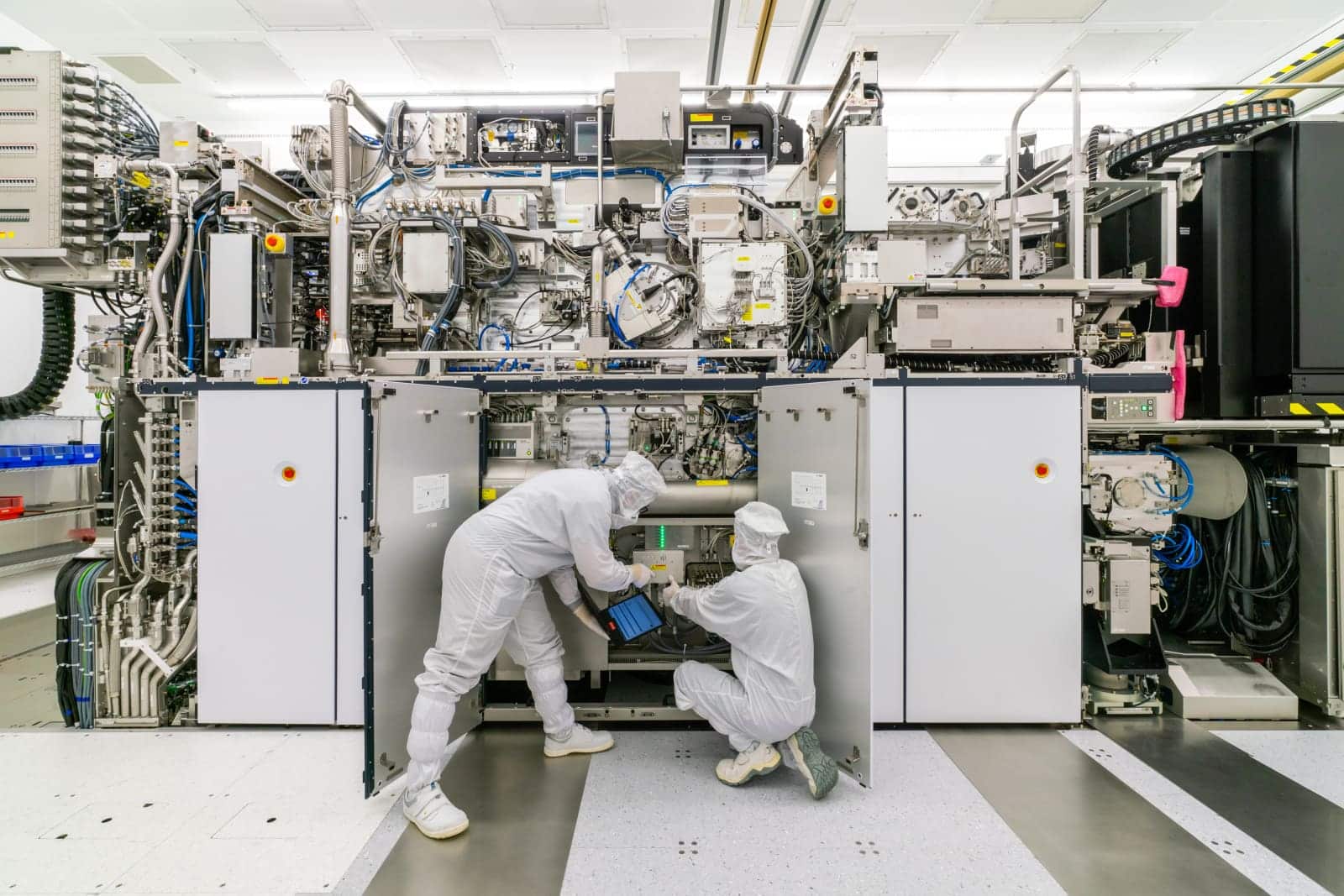

The revolution of Artificial Intelligence is no longer measured just in model launches or the race for data centers. It’s beginning to be reflected, with solid numbers, in where chips are manufactured. ASML, the Dutch supplier dominating advanced lithography necessary to print the most cutting-edge circuits, closed 2025 with a clear message: the appetite for AI compute capacity is pushing manufacturers to expand plants and, consequently, to order more machinery.

The company released its fourth-quarter and full-year 2025 results with a key data point that summarizes the moment: quarterly net orders reached €13.158 billion, a significant jump compared to the previous year, primarily driven by its flagship technology. Of this total, €7.4 billion was for EUV (extreme ultraviolet lithography) systems, the essential equipment for the most advanced nodes. Meanwhile, ASML reported €9.718 billion in sales in Q4, with a gross margin of 52.2% and €2.84 billion in net profit.

The “AI effect” isn’t limited to the quarter. For the full year 2025, ASML announced €32.667 billion in sales and €9.609 billion in net profit, with a gross margin of 52.8%. Furthermore, the year closed with a backlog of €38.797 billion, a figure acting as an early indicator of the industrial cycle and providing visibility across multiple quarters.

Record Orders: From Statements to Factory Reality

In its communications, ASML’s management explicitly linked the demand boost to expectations of “more robust” sustainability of the AI surge. In factory language: customers are raising their medium-term capacity plans, which translates into purchase orders. As explained by CEO Christophe Fouquet, increased production from major clients is “fueling” the flow of orders, from TSMC (key for Nvidia chip supplies) to Samsung and Micron.

This dynamic aligns with what’s happening in the market: AI is skyrocketing demand for servers and accelerators, with operators—including large cloud providers and hyperscalers—pressuring to secure capacity. Essentially, the news isn’t just more chips being made; it’s that the industry is adjusting its “global factory” to produce them, and ASML is at the core of that supply chain.

More EUV, more Services, and Two “High NA” Signals

The company anticipates that 2026 will be another growth year, “largely” driven by increased EUV sales and the expansion of the installed base business (services, maintenance, options, and upgrades). In fact, the Installed Base Management division reached €8.193 billion in 2025, a reminder that the business doesn’t end when a machine is delivered: maintaining, optimizing, and upgrading it has become a crucial second pillar in a market characterized by high complexity and long timelines.

Additionally, in Q4, ASML recognized revenue associated with two High NA systems, the next generation of EUV designed to push the limits of miniaturization. Without grand promises, the detail is significant: when High NA begins to contribute to revenue figures, it transitions from being a “future” technology to an operational reality.

The Big Question: Is There Enough Capacity?

The surge in orders brought with it an uncomfortable question that’s also arisen in other segments of the AI boom: Can the industry deliver at the pace demanded? Reuters highlighted analyst concerns about ASML’s ability to absorb the demand wave, especially as the sector announces new investments and expansions.

In this context, the company announced an internal reorganization focused on simplifying operations so that engineering can once again prioritize innovation. ASML revealed 1,700 job cuts in the Netherlands and the US, as part of a broader plan to reduce management layers and strengthen technical profiles. The goal is clear: cut complexity and speed up execution at a time when every quarter counts.

China, Exports, and a Rebalancing of the Sales Map

Another key element in the 2026 outlook is the geopolitical aspect. China remained ASML’s largest individual market in 2025, accounting for 33% of sales, down from 41% the previous year. The company also projects that this share will fall to 20% in 2026, in a scenario marked by export restrictions led by the US that limit the sale of advanced EUV tools to Chinese customers.

This rebalancing is significant for two reasons. First, because “lost” demand doesn’t disappear—it’s redistributed largely toward regions and players able to purchase the most advanced tools. Second, it means ASML must manage a global expansion cycle with part of the market restricted, just as the world competes to build more semiconductor manufacturing capacity.

Guidance for 2026: Growth but Margins in Check

ASML set its sales forecast for 2026 at a range of €34–39 billion, with a gross margin of 51% to 53%. For Q1 2026, the guidance points to €8.2–8.9 billion in sales, with gross margins in the same range. The company also announced a new share buyback program of up to €12 billion until December 31, 2028, and a planned total dividend of €7.50 per share for 2025.

The overall outlook makes one thing clear: while public debate focuses on models, agents, and applications, the demand for AI is driving major industrial decisions. When these decisions involve lithography—the tool that converts design into silicon—they literally translate into “on-factory floor” demand.

Frequently Asked Questions

Why are ASML’s results considered a thermometer for AI chip demand?

Because ASML sells the critical lithography machinery used to produce advanced chips. If its orders increase—especially for EUV systems—it usually indicates that manufacturers are planning to ramp up capacity to produce more high-performance semiconductors.

What is EUV and why does it matter for AI chip manufacturing?

EUV is extreme ultraviolet lithography. It enables the printing of smaller, more precise patterns necessary for cutting-edge nodes used in processors and accelerators that power AI workloads in data centers.

What does it mean that ASML has such a high order backlog?

It provides visibility into future revenues: these are signed orders pending delivery. In markets with long lead times, backlog helps assess whether demand remains solid and how much production activity is ahead.

How do export restrictions impact ASML’s strategy and the semiconductor market?

They limit sales of advanced tools to certain customers, reshaping the geographic distribution of demand. For ASML, this means expecting a smaller share of sales in China and increased reliance on investments in other regions with access to next-generation lithography.