The global technological race has entered a new phase. While the United States, Europe, and Japan impose bans and restrictions on the export of key equipment for semiconductor manufacturing, China has decided to respond with its own muscle. In just a few days, two milestones have placed the Asian giant at the center of the debate: the unveiling of its first commercially used electron beam lithography scanner and the progress of its national electronic design automation (EDA) tools toward mass production of DRAM and NAND flash memories.

Although they still cannot compete in productivity or scale with Western giants like ASML, Synopsys, or Cadence, these developments point to a clear direction: technological independence and willingness to bear all costs to achieve it.

—

“Xizhi”: the electron pen challenging ASML

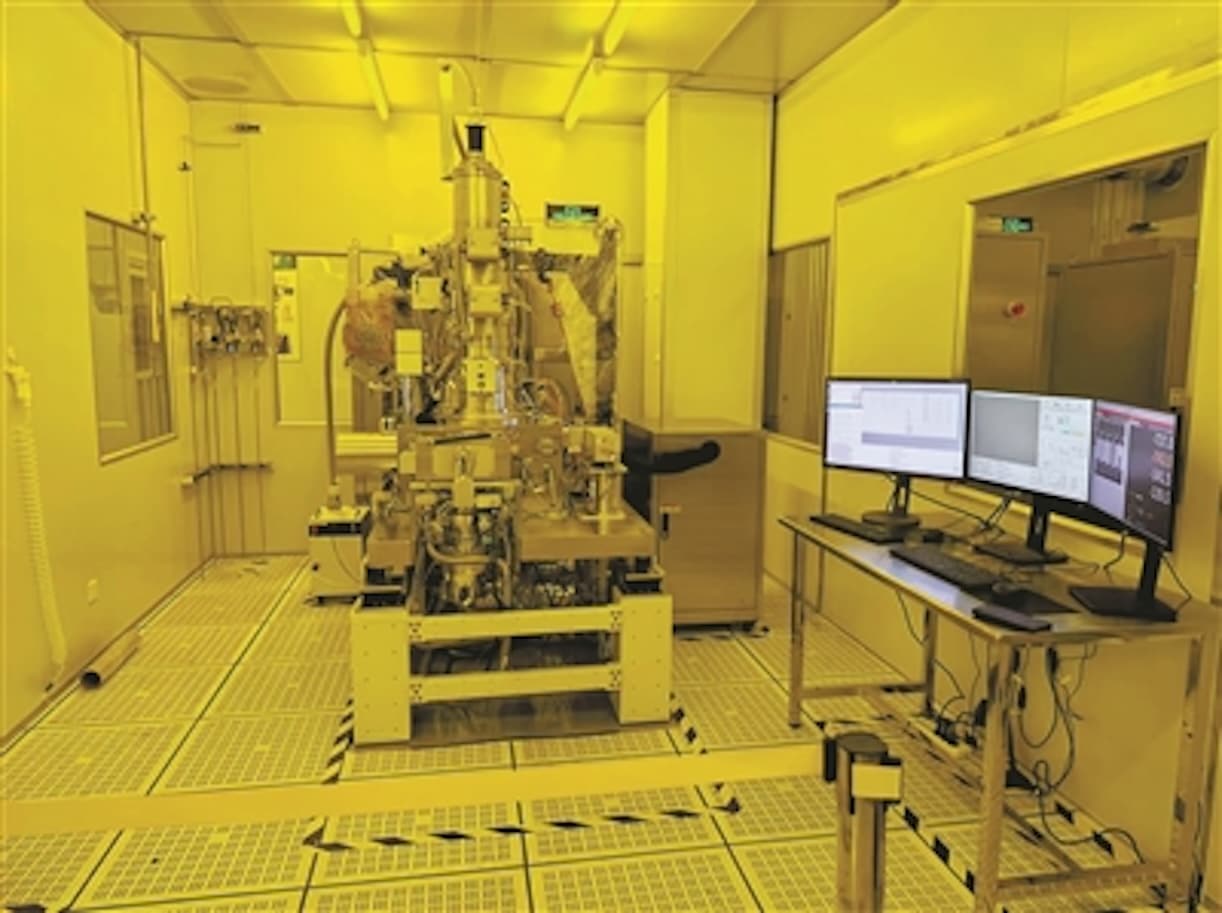

The first announcement came from Zhejiang University in Hangzhou. There, Xizhi was introduced — the first domestically manufactured electron lithography system reaching a precision of 0.6 nanometers, comparable in detail to ASML’s EUV High-NA scanners, a global benchmark in this field.

“It’s like having a pen capable of drawing entire cities on the thickness of a hair,” explained the project lead, comparing the system to a “nanometer pen” that directly engraves patterns onto silicon wafers.

The key difference from ASML’s technology lies in productivity. Electron beam lithography works point-to-point, taking hours to complete a single wafer. While this makes it unsuitable for mass production, it’s an ideal tool for R&D, advanced chip prototyping, and experimentation with quantum technologies and next-generation semiconductors.

In a context where China still depends on imported DUV machines for conventional manufacturing, Xizhi is a decisive step toward closing the gap.

—

Empyrean Technology: the “Chinese Synopsys”

The second breakthrough comes from the software sector. Empyrean Technology, considered a local alternative to Synopsys and Cadence, has achieved that its comprehensive design and verification platform is now being used in the mass production of DRAM and NAND flash memories by manufacturers like CXMT and YMTC.

Until now, Chinese companies depended on U.S. giants for EDA software, crucial tools for circuit design and validation. With rising geopolitical tensions and export restrictions on advanced software, having own EDA tools has become a matter of technological sovereignty.

Numbers reflect this commitment: in the first half of 2025, Empyrean posted revenues of 502 million yuan ($69.9 million), up 13% year-over-year, but its net profit fell over 90%, as R&D expenses absorbed nearly three-quarters of sales. This clearly shows that China is willing to sacrifice short-term profitability to gain long-term autonomy.

—

West vs. China: two models in conflict

The contrast is evident:

– ASML (Netherlands): undisputed leader with EUV High-NA machines, capable of printing below 2 nm and with mass production capacity.

– Tokyo Electron (Japan): a key player in lithography and coating equipment.

– Synopsys and Cadence (U.S.): dominate over 90% of the global EDA software market.

– China: achieving the highest precision ever recorded (0.6 nm) but lacking productivity, and starting to build its own software ecosystem to reduce dependence on foreign providers.

The strategy is clear: don’t compete head-on today, but lay the groundwork to do so tomorrow.

—

What does this mean for global geopolitics?

China’s advance is not an isolated event. It occurs in a context where:

– the U.S. tightens export controls to prevent China from accessing cutting-edge technology;

– Europe protects ASML as its “strategic jewel”;

– Japan continues coordinating with the West to restrict the sale of advanced equipment.

Beijing’s message is straightforward: “We can do it alone.” Even if the path is slower and more expensive, technological independence outweighs external dependence.

—

A long-distance race

Experts acknowledge that electron beam lithography won’t replace EUV in the short term, but they also warn: the important thing is that China proves it masters the foundational knowledge. From there, it can scale up with massive investments in R&D and a national strategy combining subsidies, state purchases, talent development, and local production.

EDA software is even more strategic: without it, chip factories cannot design, verify, or scale manufacturing processes. Like Huawei in telecommunications, China seems determined to create its own closed ecosystem to reduce foreign influence.

—

Are we witnessing the beginning of a new paradigm?

What China’s moves clearly demonstrate is that the chip race is not just technological but also political, economic, and strategic. The question is whether the West can maintain its competitive advantage against a country willing to invest enormous sums, accept huge losses, and endure sanctions to guarantee its independence.

The next decade will be decisive. While the U.S., Europe, and Japan consolidate alliances, China is forging its own path—slower, but increasingly steady.