Meta Platforms, the company led by Mark Zuckerberg, is in advanced talks to acquire the South Korean company FuriosaAI, which specializes in the development of high-performance chips for artificial intelligence. According to sources cited by MarketScreener, the negotiation could close before the end of the month, although other companies have also shown interest in the startup.

This potential acquisition fits into Meta’s strategy to develop its own hardware infrastructure for AI and reduce its dependence on Nvidia, the market leader in graphics and computing chips for AI models. In a context of high demand and a shortage of advanced chips, more and more tech companies are looking to manufacture their own custom semiconductors.

What is FuriosaAI and why is it of interest to Meta?

FuriosaAI was founded in 2017 in Seoul by former engineers from Samsung and AMD, with the goal of developing chips specifically designed to accelerate the processing of artificial intelligence models, including text generation models like Meta’s Llama 2 and Llama 3.

So far, the startup has raised $115 million in funding from various investors, including the South Korean tech company Naver and the investment fund DSC Investment. Additionally, it already has preliminary agreements with clients in the United States, India, and Japan, although it has not disclosed specific names.

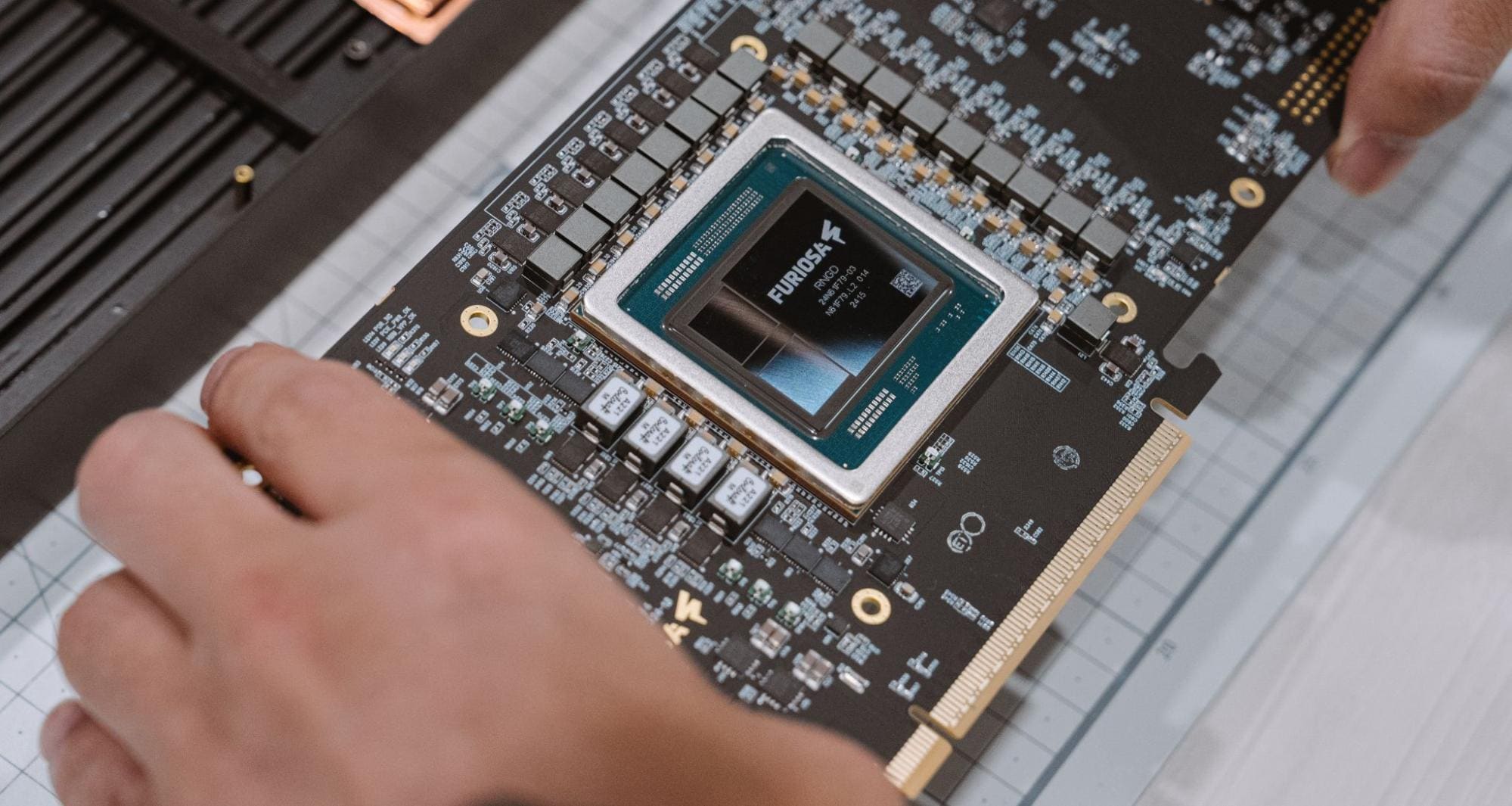

The latest development from FuriosaAI is its chip RNGD, unveiled in August 2024 and developed in collaboration with Global Unichip Corp. from Taiwan. This chip is designed to run AI model inferences with remarkable energy efficiency:

- While Nvidia’s most advanced GPUs can consume up to 1,200 watts, RNGD operates with only 150 watts of thermal power.

- It incorporates SK Hynix’s HBM3 memory, a key technology for processing large AI models.

- According to FuriosaAI, its performance is three times that of the Nvidia H100 GPU, the current industry benchmark.

- Mass production of RNGD is expected to begin in the second half of 2025.

One of the companies that has shown interest in this chip is the LG AI Lab, reinforcing the perception of FuriosaAI as an emerging company with highly competitive products.

Meta and its AI hardware strategy

The potential acquisition of FuriosaAI aligns with Meta’s strategy to develop its own artificial intelligence hardware infrastructure, a trend that other tech giants like Google Cloud, Amazon Web Services, and OpenAI are also following.

Meta has already been investing in the design of custom chips to optimize the execution of its AI models. However, the company continues to rely on Nvidia and other suppliers for its computing needs. With the acquisition of FuriosaAI, Meta could accelerate the development of its own AI accelerator chips, specifically designed for its language models and other AI applications.

This move could also help Meta control costs, given that the price of Nvidia GPUs has significantly increased in recent years due to high demand and supply chain shortages.

Competition for the acquisition

Although Meta is one of the main interested parties, FuriosaAI has also attracted interest from other companies in the tech sector. OpenAI, the company behind ChatGPT, recently announced that it is in the final phases of designing its own custom chips, which could make it another potential buyer.

However, Meta’s acquisition of FuriosaAI could represent a strategic advantage in the race for artificial intelligence, allowing it to have greater independence in the development and deployment of its large-scale AI infrastructure.

Conclusion

The purchase of FuriosaAI would be an important step for Meta in its AI hardware strategy, allowing it to compete more effectively in a market dominated by Nvidia and other companies with advanced computing capabilities. If the deal is finalized, the South Korean tech company would become a key pillar within Meta’s ecosystem, accelerating its development of custom chips and strengthening its position in the artificial intelligence race.

The question now is whether the acquisition will close before the end of the month and how the competition will react to this potential strategic move by Meta.