Intel is betting part of its future on advanced semiconductor manufacturing with its 14A node, with attention focused on two potential strategic clients: Apple and NVIDIA. Industry sources indicate that both companies have gained access to the 14A process design kits (PDK) and are considering starting trial productions, a move that could determine whether Intel proceeds or halts investment.

Intel’s CEO, Lip-Bu Tan, was clear in his latest earnings call: the development of 14A will depend on confirmed external orders. This marks a shift from their previous “build first, sell later” strategy and serves as a warning that the project may be paused or even canceled if there are no willing customers.

A diversification strategy for Apple and an opportunity for NVIDIA

Apple is evaluating the 14A node as part of a dual-supplier strategy for manufacturing its M-series chips, aiming to reduce reliance on TSMC. This approach would help mitigate supply chain risks and pressure its Taiwanese partner to adjust pricing or capacity.

NVIDIA, on the other hand, could utilize the node for entry-level GPUs or specialized products, diversifying its manufacturing base beyond TSMC and Samsung. In both cases, pilot productions would serve to validate the process and decide whether to commit to large-scale manufacturing.

Technical promises and the challenge of bringing them to production

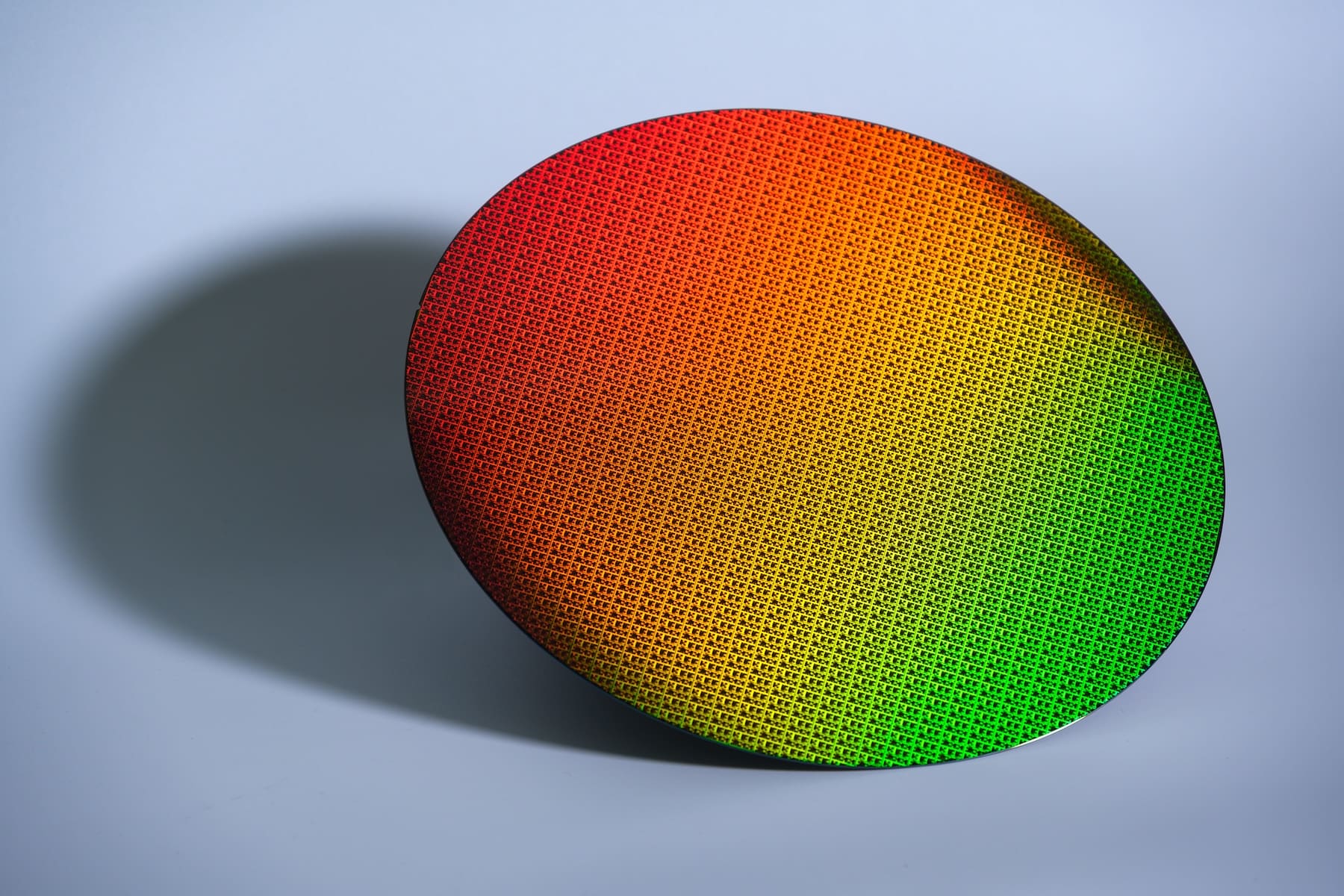

14A is an evolution of the 18A node, featuring second-generation RibbonFET transistors and PowerDirect architecture to improve energy efficiency. However, turning these innovations into a manufacturing process with high yields and competitive costs is a significant challenge.

Intel is not starting from scratch: it already manufactures 18A chips for clients like Microsoft and its Clearwater Forest CPU, but moving to 14A requires not only technology but market confidence. An order from Apple or NVIDIA would be a crucial validation to convince other potential customers.

A tense market

If Apple decides to adopt 14A, the impact on TSMC would be substantial, forcing the Taiwanese giant to reevaluate its capacity allocations and pricing policies. Conversely, if testing does not result in firm orders, Intel could face another setback like past failed attempts, weakening its competitive position and reducing its attractiveness as a top-tier alternative.

Moreover, competition in advanced nodes is intensifying: TSMC is advancing towards 2nm, Samsung is pushing with its GAA technology, and GlobalFoundries is focusing on AI and automotive-specific processes. Intel’s “5 nodes in 4 years” roadmap means it cannot afford prolonged delays if it wants to regain market share in the foundry industry.

Frequently Asked Questions

What is Intel’s 14A node?

It is an advanced manufacturing process that improves upon 18A, incorporating second-generation RibbonFET transistors and PowerDirect to enhance performance and efficiency.

Why are Apple and NVIDIA interested?

Apple aims to diversify its supply chain and reduce dependence on TSMC, while NVIDIA might explore 14A for entry-level products and mixed manufacturing strategies.

What happens if there are no firm orders?

Intel could pause or cancel the development of 14A, reallocating resources to other nodes and projects with higher confirmed demand.

When might mass production begin?

If testing starts soon and proves satisfactory, limited production could begin in 2026, but this will depend on contract agreements and Intel’s ability to achieve high yields.

via: Digitimes