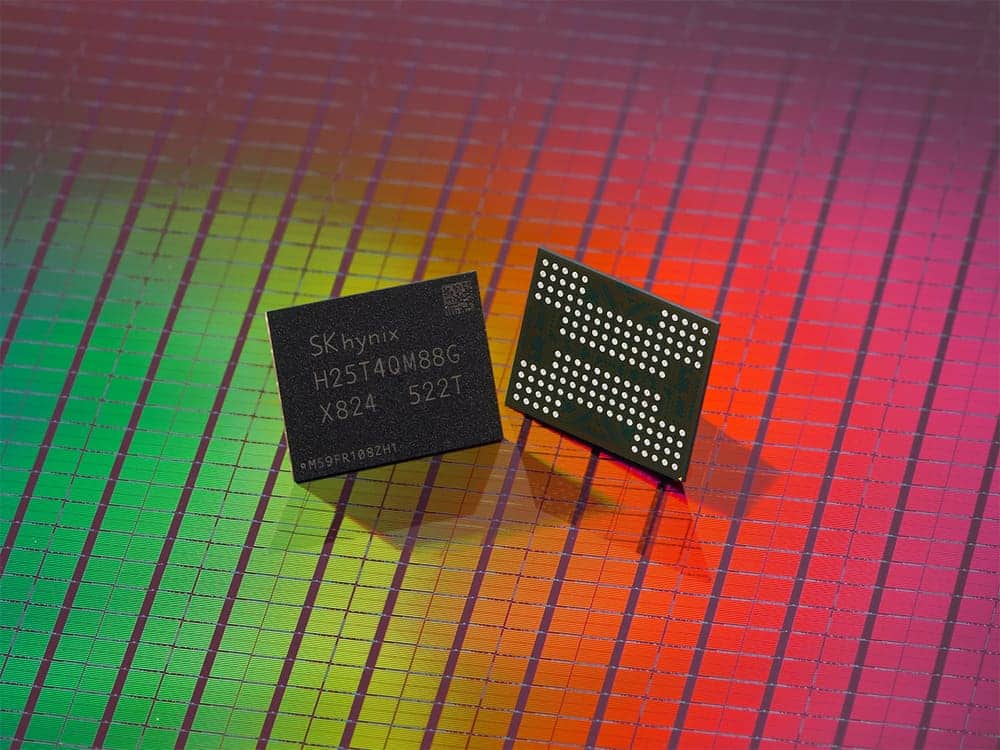

The NAND flash memory market is entering a phase of price increases that are already noticeable outside the professional sector. What has been for years a “cost-effective” category—for entry-level laptops SSDs, SATA drives to upgrade older systems, or external storage boxes—is beginning to face upward pressure from the same force transforming all hardware in 2026: the accelerated buildup of artificial intelligence infrastructure.

Various industry sources place the turning point in late 2025 and early 2026. DigiTimes reports that NAND manufacturers are raising prices “up to 100%,” a range that, due to its wide scope, indicates not all products are increasing equally, but clearly points to a phenomenon: consumer segments, especially those with lower margins, are more exposed when the industry prioritizes more profitable and predictable contracts.

The short explanation: AI “buys” capacity before consumers

This pattern repeats across several product families. Data center demand (and within it, AI platforms) is consuming capacity and prompting suppliers to refocus production toward enterprise lines. Meanwhile, memory manufacturers maintain a “supply discipline” strategy (avoiding market flooding to prevent price crashes), which amplifies any demand spikes.

TrendForce, cited by media outlets that report on its analysis, predicts that in the first quarter of 2026 contract prices could increase by 33%–38% across “all NAND flash categories.” Specifically, for client SSDs (typical for laptops and desktops), the same analysis suggests increases of over 40% quarterly, with a market increasingly polarized between consumer and AI load types.

From contracts to stores: early signs of price hikes already visible

Although contracts between manufacturers and large integrators do not immediately translate into end-user prices, consumers are already seeing symptoms. A retail price tracking study in Europe conducted by ComputerBase detected, in a selection of popular models, average increases of 74.12% in SSDs (since October 2025) and 46.41% in HDDs (since September 2025) in just a few months.

Additionally, within the industrial chain itself, long double-digit movements and, in some cases, doubling in prices are already being discussed. An industry report cited by DigiTimes quoting Phison’s CEO (a key controller supplier) stated that the price of a 1 TB NAND TLC chip rose from $4.80 to $10.70 between July and December 2025, more than doubling.

All in all, the message to the market is uncomfortable but straightforward: when storage becomes a strategic component for AI (datasets, checkpoints, training and inference pipelines), NAND ceases to behave as a “cheap commodity” and begins competing for manufacturing priority with more profitable products.

What “gold-backed SSD” (without exaggeration) means

Consumers tend to interpret these price increases as “price per TB,” which is where the pain really hits: 4 TB and 8 TB models, which had been decreasing due to competitive pressure and market maturity, are once again becoming “luxury” purchases for many home users. In mid-range and budget systems, the impact can be twofold:

- Entry-level laptops: capacity cuts (fewer GB included as standard) or jumps to configurations with slower storage.

- Home upgrades: less incentive to expand an older PC with large SSDs; a return to small SSD + HDD combos.

- Home NAS and homelabs: more conservative planning and pre-emptive purchases to avoid dependence on peak prices.

Other media outlets also describe this cycle as a shift in balance where AI-driven demand reorders priorities and prices across the entire semiconductor supply chain, including memory.

Quick table: key market figures

| Indicator (period) | Magnitude | What it reflects | Source |

|---|---|---|---|

| SSD retail in Europe (Oct. 2025 → Jan. 2026) | +74.12% | Transfer of tension to end prices | ComputerBase |

| HDD retail in Europe (Sep. 2025 → Jan. 2026) | +46.41% | Ripple effect also in mechanical storage | ComputerBase |

| NAND TLC 1 TB (Jul. → Dec. 2025) | $4.80 → $10.70 | Doubling at component level | DigiTimes/Phison |

| Contract price forecast for NAND (Q1 2026) | +33%–38% quarterly | General increase per market analysis | TrendForce (via press) |

| Client SSD contract forecast (Q1 2026) | >40% quarterly | Heavy pressure on higher capacities/limited QLC | TrendForce (via press) |

Why the “low-end” is the first to suffer

In any cycle of scarcity or capacity reallocation, products with lower margins become dispensable for manufacturers: they face more competition, are negotiated at lower prices, and tend to be the first to “drop out” when premium demand (business, data centers, integrators) arises. This explains why, when prices are reported as “up to 100%,” these increases are often associated with specific segments: entry-level units, spot batches, or categories where retail stock depletes quickly and prices heat up.

The result is a more volatile market: shorter promotional periods, models disappearing for weeks and reappearing at higher prices.

Frequently Asked Questions

Why are consumer SSDs increasing in price if AI uses enterprise storage?

Because NAND is a shared supply chain: when manufacturers prioritize enterprise lines or “control” supply, the available volume for consumer products decreases and the reference price rises, impacting domestic catalog prices.

Which capacity ranges are most exposed to price per TB hikes?

Typically 4 TB and 8 TB, where cost/TB ratios depended heavily on NAND availability (including QLC) and retail inventories with “old” prices.

Will HDDs also rise, or can they be a stable alternative?

HDDs can serve as an alternative for bulk storage, but they can also increase in price due to ripple effects and demand shifts. Recent months in Europe already saw significant retail price hikes.

When might NAND prices normalize?

It depends on two variables: how much data center/AI demand continues to grow, and whether manufacturers decide to expand supply for consumer markets instead of maintaining supply discipline. Short-term market analyses point more to continued pressure than quick correction.