The transition of Apple to proprietary processors has been more than just a technological stunt. Five years after the debut of the first M1 chip for Mac, this shift is starting to clearly reflect in an industry-focused metric: the unit market share of CPUs in the laptop and desktop segments. Data collected by Mercury Research and analyzed by Bernstein indicate an uncomfortable reality for Intel and an increasingly significant trend for the entire ecosystem: Apple is now competing with AMD in portable unit shares, a longstanding player in the segment.

Mercury’s graphics (with Bernstein’s analysis) show a long-term trend between 2014 and 2025: Intel steadily declines, while AMD gains ground—especially in desktops—and Arm architecture, led on PC by Apple, consolidates as the third force in laptops. Roughly speaking, recent figures depict a scenario where Intel maintains “most” of the laptop market with just over 60%, but far from the near 90% dominance it held last decade. AMD hovers around 20%, and Apple approaches the same mark, just a step away from matching Lisa Su’s company in unit share in laptops.

A shift that began in November 2020

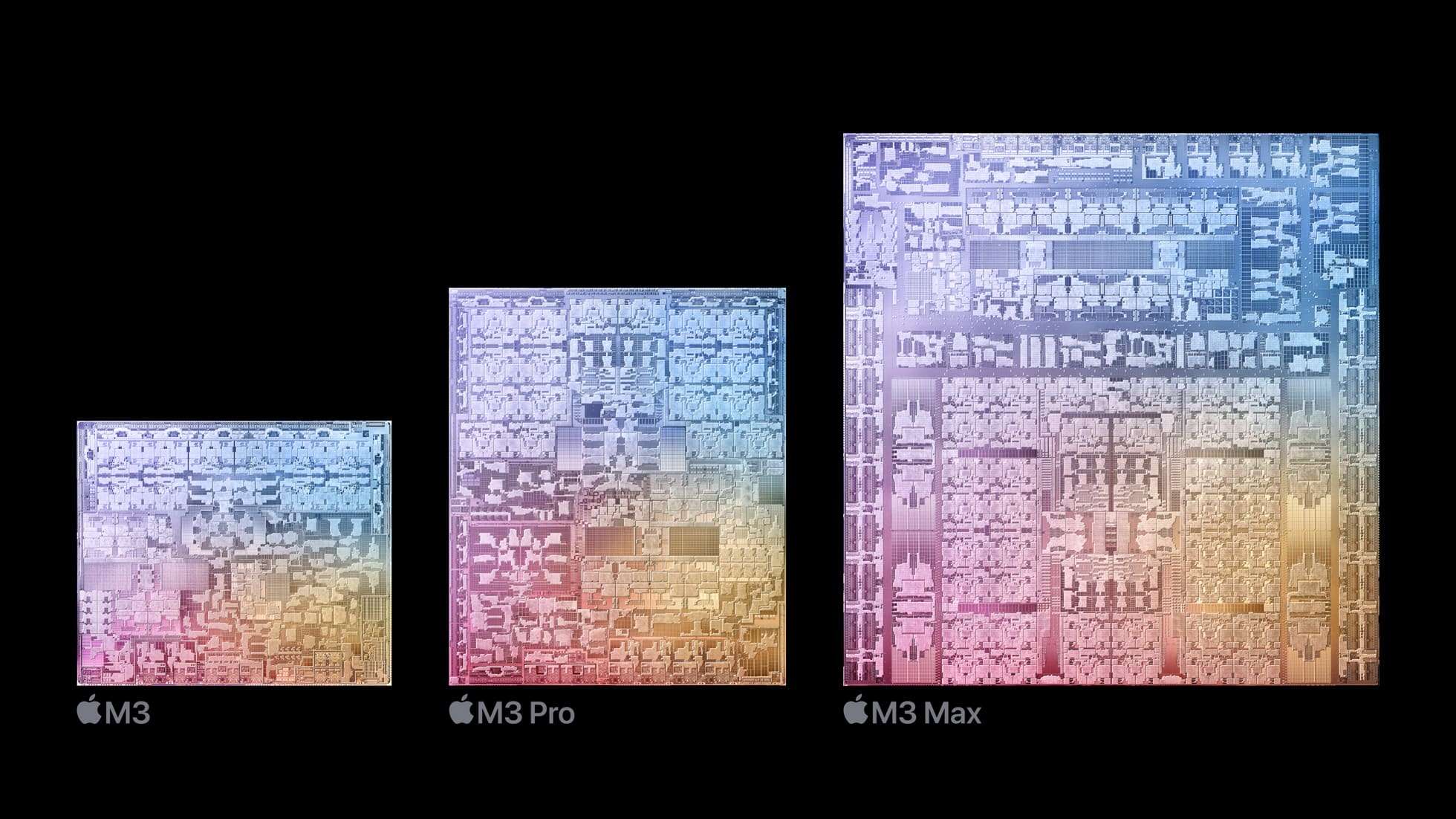

The turning point was the launch of the M1, Apple’s first chip designed specifically for the Mac, unveiled in November 2020. That decision marked a progressive move away from Intel processors towards an in-house Arm-based design, aiming to improve energy efficiency, performance per watt, and platform control (hardware + OS). Apple then announced a new generation of MacBook Air, 13-inch MacBook Pro, and Mac mini equipped with M1, marking the start of a transition the company described as an era change for the Mac.

Five years on, this “experiment” has expanded into a complete ecosystem of chips and products covering everything from ultralight devices to workstations. In 2024, Apple introduced the M4 Pro and M4 Max as evolution of the M4 family, and in March 2025, announced the MacBook Air with M4, reinforcing its presence in the most mass-market segment of its laptops. Also in March 2025, it took another step with the M3 Ultra, targeted at high-performance machines like Mac Studio, solidifying its position in the premium market segment.

It’s not just Apple: Arm as a real alternative

The market analysis is not limited to “Apple versus Intel.” The numbers align with a broader trend: Arm is gaining weight as a PC architecture, driven by three main paths: Macs with Apple Silicon, Chromebooks with Arm chips, and the rise of Windows devices over Arm.

In the first quarter of 2025, estimates cited by European media already placed Arm above 10% in certain slices of the PC and server markets—a symbolic threshold long perceived as unreachable outside mobile platforms. This growth, according to those estimates, relies on Chromebook sales and the expanding Windows on Arm offerings, while Apple continues to concentrate most of the Arm volume in PCs.

Simultaneously, the total market share data also supports this trend. In Q3 2025, Mercury Research reported a 3.9% quarterly increase in microprocessor shipments (above the usual seasonal pattern of 2.4%), with a global market share: Intel fell to 64.2%, AMD rose to 22.1%, and Arm reached 13.7%. While these figures combine categories beyond traditional PCs, the headline is clear: Intel remains the leader, but the market is no longer a “clean” duopoly in units.

Intel declines, AMD grows… and Apple captures part of the market

Segment-specific details are consistent with the portable and desktop graphics. In mobile x86 (laptops), Intel continues to lead in units, but AMD remains close to 22% in Q3 2025. In desktops, the shift is even more pronounced: AMD accounts for about one-third of the x86 desktop market in that same quarter, highlighting Intel’s erosion in its traditional stronghold.

However, the key element is what happens when Arm (and thus Apple) are added to the laptop picture: Intel’s decline becomes more apparent because some units previously counted as “Intel in Mac” disappeared once Apple cut off supply. In other words, Apple has not only gained share: it has reshaped the landscape by removing Intel from an entire family of high-volume, high-margin products.

What it means for consumers and industry

For end users, the immediate takeaway boils down to two main points:

- Efficiency and battery life as market standards. Apple has made performance per watt a key selling point of premium laptops; since then, the entire industry has had to respond, whether with new architectures, NPUs, or aggressive power optimization.

- Fragmentation and specialization. Intel and AMD compete in x86 with different strategies (volume, price, hybrid ranges, AI focus in PCs), while Arm enters through specific avenues where integration and autonomy matter more than traditional compatibility.

For manufacturers, the advancement of Apple Silicon signals a strategic conclusion: controlling the platform (silicon + software + product) is once again a competitive weapon. And for Intel, the persistent decline in laptops and desktops increases pressure on what has been its main stronghold, especially as the market reorganizes around new workloads (local AI productivity, content creation, inference, etc.).

Frequently Asked Questions

What does “unit market share” in CPUs for laptops and desktops mean?

It represents the percentage of processors sold (by units) for each manufacturer or architecture within a segment, without considering revenue or average price.

Is Apple taking market share from AMD or mainly from Intel?

In laptops, the transition of Macs from Intel to Apple Silicon directly impacts Intel. AMD is also growing strongly, mainly in desktops, also at Intel’s expense.

Why is Arm growing in PCs if it didn’t take off for years?

The combination of energy efficiency, new chip ranges, software improvements, and highly integrated products (like Macs) has allowed Arm to compete realistically in terms of autonomy and performance per watt.

Can Windows on Arm accelerate this shift in laptops even further?

If a solid offering with good compatibility and competitive battery life materializes, Windows on Arm could expand the Arm market beyond Apple’s ecosystem, especially in ultralight devices.