The race to scale Artificial Intelligence by 2026 isn’t just about GPUs, HBM memory, or data center power capacity. Behind the scenes of the supply chain, a much less visible component threatens to influence timelines and costs: advanced fiberglass used in printed circuit boards (PCBs), laminates (CCLs), and especially in high-end substrates for chip packaging. Various industry analyses point to continued scarcity of premium “glass fiber cloth”, with particular pressure on technical families like Low CTE and Low Dk2, which are considered critical for the most demanding products in the AI ecosystem.

A discreet material with a direct impact on performance and reliability

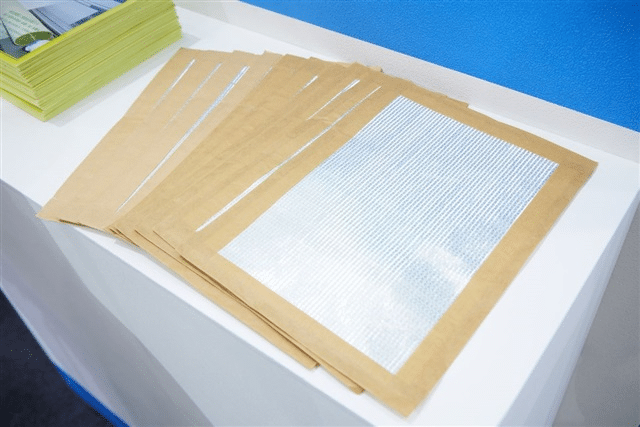

Practically speaking, “fiberglass cloth” is used as reinforcement in laminates and substrates. In the most advanced products, the goal isn’t only durability: it also aims to minimize deformations, maintain dimensional stability, and preserve electrical properties that enable high-speed signals with less loss. In this context, two acronyms have emerged that have shifted from technical jargon to the geopolitical-industrial arena:

- Low CTE (low coefficient of thermal expansion): helps reduce heat-induced deformations, especially relevant when high-consumption chips and memories are integrated into complex packages.

- Low Dk / Low Dk2 (low dielectric constant, second generation): aimed at improving electrical interconnect performance, increasingly important with wider bandwidths and higher interconnection densities in AI accelerators and servers.

According to market sources and specialized media reports, pressure is most intense for Low CTE, followed closely by Low Dk2. Meanwhile, first-generation Low Dk1 appears to have achieved a more balanced supply-demand situation.

The domino effect: from AI server upgrades to the “Low Dk2” bottleneck

The critical point is that demand continues to grow. Upgrading server platforms — with more power, interconnection, and density — drives adoption of higher-spec materials. This industry phenomenon reflects that when a bottleneck is alleviated, the next one appears upstream. Currently, some players see Low Dk2 as the next potential constraint, precisely because it supports new performance and signaling demands within PCBs and substrates.

Simultaneously, improvements are seen in “mid-range” applications—such as certain smartphone components or memory controllers—thanks to efforts by Taiwanese manufacturers to expand supply of substrates ABF and BT. However, the “premium” segment linked to AI — high-level substrates and advanced packaging — remains the battleground.

The real bottleneck lies further upstream: special yarns and furnaces

Although it appears as a “fabric” issue on the surface, industry describes two key production stages: special yarn manufacturing and weaving. The crucial detail is that the bottleneck isn’t always at the weaving stage, but rather in the supply of high-end specialty yarns.

Producing these yarns demands expertise, stabilized processes, lengthy validation, and significant investments in furnaces (which involve long construction or reconversion times). Historically, the market has depended heavily on a small group of suppliers, with Nittobo (Japan) repeatedly mentioned as the dominant actor in this niche. As a result, even as ramp-ups are announced, supply flexibility doesn’t always keep pace with AI-related demand.

Taiwanese players step into the arena: Taiwan Glass, Fulltech, and Nanya making moves

In this context, several Taiwanese companies are working to bridge the gap.

Taiwan Glass emerges as one of the most prominent contenders. Industry reports highlight advances with alternative materials—such as “TS-Glass”—which have helped them enter supply chains linked to AI, including partnerships with NVIDIA. Their clear ambition is to strengthen their position in Low CTE and Low Dk2 materials and become a top-tier supplier by 2026.

Meanwhile, Fulltech Fiber Glass announced progress with a new product line (“FLE”), which reportedly passed customer certifications and was set to begin limited shipments in Q4 2025 with plans to increase volumes in 2026. The company expects families like Low Dk, Low Dk2, and Low CTE to comprise a significant portion of their growth.

The third key player is Nanya (Nan Ya Plastics), which has announced a strategic agreement with Nittobo to split manufacturing tasks: Nittobo will produce the specialized yarn, while Nanya handles weaving. The goal is that, by late 2027, about 20% of Nittobo’s total specialized fabric production will be woven by Nanya. It’s also noted that Nanya’s Low CTE products completed certification in Q4 2025 and began initial small-scale production, with plans for increased orders starting in 2026.

The consensus among industry sources is that these alliances aim to accelerate supply response without waiting for entirely new capacity to come online. Nonetheless, the prevailing outlook is that in 2026, the market will remain tight, especially for the most demanding grades used in advanced packaging and AI substrates.

Implications for the market: costs, availability, and priorities

When a critical raw material faces constraints, its effects typically manifest across three areas:

- Cost and renegotiations: technical improvements (and shortages) tend to drive up prices.

- Capacity allocation: larger buyers with long-term contracts secure supply first.

- Schedule risks: even with chips available, lack of substrate or PCB materials can slow ramp-ups and deliveries.

In other words: the industry might have advanced designs and nodes ready, but if a “humble” link — like extreme-spec yarns and fabrics — fails, the entire supply chain slows down.

FAQs

What is “Low CTE glass fiber cloth” and why is it critical for AI substrates?

It’s a type of fiber/fabric with a low coefficient of thermal expansion. It reduces heat-induced deformations and enhances reliability in substrates and advanced packaging, where mechanical and thermal tolerances are increasingly tight.

Why is Low Dk2 considered the next bottleneck in 2026?

Because AI server upgrades demand materials with better electrical properties. Low Dk2 improves signal integrity in high-speed interconnects, and with soaring demand, supply may fall short.

What are the differences between ABF and BT substrates, and how does fiberglass influence them?

ABF and BT are families of substrates used in packaging. In advanced applications, reinforcement quality (fiberglass) impacts stability, planarity, and electrical behavior—hence the rising relevance of Low CTE and Low Dk variants.

How does this scarcity affect companies and end-users (PCs, mobiles, data centers)?

It tends to prioritize supply towards AI and higher-margin products. For consumers, this may mean less availability of certain components, increased costs, and tighter schedules for product launches or upgrades.