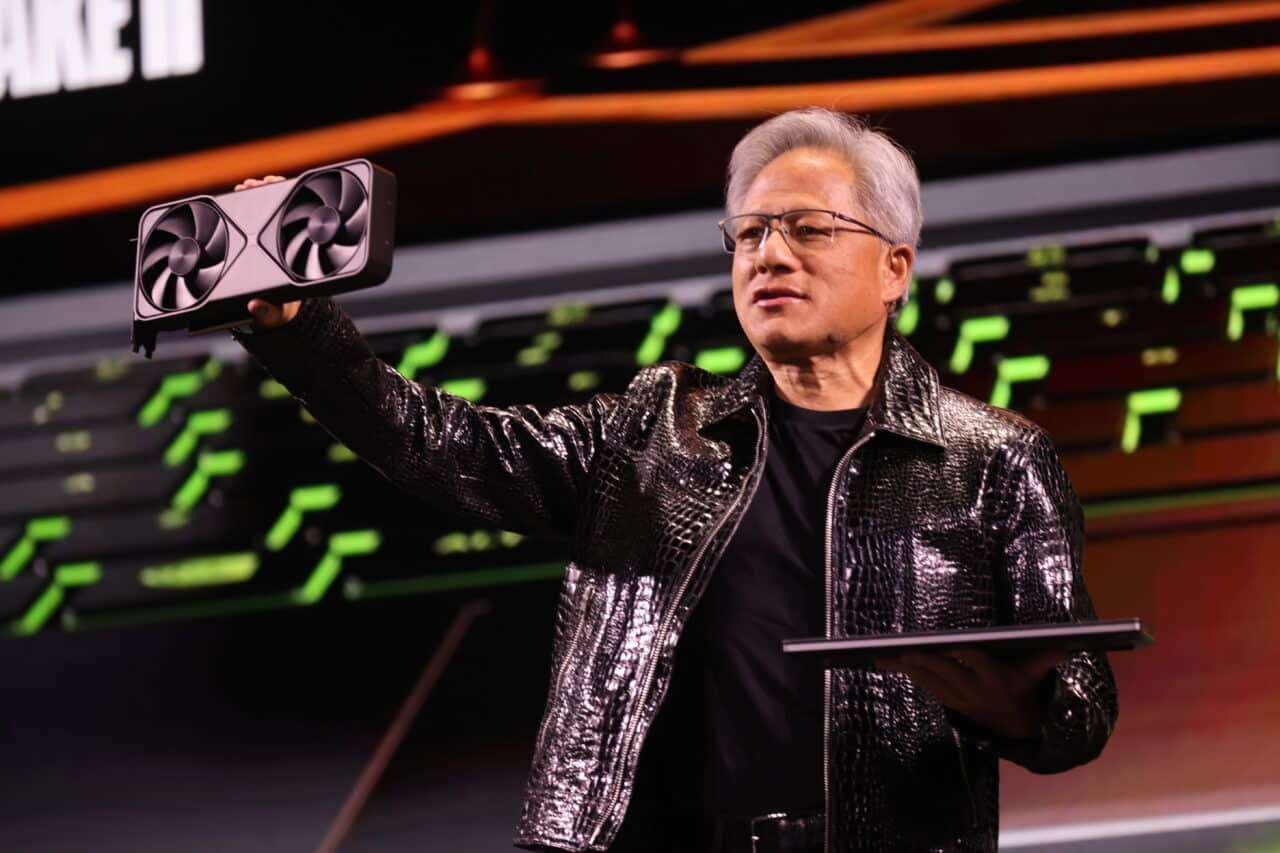

The charismatic CEO of NVIDIA, Jensen Huang, has returned to Taiwan, and once again, his arrival has sparked a wave of speculation. In front of the cameras, Huang made it clear that he was there to meet with TSMC executives and review the status of the Rubin AI chips, their next-generation AI GPU, which has already reached the tapeout phase—meaning the chip design has been finalized and transferred to the photomask for early production testing before manufacturing begins.

Huang also took the opportunity at the airport to address questions about Chinese accusations that the H20 GPU, designed specifically to comply with U.S. restrictions, might include backdoors for security purposes, as well as discussions with President Donald Trump regarding export license approvals.

However, according to Taiwan’s Economic Daily News and analysts cited by United Daily News (UDN), what is publicly said does not reveal the entire picture. Beyond technology, the actual purpose of the trip reportedly centers on discussing tariffs and transfer pricing—issues that directly impact NVIDIA’s profitability and the stability of the global semiconductor supply chain.

Rubin AI in Tapeout: Technology in the Geopolitical Spotlight

The Rubin AI GPU family marks NVIDIA’s next step following the success of Hopper and Blackwell architectures. These chips are expected to maintain the company’s leadership in AI workloads and supercomputing.

The tapeout at TSMC signifies a critical milestone: the design is complete, and the process of creating photomasks for early production and defect detection begins. This stage involves billions of dollars in investment, and any design errors could cause delays lasting months.

Huang’s presence in Taipei highlights TSMC’s role as the epicenter of the AI boom. While in the U.S., there’s talk of “friend-shoring” and subsidies for chip manufacturing domestically, the reality remains that the most advanced nodes—3 nanometers today and 2 nanometers on the horizon—are still primarily manufactured in Taiwan.

This presents a dilemma: NVIDIA could diversify some production to TSMC’s Arizona facility, but most cutting-edge capacity will stay in Taiwan, with all the associated geopolitical risks.

Tariffs and Trump: NVIDIA’s Delicate Balance

Another key reason for Huang’s visit is tariffs. The Trump administration has tightened export controls toward China, forcing NVIDIA to create “reduced” versions of its chips, like the H20, to continue sales in that market.

Now, the Biden White House is considering imposing additional tariffs on semiconductors produced in Asia but sold in the U.S., which would directly threaten NVIDIA, given its supply chain’s heavy reliance on TSMC in Taiwan.

The company has attempted to hedge against this by announcing a bold plan to invest $500 billion in data centers across the U.S., aiming to generate good will in Washington. Still, analysts suggest the real purpose of discussions in Taiwan is to negotiate internal pricing and invoicing arrangements with TSMC that could reduce NVIDIA’s exposure to these tariffs.

Transfer Pricing: The “Hidden Agenda”

According to UDN, the most sensitive issue of the trip likely involves transfer pricing. This refers to the prices multinational corporations set when selling to their own subsidiaries in different countries—a common practice to optimize tax burdens, but often scrutinized by regulators and international bodies.

Practical examples include TSMC in Arizona selling chips to the parent company in Taiwan at one price, then reselling them to NVIDIA under different terms. Additionally, NVIDIA could route some of its procurement through subsidiaries in Ireland or Singapore, jurisdictions with more favorable tax laws.

While not illegal, such structures are controversial, and governments in the U.S. and Europe have tightened rules to prevent tech companies from aggressively reducing their tax bills through financial engineering.

In this context, negotiations between Huang and TSMC CEO C.C. Wei are pivotal to shaping a pricing strategy that benefits both sides without raising regulatory red flags.

A Taipei analyst summarized it as: “Rubin is the headline, but the behind-the-scenes is financial. What’s at stake are transfer prices, fiscal strategy, and how to minimize tariffs that threaten to erode NVIDIA’s margins.”

Rumors, Washington, and TSMC Stakeholdings

The visit also comes amid persistent rumors that the Trump administration might aim to take equity stakes in TSMC to secure strategic control. Although The Wall Street Journal has dismissed such reports, the mere speculation has unsettled the market and caused some volatility in the Taiwanese company’s stock.

Asked about this, Huang avoided financial debates, instead calling TSMC “the best company in the world.” It was a diplomatic response and also a symbolic message: NVIDIA’s future is closely tied to TSMC.

Market Impact: Rotation Out of AI

Huang’s trip coincides with a market correction. Over the past five days, NVIDIA’s shares have fallen 3.7%, reflecting a rotation of capital from high-growth tech stocks to more defensive assets.

While the decline is modest, it suggests Huang’s focus is on long-term risk management—ensuring tariffs, taxation, and supply capacity issues do not hinder the upcoming growth phases driven by Rubin and subsequent chip generations.

The Real Stakes

Three key fronts intersect in this visit:

Technological Roadmap: Ensuring Rubin AI stays on schedule and is produced without delays on TSMC’s most advanced nodes.

Tariff Mitigation: Finding ways to prevent new tariffs from eroding NVIDIA’s margins.

Tax Optimization: Negotiating transfer pricing that maximizes profits while avoiding regulatory conflicts.

The implications extend beyond NVIDIA: they influence TSMC’s financial strategy, U.S. industrial policy, and Taiwan’s role as a semiconductor hub.

A senior Taipei analyst summed it up: “This is no longer just about GPUs or AI. It’s about global fiscal policy, trade wars, and who retains the added value in the most critical supply chain of the 21st century.”

Conclusion: Between Algorithms and Accounting

Publicly, Huang travels to Taiwan to celebrate innovation and discuss Rubin. Behind closed doors, however, the agenda appears to involve as much accounting as algorithms.

Critical questions remain: Can NVIDIA avoid new tariffs through deals with TSMC? Will the Arizona plant be a genuine manufacturing shift or just political symbolism? Will Huang balance investor expectations with Washington’s demands?

Time will tell whether this visit is remembered for airport statements or the deals sealed in meetings.

Sources include Wccftech and UDN.