The semiconductor giant admits it might cease developing leading-edge technologies if it cannot find a major external customer. The news shocks Wall Street and threatens to dismantle Oregon’s largest tech stronghold.

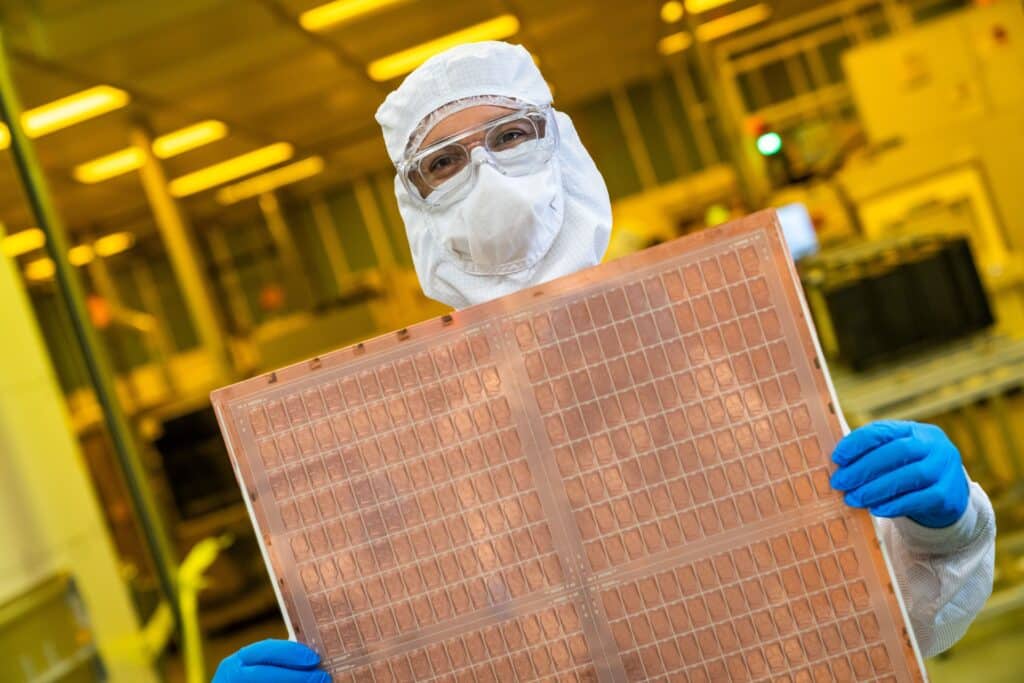

For decades, Intel has been the beacon of innovation in the semiconductor industry, but it has stunned the tech sector by revealing it might abandon its next-generation advanced chip development, known as Intel 14A. This disclosure, discreetly included in a regulatory filing released on Thursday, July 25, raises uncertain prospects for the Ronler Acres research campus, Intel’s core in Oregon and one of the state’s primary economic drivers.

According to the company, if it cannot attract a large external client interested in manufacturing chips with its upcoming process technology—scheduled for 2028 or 2029—it may “not be economically feasible” to continue the development. The warning is clear: if this manufacturing line is halted, there may be no going back.

An unexpected announcement with significant implications

The impact was immediate. Intel’s stock dropped 9% the following day, as analysts and investors tried to process the implications of a statement that wasn’t issued via press release or analyst call, but buried within a lengthy legal document.

This decision comes at a sensitive time for the company. Over the past year, Intel has cut more than 5,400 jobs in Oregon, and its new leadership, headed by CEO Lip-Bu Tan, has halted expansion plans in Ohio, shut factories in Costa Rica, and canceled investments in Europe. Its latest move is a global layoff plan affecting 15,000 employees.

Intel in crisis: no clients for its foundry model

The independent foundry project—opening its factories to third-party clients like Apple or Nvidia—was a major bet under the previous administration of Pat Gelsinger, supported by $7.9 billion from the U.S. government through the CHIPS Act. Yet, to date, Intel has failed to attract any flagship customers for its cutting-edge technologies.

Analysts like Stacy Rasgon of Bernstein & Co. warn that the very prospect of withdrawal could have a discouraging effect: “The revelation itself could hinder the recruitment of large customers if they don’t trust Intel’s commitment to advanced manufacturing.”

Furthermore, the Intel document states that abandoning advanced manufacturing would have serious repercussions:

- Loss of self-reliance in cutting-edge chips

- Over $100 billion in factories and equipment could become obsolete

- Potential refunds of investments due to unmet production goals

- Risk of losing key talent

An uncertain future for Oregon

The Ronler Acres campus—rebranded as Gordon Moore Park—is Intel’s crown jewel and its largest research and development complex worldwide. Once employing over 23,000, it now stands at a decade-low following recent layoffs.

“The purpose of the CHIPS Act was to ensure the U.S. maintains a leadership role in advanced chip manufacturing,” said Duncan Wyse, president of Oregon Business Council. “And it’s hard to see how that’s possible without a cutting-edge node in the U.S., and that node is Ronler Acres.”

Strategy shift or plea for help?

Some observers interpret the announcement as a last-ditch effort to pressure the U.S. government to release the remaining $5.7 billion from the CHIPS Act, including $1.9 billion specifically for Oregon. Rasgon suggested it might be a “cry for help with a veiled threat,” implying Intel is saying, “Help us or we give up.”

The new CEO, Lip-Bu Tan, has not publicly clarified the company’s future plans beyond stating they are in talks with potential clients to customize the 14A platform. While maintaining some optimism, time is running out—Intel has a maximum of 18 months to secure a key customer to safeguard its investment.

A symbol that must not fall

For decades, Intel has been synonymous with innovation and technological progress. Its potential withdrawal from developing advanced chips would be a blow not just to Oregon but to the entire U.S. industry and its competitiveness against giants like TSMC (Taiwan) and Samsung (South Korea).

“The industry needs Intel,” concluded Jim McGregor of Tirias Research. “The whole industry fails if Intel doesn’t succeed.”