Anthropic, the artificial intelligence company behind Claude, has taken a significant step towards going public. The company has hired the prestigious law firm Wilson Sonsini Goodrich & Rosati (WSGR), a leading Silicon Valley firm known for guiding tech companies through IPOs, to prepare for a potential U.S. initial public offering.

According to sources close to the matter cited by international financial press, Anthropic is also conducting preliminary discussions with multiple investment banks to analyze the best timing and structure for a possible offering. For now, the board of directors has not made a final decision, nor is a timeline set, but the move indicates that the company is positioning itself to go public within the next few years.

An AI “startup” valued like a tech giant

Although founded in 2021 as a more cautious and safety-focused alternative to other players in generative AI, Anthropic has become one of the most valuable private companies in the world. In 2025, the company closed a $13 billion Series F funding round, raising its valuation to approximately $183 billion, led by ICONIQ Capital with participation from Fidelity, Lightspeed, Coatue, Qatar Investment Authority, Blackstone, and others.

The business is also growing at a pace comparable to major tech giants. According to data published during the same funding round, Anthropic’s annual recurring revenue (ARR) increased from around $1 billion at the beginning of 2025 to over $5 billion by August of that year, driven by the adoption of its Claude models by companies across sectors such as banking, retail, insurance, government, and software development.

Adding to its financial strength is support from strategic partners. Amazon has committed to investing up to $4 billion in Anthropic through a combination of convertible notes and future options, in exchange for establishing AWS as a key infrastructure provider for training and deploying the company’s models.

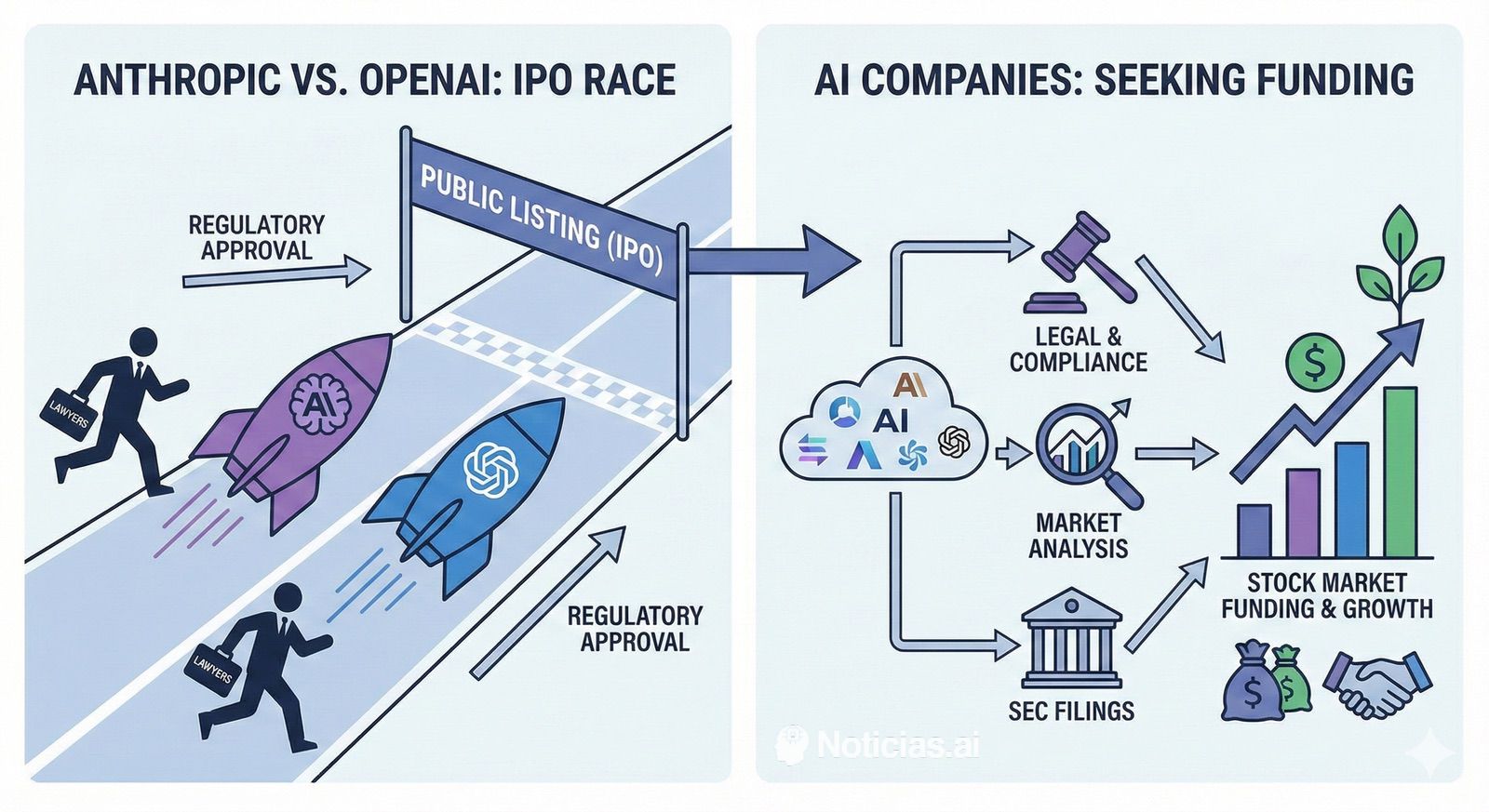

The AI race to Wall Street: Anthropic vs. OpenAI

The potential IPO of Anthropic marks a new phase in the generative AI boom: the battle to also dominate capital markets. While OpenAI explores ways to monetize its growth through equity raises, secondary sales, and eventual going public, Anthropic is moving to ensure it doesn’t fall behind the “AI champions” narrative aimed at attracting institutional investors.

For Wall Street, the appeal is clear: these are companies with double- and triple-digit revenue growth, potentially high margins over the long term, and a central role in transforming businesses and governments digitally. For Anthropic, going public would provide additional funding to continue training increasingly complex models—whose hardware and energy costs are soaring—and strengthen its independence from the tech giants that are currently partners and investors.

However, the environment remains challenging. U.S. and European regulators are scrutinizing AI’s impact on competition, privacy, and employment; central banks maintaining high interest rates make capital more expensive; and markets are starting to differentiate between solid projects and purely speculative bets in the sector.

What could change with Anthropic’s IPO

If the company goes public, the tech sector could experience a new “benchmark moment,” similar to how Nvidia’s IPO once marked a milestone, or more recently, cloud-based AI infrastructure providers. A listed Anthropic would allow analysts and investors to monitor quarterly financial results from one of the leading generative AI players and provide greater transparency on margins, compute costs, customer structure, and innovation pace.

For user companies, the impact would be more indirect but still significant: a broader capital base could accelerate product roadmaps, improve service level agreements (SLAs), and bolster long-term stability. Competitors—from OpenAI to open-source models supported by other tech groups—would face increased pressure: the market would systematically compare revenue, costs, and execution speed.

In any case, Anthropic’s move confirms that generative AI has shifted from an experimental phase to a scenario where major decisions are now being made on stock exchanges as well.

Frequently Asked Questions About Anthropic’s Possible IPO

What is Anthropic, and why is it relevant in AI?

Anthropic is an AI company founded by former OpenAI members, known for its Claude models focused on safety and risk management. It has become a key player in generative AI, generating billions of dollars in annual revenue.

Why is Anthropic preparing for an IPO?

The company seeks to access more capital to fund training larger models, expand cloud infrastructure, and grow internationally. Hiring a specialized law firm and engaging with banks are typical first steps before a tech IPO.

How does Anthropic differ from OpenAI in investors’ eyes?

While competing in the same sector, Anthropic emphasizes safety, AI governance, and regulatory compliance. For investors, this focus can be a key differentiator, along with its client and strategic partner portfolio.

What does it mean for Claude users that Anthropic goes public?

Initially, there should be little change in daily service operations, but increased financial transparency, more pressure to innovate, and enhanced long-term stability could arise from a broader capital base.