The situation for Intel, one of the most prominent names in the hardware world, remains uncertain. Although the company has dominated the processor market for decades, it has lost ground to competitors in recent years, particularly AMD. The arrival of AMD’s X3D processors, along with the Ryzen Threadripper and EPYC, which have proven to be faster and more cost-effective in the professional and server markets, has left Intel in a tough position. In this context, rumors have emerged pointing to a potential acquisition of Intel by TSMC, which has met with strong opposition from several former executives of the company, according to reports from Tom’s Hardware.

Over the past year, Intel has faced serious issues with its processors, such as the Intel Core 13 and Core 14, which displayed instability. Despite several patches to address these failures, the situation severely affected consumer confidence, leading many to seek more reliable alternatives in the market. Additionally, the launch of the Intel Core Ultra 200S did not meet expectations, particularly in gaming performance, where even previous models like the Core 12 offered superior performance. As a result, Intel’s stock, which was around $46 a year ago, has fallen to about $23.

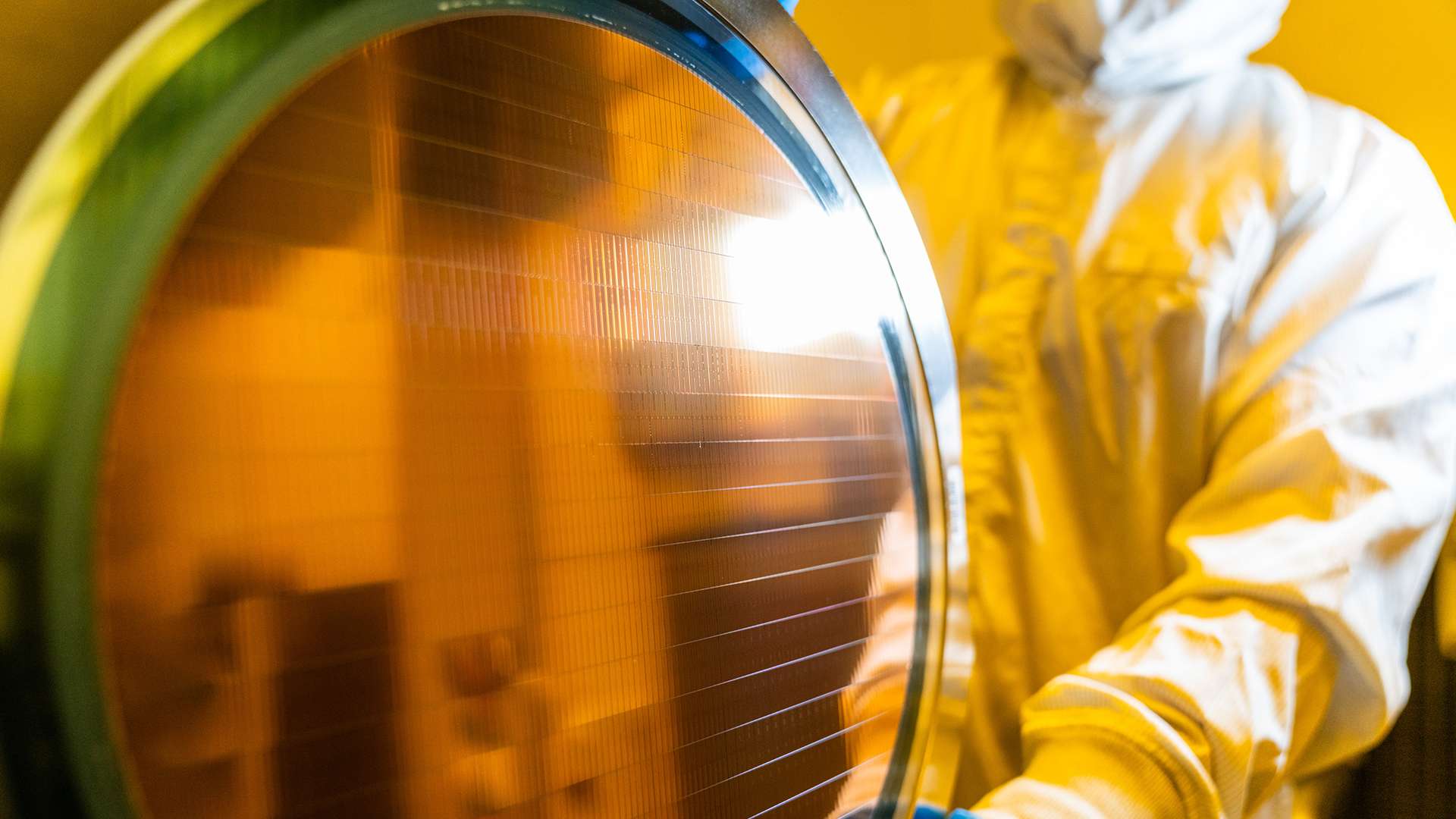

TSMC and Broadcom Interested in Acquiring Intel

Recently, it was reported that TSMC intends to acquire Intel’s factories, while Broadcom has shown interest in designing its own chips using the company’s infrastructure. This possibility was quickly supported by rumors that the administration of Donald Trump might be pushing for a joint venture between Intel and TSMC. This prospect of a sale has not been well-received by some former Intel executives, who have openly opposed the idea of TSMC taking control of Intel’s factories.

Four former Intel executives have expressed concern over what they see as a risk to the United States’ ability to continue manufacturing advanced chips. Instead of allowing TSMC to take over the company, these former executives propose that a portion of Intel’s division be spun off into a separate company, but with U.S. capital. This would ensure that Intel remains an entity controlled by U.S. investors, free from the influence of Taiwan. According to their plan, Washington should intervene with a $10 billion non-voting capital injection while Intel commits to maintaining a sufficient volume of orders to ensure business stability.

The Risk of a Semiconductor Monopoly

Former Intel executives warn that allowing TSMC to acquire the company’s factories could lead to a monopoly in the semiconductor industry, as TSMC is already a leader in the sector. If this acquisition goes through, competition in the chip market would be severely impacted, with implications not just for Intel but for the entire tech industry.

This group of former executives also opposes the plan for a joint venture between Intel and TSMC, believing that such a decision could undermine the United States’ independence in the production of advanced semiconductors, a key industry in the global economy. The suggestion to create a brand-new American foundry responds to the need to preserve the capacity to produce cutting-edge chips on U.S. soil, without relying on foreign players.

Conclusion: The Future of Intel and the Semiconductor Industry

As Intel navigates this challenging situation, the future of the company remains uncertain. Rumors about its potential sale to TSMC have ignited debate about the independence of semiconductor manufacturing in the United States and the creation of monopolies. Meanwhile, the sector continues to closely monitor the movements of companies like AMD, which continue to gain ground with their more competitive chips.

Ultimately, what many consider a “crisis” for Intel could also be an opportunity to reinvent itself and restructure under a model that ensures its survival in the market while preserving the United States’ capacity to lead in the manufacturing of advanced semiconductors.