In light of China’s growing control over the global supply of rare earth metals, Australia has begun to explore alternatives to source these critical materials from mining waste. Rare earth metals, essential for manufacturing chips and other advanced technological components, are at the center of the increasing geopolitical and economic competition. As China, the undisputed leader in the production and refining of these materials, imposes new restrictions on their export, Australia is working on innovative solutions to extract valuable metals like gallium and germanium from mining byproducts.

Australia Seeks Independence in Rare Earths

The global demand for rare earths has surged in recent years due to the boom in technology devices, artificial intelligence, and the transition to renewable energy sources. However, China controls nearly 90% of these minerals, and in the case of certain elements like dysprosium, it holds almost 100% of the supply. In this context, countries reliant on these materials, like Australia, have begun seeking alternative methods to avoid total dependence on the Asian giant.

Recently, Australian scientists have developed techniques to extract germanium from zinc refining and gallium from alumina refining waste derived from bauxite. These methods, although complex, could provide a consistent source of rare earths without the need to import large volumes from China.

Chinese Regulations and Their Impact on the Global Industry

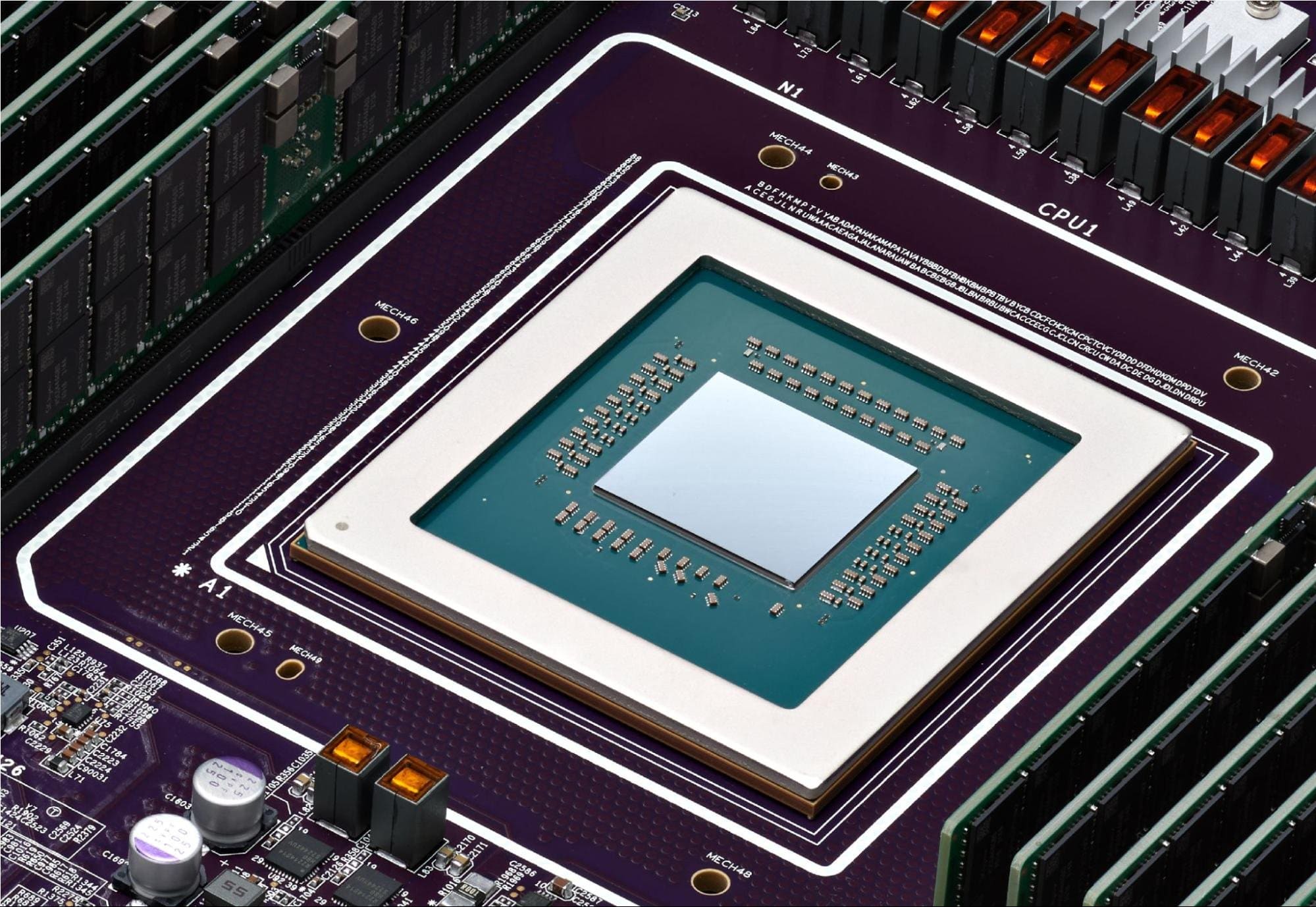

China’s policy shift regarding rare earth exports has raised alarms in the global technology industry. As of October 1, China requires exporters to document in detail the supply chain and end use of these materials, allowing the country to decide who can access them. This regulation adds to the restrictions already imposed on other elements like antimony, gallium, and germanium, all essential in the production of semiconductors and electronic devices.

China’s goal is clear: to control the flow of rare earths and ensure that only those countries and companies aligned with its interests can access these resources. This measure affects not only the chip industry but also key sectors such as defense, renewable energy, and automotive, all heavily reliant on these materials.

Mining Waste: A Promising Yet Challenging Alternative

The recovery of rare earths from mining waste represents a promising alternative for Australia. Extracting gallium from alumina refining waste and germanium from zinc byproducts could reduce the need for imports and help build a more independent supply chain. However, these processes require significant investments in infrastructure and technology to be competitive against China’s efficiency and low production costs.

Australia is not the only country investing in this direction. Other nations, such as the United States and the European Union, have also begun allocating funds for the development of new rare earth refining and processing facilities. However, these projects face regulatory and cost challenges that hinder their implementation in the short term.

The Race for Critical Minerals

As the demand for high-tech products rises, the competition to secure the supply of rare earths intensifies. The International Energy Agency estimates that by 2040, the demand for these materials will multiply, particularly to meet the needs of the energy transition toward renewable sources.

In this context, the search for sustainable alternatives to obtain rare earths is crucial. While Australia’s advancements represent a step toward independence, there is still a long way to go to achieve large-scale production and refining of rare earths without depending on China. Only time will tell if these initiatives succeed in reducing global dependence on the Asian giant or if, conversely, China will maintain its dominance in the rare earth industry.

via: Nikkei