ASML, the Dutch leader in lithography technology, is moving forward with its expansion in China despite increasing restrictions imposed by the United States. The company has confirmed the opening of a new reuse and repair center in Beijing in 2025, strengthening its presence in a market that represents a crucial part of its revenues. However, this decision could intensify tensions between the European Union and the United States at a time when Washington seeks to restrict China’s access to advanced semiconductor technologies.

A Strategic Move with Geopolitical Implications

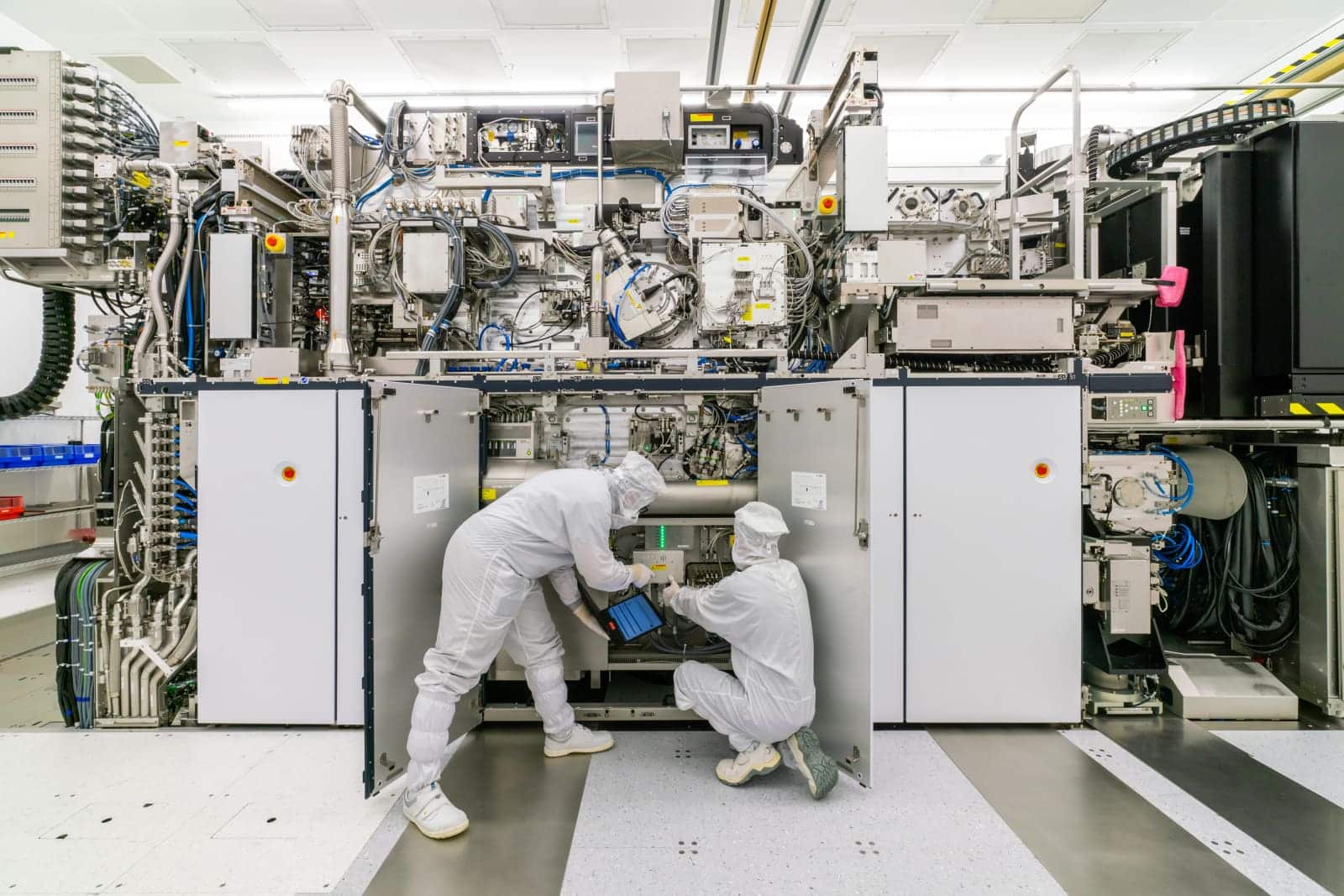

Despite regulatory barriers imposed by the United States, ASML continues with its global expansion strategy. In 2023, the company had already leased facilities in Yizhuang, Beijing, where it established a small maintenance department. With the construction of the new center, service and technical support operations will be relocated to this new site, improving the capacity for equipment repair and reuse in the region.

The announcement comes amid increasing pressure from Washington on the Netherlands to further restrict China’s access to advanced lithography equipment. ASML has been a key player in these restrictions, especially regarding the export of its extreme ultraviolet lithography scanners (EUV), essential for manufacturing next-generation chips.

Europe, ASML, and U.S. Pressure

ASML’s decision has not only economic implications but also geopolitical ones. In recent years, the European Union has shown signs of distancing itself from U.S. technology policy. Washington’s pressure to limit Chinese access to advanced semiconductors has created tensions within the EU, which sees China as a key market for its tech companies.

The establishment of the new repair center in China could become a point of friction between Brussels and Washington. Donald Trump, if he returns to power, has already hinted at the possibility of imposing tariffs on European products, which could impact not just ASML, but the entire tech industry on the continent.

China, a Crucial Market for ASML

The Chinese market is vital for ASML. In 2024, China accounted for €10.195 billion in revenue for the company, equivalent to 36.1% of its total sales. This growth has been notable compared to other key markets:

- South Korea generated €6.409 billion.

- The United States ranked third with €4.522 billion.

Despite the increase in sales, ASML has experienced a decline in its net profit, which was €7.572 billion (-3.41%) in 2024, while its net revenues grew by 2.55%, reaching €28.263 billion.

The shipment volume also indicates the significance of China in the company’s strategy. In 2024, ASML sold 418 lithography machines, of which 44 were EUV and 374 DUV, maintaining a demand exceeding its delivery capacity. China remains a priority market for DUV equipment, which continues to be produced at elevated levels.

U.S. and the Battle for Technological Supremacy

ASML’s announcement has raised concerns in Washington, as the opening of the center in Beijing could strengthen China’s ability to sustain its semiconductor industry while developing its own EUV technology. The United States has made it clear that it will not allow China to achieve technological self-sufficiency in the chip sector without facing consequences.

In this context, the EU and the U.S. are expected to negotiate future restrictions on ASML, especially regarding the renewal of licenses for the supply of spare parts and services in China. If the Netherlands decides not to renew these licenses, ASML could face operational difficulties in the Asian country.

What is clear is that ASML has made a decision that will not go unnoticed in Washington. The company finds itself at the center of a technological and geopolitical battle in which China, the United States, and the European Union play key roles in shaping the future of the global semiconductor market.

via: Mydrivers