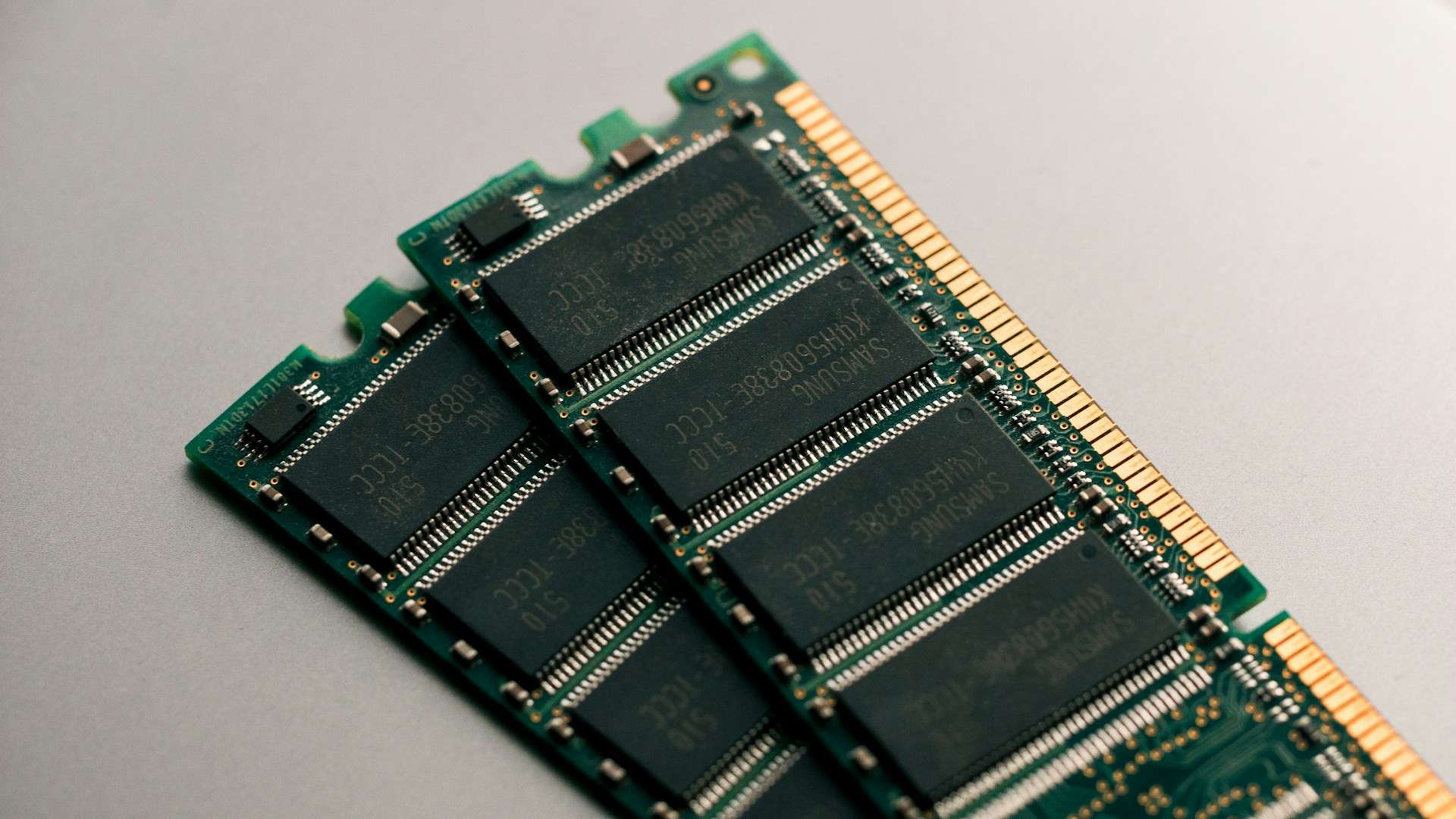

The hardware market is experiencing a contradictory moment: while some graphics cards have lowered their prices, RAM modules and many SSDs continue to become more expensive. After a year of supply tensions that already led to cumulative increases of up to 60% in memory prices, Samsung Electronics anticipates a new 15–20% increase in DRAM in Q4 2025. Translated into consumer timelines, this means that the holiday season won’t be the best time to upgrade your PC or laptop’s RAM.

Why is memory prices rising again?

The explanation again lies in the imbalance between supply and demand:

- The demand for AI (data centers and accelerators with high memory needs) continues to grow strongly and “pulls” the DRAM market.

- Manufacturers prioritize the most profitable segments and adjust their production mix to fulfill higher-margin orders. Meanwhile, there have been reports of movements to reduce NAND production and redirect capacity to DRAM, where profits are greater.

- The result is a bottleneck that increases the cost of consumer DRAM (DDR5 for PCs, LPDDR5/5X for mobiles and tablets) and also pressures SSD prices when demand peaks overlap.

According to industry forecasts, Samsung plans to raise prices by 15–20% in Q4 2025; SK hynix would increase rates around 10%. On the other end of the supply chain, OEMs like Xiaomi have reportedly accepted payments up to 50% higher to secure stock, while companies such as Lenovo have signed long-term supply contracts to ensure availability.

What does this mean for users (and small businesses)

- PC and laptop RAM: if now you see DDR5 kits (not extreme overclocked ones) at prices well above those of a year ago, the new wave could push modules 15–20% more expensive than the previous quarter.

- Mobile phones and tablets: the rise in LPDDR prices may lead to models with more memory (12–16 GB) or restrict aggressive promotions in certain price ranges.

- SSD: although the main pressure comes from DRAM, the context of selective scarcity and AI-related demand drives up many solid-state units, especially high-performance models.

For small businesses and IT teams planning RAM upgrades or laptop refurbishments, the message is clear: budget generously and avoid last-minute purchases in December.

Should I buy now or wait until 2026?

There’s no one-size-fits-all answer, but these practical guidelines may help:

- If you need to upgrade urgently (for development, video editing, VMs), buy early. The forecast for Q4 2025 is upward.

- If you can stretch a few months, compare the total cost: sometimes jumping from 16 to 32 GB when purchasing a new system is more cost-effective than upgrading later.

- Avoid overpaying for extreme frequencies: in many real workloads, DDR5-5600/6000 stable kits with reasonable latencies offer a more sensible price/performance ratio than enthusiast-grade kits.

- Check compatibility (motherboard, XMP/EXPO profiles, density, ranks) to prevent returns that increase your total expense.

- Refurbished market: it can be an option, but review warranty and return policies; avoid modules from mixed brands and chips in sensitive systems.

Side effects: from mobile to the cloud

The “AI boom” affects not only desktop setups. Memory is a critical cross-cutting component:

- Smartphones: manufacturers prioritize flagship launches and high-margin batches. Mid-range models may see less stock in variants with more RAM.

- Laptops: models with interchangeable DIMMs (not soldered) become more attractive due to their upgrade potential.

- Data centers: large AI contracts set the pace. As clusters grow, the professional market absorbs more capacity, putting pressure on the consumer segment.

Signals to watch in the coming weeks

- Wholesale price guides and catalog movements in retailers: often forecast price hikes before they become evident at the retail level.

- OEM bundles (laptops with more RAM) with “short-term” promotions: sometimes they buy in advance to offset increases and then cut back on offers.

- SKUs replacements: when 2×16 GB modules are unavailable, temporary 1×32 GB kits with worse timings or different speeds may appear.

“Checklist” to avoid overpaying

- Define your goal (gaming, editing, local AI, VMs) and minimum RAM requirements.

- Compare €/GB, not just absolute price.

- Opt for twin kits (2×16 GB, 2×32 GB) for dual channel; avoid mixing mismatched modules.

- Update BIOS before installing fast memory (improves compatibility and XMP/EXPO profiles).

- Assess the total cost: sometimes an additional SSD or optimizing boot processes yields a better experience than just jumping from 32 to 48 GB.

Frequently Asked Questions (FAQ)

How much could RAM prices increase by late 2025?

Forecasts suggest a +15–20% rise in DRAM during Q4 2025, after cumulative increases already near 60% in previous months.

Does this affect both PC DDR5 and mobile memory equally?

The impact is observed on both fronts: DDR5/DDR4 for PCs and LPDDR5/5X for mobiles and tablets. The pressure stems from the supply-demand imbalance and the prioritization of higher-margin orders.

Why are SSD prices rising if the issue mainly lies with DRAM?

Because the market is interconnected: as the production mix adjusts and demand linked to AI grows, the NAND/SSD ecosystem also experiences pressure, especially in high-performance models.

Is it a good time to buy RAM?

If you need it now, it’s better to buy before the holiday season. If you can wait and it’s not critical, consider integrated options in a new system or planning for 2026 when visibility on the cycle improves.