Bitcoin mining started largely as a hobbyist activity using home computers and patience. Fifteen years later, that scene is a distant memory: the oldest mining pool in the ecosystem, originally launched as Bitcoin CZ and known for years as Slush Pool, celebrates its 15th anniversary now under the name Braiins Pool, with figures that reflect the sector’s radical transformation.

According to the pool itself, over these 15 years, it has participated in mining 1,311,339 bitcoins. In monetary terms, based on the market price at the time these figures were shared, that volume would be around $115 billion. If calculated with the maximum annual figure mentioned in the same data, it rises to $162 billion. It’s important to highlight the nuance: in such a volatile asset as Bitcoin, any dollar figure is a “snapshot” that fluctuates with the price.

The birth of pools: when solo mining ceased to be “reliable”

Braiins Pool not only commemorates years; it commemorates an idea. By the end of 2010, individual mining was already becoming unpredictable for many participants. Finding a block could mean streaks of “luck” or long periods without rewards, and energy costs started to weigh heavily. The answer was cooperation: pooling power among many miners and distributing rewards more steadily.

This was the foundation of Bitcoin CZ, driven by the programmer known as Slush (Marek Palatinus), which eventually became Slush Pool and later Braiins Pool. In those early days, the approach was simple and, for the time, almost revolutionary: a system allowing each miner to contribute hash power, record their contribution, and receive payments when a configurable threshold was reached.

From 60,000 KH/s to 13.56 EH/s: a scale leap that explains an entire industry

The most symbolic data point of the anniversary is the comparison between the starting point and the present. When it launched, the pool had a combined power of about 60,000 KH/s. By 2025, the published figure places its capacity around 13.56 EH/s.

The translation is almost absurd for those unfamiliar with the sector: it represents multiplying the initial power by roughly 225 billion times. This growth isn’t just “more computers”; it’s evidence of how mining has shifted from home CPUs and GPUs to specialized ASICs, industrial farms, and a global competition where energy efficiency and access to cheap electricity determine who survives.

(In fact, the debate over the exact figure arises even in public discussions: some headlines mention 255 trillion, but calculations based on publicly available power magnitudes suggest a figure around 225 billion.)

A historic pool in an unrecognizable Bitcoin compared to 2010

The technological leap of the pool has paralleled Bitcoin’s own evolution. In December 2010, when the first pool emerged, the BTC price was nearly symbolic—about $0.22 according to available data. From there, the asset experienced cycles of euphoria and declines, reaching major milestones: surpassing $26 in 2011, breaking $1,000 in 2013, approaching $20,000 in 2017, and exceeding $67,000 at the end of 2021.

At the time of the 15th anniversary data release, the approximate BTC price was around $86,000, with recent weeks seeing the asset briefly above $125,000. These figures help explain why, over time, mining has shifted from a hobby to an industry with energy, financial, and geopolitical implications.

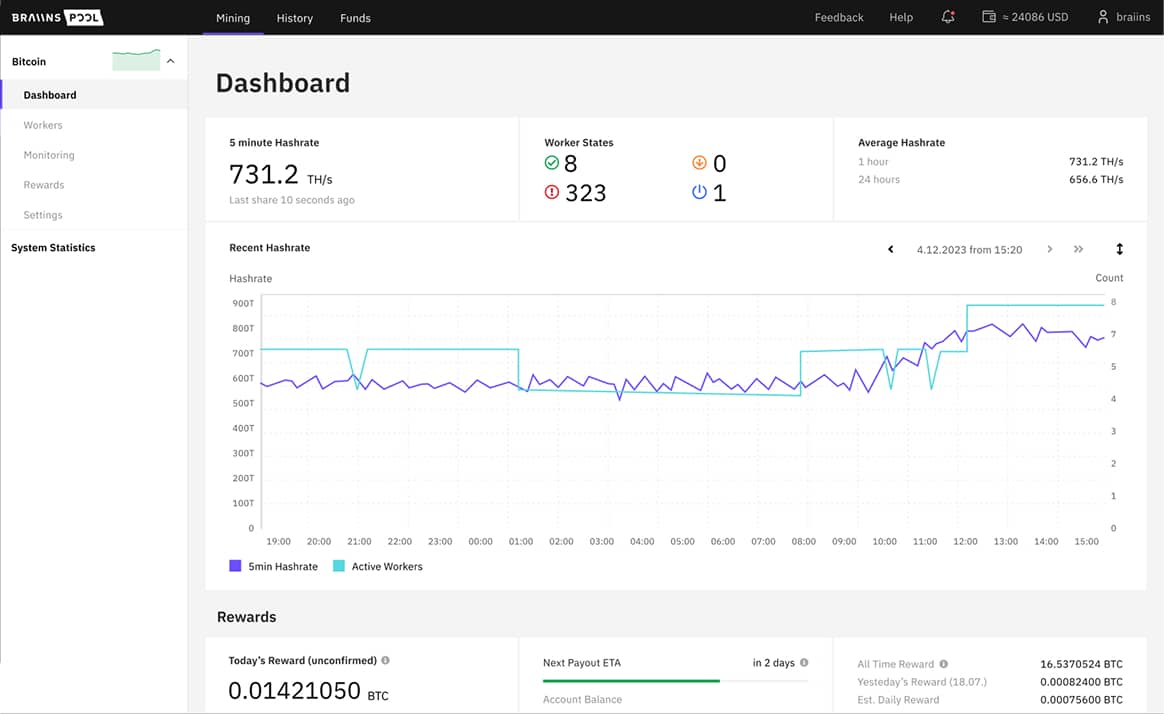

13,000 active users and an “ecosystem” surrounding mining

Braiins Pool claims to have nearly 13,000 active users and presents its activity as part of a broader ecosystem that includes management tools, firmware for ASICs, and related services. The message, amid the celebration, is clear: the pool that helped “normalize” collaborative mining continues to compete in a market where the global hashrate is hitting record highs and professionalization has become the norm.

Frequently Asked Questions

What is a Bitcoin mining pool and why was it created?

A pool is a group of miners combining their hashing power to find blocks more consistently and then sharing the rewards proportionally based on each participant’s contribution.

What does it mean for a pool to have 13.56 EH/s of hashrate?

Hashrate measures the computational power dedicated to mining. EH/s means exahashes per second—a huge magnitude indicating industrial-scale activity, not home setups.

How is the “dollar value” of coins mined by a pool calculated?

It’s the number of BTC attributed multiplied by the current market price. Since Bitcoin’s price fluctuates constantly, this valuation can vary significantly.

Does joining a pool still make sense in 2026 if mining with an ASIC?

For most, yes: solo mining is typically highly irregular. In a pool, earnings tend to be more stable, although they depend on fees, difficulty, BTC price, and electricity costs.