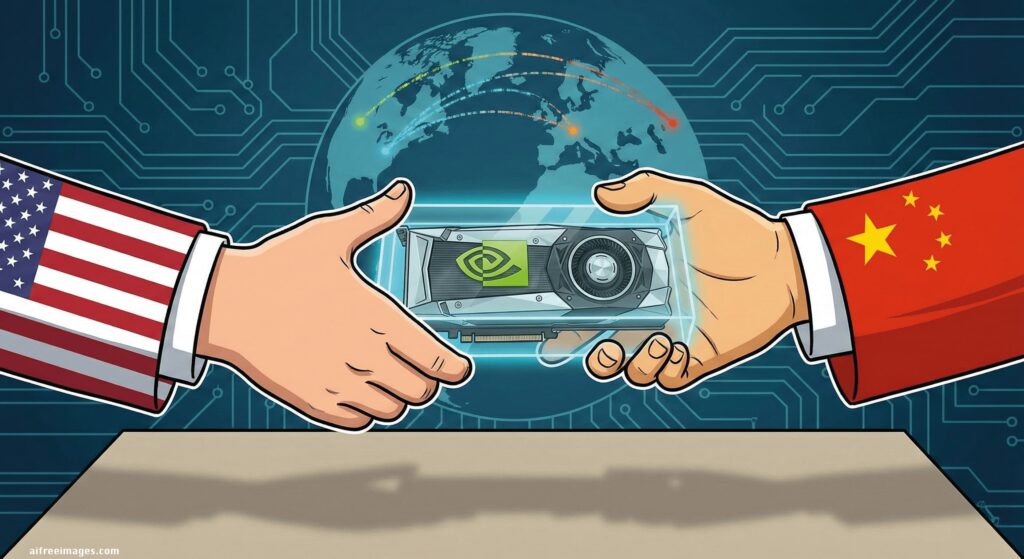

Nvidia has responded to rumors claiming an unusual tightening of its commercial terms for selling its H200 GPUs to Chinese customers. The company has assured that it does not require full upfront payment and that it has “never” asked a customer to pay for a product they have not yet received, according to a spokesperson’s statement in response to reports published in recent days.

The clarification comes at a particularly sensitive time for the AI accelerator business. The H200 is a coveted piece in the market — aimed at AI workloads in data centers — and its availability, pricing, and purchase permissions have become matters of industrial strategy, not just logistics. In this context, any sign of commercial “friction” (such as advance payments without cancellation options) is quickly interpreted as a sign of regulatory risk or uncertainty about deliveries.

The origin of the noise: regulatory uncertainty and inventory risk

The reports Nvidia denies were based on a simple idea: if the regulatory framework casts doubt on whether an order can be fulfilled, the seller tries to cover themselves. In this case, the uncertainty is not limited to a single front. On one hand, Washington maintains a restrictive approach to exporting advanced technology to China; on the other, Beijing is also modulating its companies’ access to these chips, partly to prioritize domestic alternatives and control external dependencies.

Reuters reported that China has announced new restrictions on H200 purchases, with criteria described as deliberately “vague” and approvals restricted to “special circumstances,” such as certain uses related to university research. This move suggests that a return to normalcy for Nvidia accelerator purchases is not guaranteed, and the Chinese market will remain conditioned by political and administrative decisions. (Reuters)

In this scenario, the business risk is clear: if large volumes are reserved for production and, at the last minute, a significant portion cannot be delivered, the manufacturer may end up with stock that is difficult to resell or manufacturing capacity committed to other higher-margin products. That’s why the debate over “who bears the risk” — the customer or the supplier — has moved from boardrooms to headlines.

Nvidia’s stance: “You don’t pay for what you don’t receive”

Nvidia’s response aims to clarify this perception. According to Reuters, the company emphasizes that it does not require upfront payments for the H200 and underscores that it would not ask anyone to pay for a product that has not yet been delivered. At the same time, it acknowledges that in previous dealings with Chinese clients, deposits had been used — a common practice in sectors with long lead times and limited allocations — but this does not mean requiring 100% payment before delivery. (Reuters)

This clarification is significant for two reasons. First, reputation: Nvidia does not want to be associated with “exceptional” practices for a specific country, especially when public discussions blend trade, sanctions, and geopolitics. Second, practical: in a market where orders are planned months in advance, contractual terms signal trust. If buyers perceive conditions to be tightening, they may accelerate the search for alternatives or renegotiate volumes.

China, “very high” demand, and the market looking ahead

The situation also offers a broader lesson: the AI business today is less a simple supply chain and more a critical infrastructure where technological sovereignty, industrial competition, and changing rules converge. In this context, a phrase like “we do not ask for upfront payments” is more than accounting clarification — it’s a message to the market on how Nvidia intends to manage risk without abruptly transferring it to customers.

Implications for companies, integrators, and data centers

For companies relying on advanced GPUs — from AI labs to cloud providers, integrators, and data center operators — the key issue is not just payment. It’s predictability. If approvals can vary and purchase criteria become opaque, capacity planning (clusters, power, cooling, networking, rollout timelines) gets more complex.

In the short term, Nvidia’s statement aims to prevent a domino effect: that rumors of stricter conditions lead to additional uncertainty, delays, or loss of confidence in ordering processes. But the overall picture remains the same: the availability of AI hardware in certain markets is shaped both in regulatory offices and manufacturing plants.

Frequently Asked Questions

Why is it so important that Nvidia does not require upfront payment for H200 GPUs?

Because when it comes to critical AI hardware, lead times and regulatory risks can be high. If the supplier demands full prepayment, it shifts the delivery risk onto the customer and can disrupt budgets, financing, and deployment planning.

What does China’s restriction to “special circumstances” mean for H200 purchases?

It means not all companies will be able to buy freely, and approval might depend on the use case (e.g., research). This creates uncertainty for AI projects that depend on these GPUs.

How do export controls and Beijing’s policies affect data centers and AI projects?

They impact the actual availability of accelerators, delivery schedules, and capacity planning. When GPU access becomes uncertain, infrastructure sizing and expected ROI are also affected.

What alternatives do companies consider when facing uncertainty around top-tier GPUs?

In addition to diversifying suppliers and architectures, many organizations revisit strategies like inference optimization, more efficient models, reuse of existing hardware, and flexible supply arrangements.

Source: tomshardware