The EPYC family drives an unprecedented comeback as Intel loses momentum in the midst of the artificial intelligence era and global data centers.

In a move that seemed unthinkable just a decade ago, AMD has managed to match—and some segments surpass—Intel in the competitive server processor market. According to the latest PassMark data, the company led by Lisa Su has reached a 50% market share in data center CPUs, a domain traditionally dominated by Intel for over 30 years.

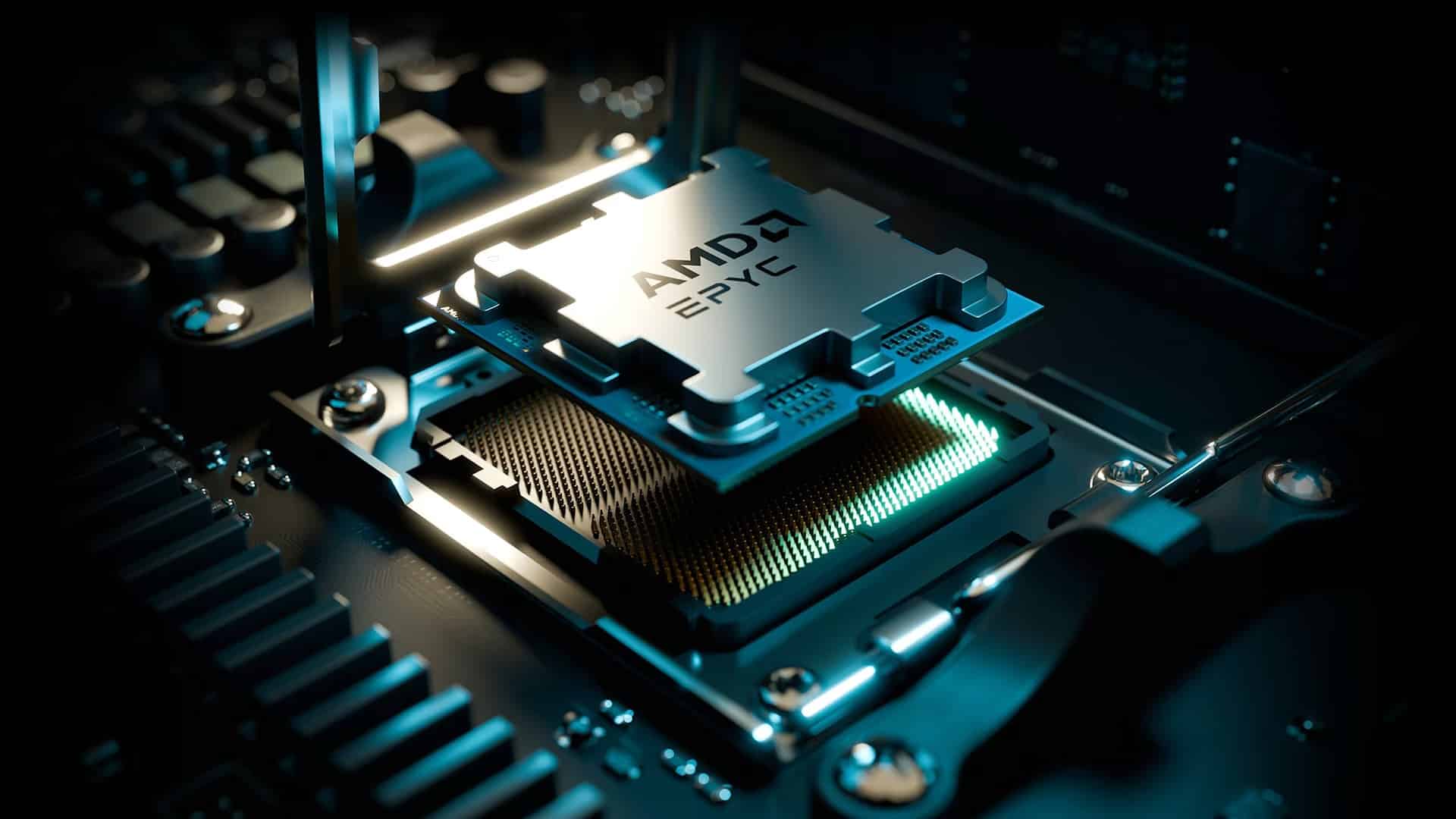

This rapid resurgence is powered by its flagship: EPYC. AMD’s high-performance processor line has gained the trust of corporations, hyperscalers, and cloud infrastructure providers because of its power efficiency, scalability, and competitive cost. All of this is happening amid surging demand for computing driven by the rise of generative AI, massive analytics, and multi-cloud environments.

From irrelevance to leadership in just 8 years

In 2017, AMD held barely 2% of the server CPU market. That was when they decided to bring their Zen architecture into the enterprise sector with the first EPYC “Naples” processors. Since then, generation after generation, the company has maintained an relentless pace of innovation, with architectures like Milan, Genoa, and recently Venice, built on TSMC’s 2-nanometer process.

Data shows AMD’s market share has soared from 20% to 50% in less than two years, a feat unprecedented in the industry. Meanwhile, Intel has faced multiple internal challenges: leadership changes, manufacturing delays, and an Xeon lineup that has failed to keep pace with the competition.

Intel’s delay and AMD’s opportunity

While Intel still holds significant market share and maintains a loyal customer base, its sluggish response to evolving technological demands has led to uncertainty. Its Gaudi line, designed for AI accelerators, has underperformed compared to alternatives from other brands, further emphasizing a stagnation perception. Even CEO Lip-Bu Tan acknowledged that the company has lost its leadership position and is no longer among the top ten most influential companies in semiconductors.

In this void, AMD has strategically positioned itself with a robust offering that combines performance, energy efficiency, and availability, supported by TSMC’s manufacturing capacity, enabling it to meet rising demand.

A new era in data centers

Analysts point out that the shift toward heterogeneous architectures, AI workloads, and digital sovereignty strategies have favored AMD. Its Venezia and Verano EPYC processors (based on Zen 6 and Zen 7) promise up to 256 cores, DDR5 memory speeds up to 12,800 MT/s, and 128 PCIe 6.0 lanes, directly targeting the heart of modern data centers.

Furthermore, AMD isn’t alone. Its ecosystem of Instinct accelerators and expanding partnerships with major cloud providers bolster its position as a strong alternative for HPC, AI, and edge computing architectures.

What’s next?

The battle for server market leadership is far from over. Intel is working on its unified architecture post-Raptor Lake and is reevaluating its strategy with new partners. But the momentum is clearly on AMD’s side.

With half the market already in its grasp and new products scheduled for 2026 and 2027, the question is no longer whether AMD can compete with Intel in servers. It’s whether anyone can catch up to AMD.