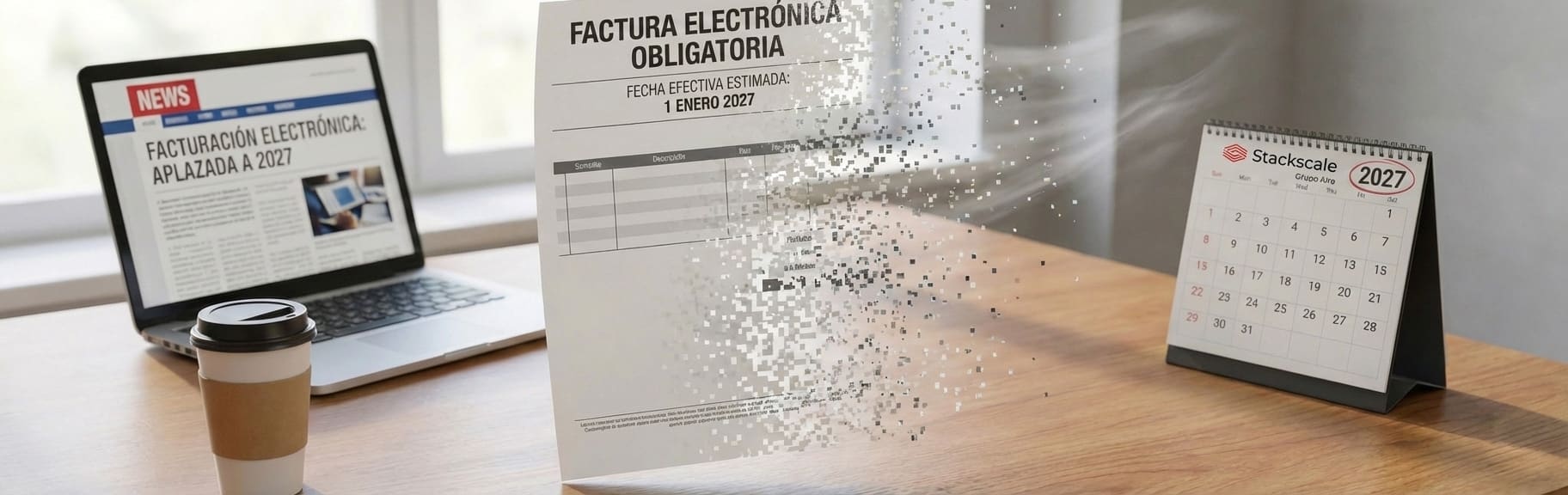

The mandatory implementation of electronic invoicing in Spain, one of the pillars of the plan to combat tax fraud and the underground economy, will not happen as soon as initially planned. The Government has decided to postpone the system’s rollout until January 1, 2027, for companies and until July 1, 2027, for self-employed workers, according to sources from the Ministry of Finance cited by various economic and legal outlets.

The schedule change affects both the electronic invoicing mandated by the Law Crea y Crece and the verified billing software ecosystem, including the Verifactu system, designed to send invoice records to the Tax Agency in near real-time and prevent dual-use programs.

From 2025–2026 to 2027: a calendar that moves again

Until a few weeks ago, the official scenario spoke of phased mandatory adoption starting in 2025–2026, beginning with the largest companies and then extending to other businesses and self-employed workers. However, delays in regulatory development, technical complexity of the requirements, and pressure from professional groups have led the government to hit the brakes.

The new roadmap sets the “starting gun” in 2027: first corporations (January 1), and six months later, self-employed workers (July 1). In practice, the Government acknowledges that the business fabric, especially SMEs and microenterprises, were not prepared to meet the initial deadlines.

Finance explains the delay as necessary to “provide more time to properly adapt” to the new electronic billing framework, both in terms of software and internal procedures. The development of technical standards, application certification, and preparation of providers and consultants have clearly lagged behind the political schedule.

Pressure from SMEs, advisors, and industry groups

For months, tax advisor associations, professional colleges, and business organizations warned about the “regulatory and technical uncertainty” surrounding the deployment of electronic invoicing, calling for more room to avoid administrative chaos among small taxpayers.

Organizations like CEOE and associations of the self-employed warned that, with regulations still evolving, demanding such a profound change from SMEs in just a few months could lead to increased bureaucracy, additional costs for software and consultancy, and even penalties due to unavoidable errors in the initial phase.

The postponement to 2027 is seen by these groups as a partial victory: it provides relief to businesses and freelancers but also marks the beginning of a long transition period, during which it will be crucial to see if the government uses this time to clarify rules, simplify requirements, and support digitalization with real aid.

A gesture toward Junts… and a warning to others

The decision is not solely technical. Several media outlets have noted that the delay was included in a Royal Decree-Law containing measures agreed between the Government and Junts, as part of commitments to ensure parliamentary stability. The decree explicitly mentions “extension of the deadline for promoting digitization of billing processes in companies,” a phrase that political sources directly associate with electronic invoicing and systems like Verifactu.

In other words, the delay also becomes a political bargaining chip. Many experts interpret it as a “warning to others”: if the implementation remains perceived as unmanageable by a significant portion of SMEs and freelancers, further calendar adjustments or future easing of obligations cannot be ruled out.

The fundamental issue is clear: a system designed to fight fraud and modernize the economy risks becoming an additional barrier for small businesses if the control load, certifications, and technical requirements are not adapted to their realities.

Verifactu and the challenge of not choking small businesses

Verifactu, the automated submission model for billing records to the Tax Agency, symbolizes this new phase. The guiding principle is straightforward: every issued invoice must be recorded in a standard, unalterable format, eliminating dual-use software and strengthening VAT control.

On paper, the goal is commendable. In practice, thousands of small businesses will need to:

- Change or update their billing software.

- Adapt internal processes for recording and reconciliation.

- Coordinate with accountants, consultants, and tech providers to meet deadlines and format requirements.

With the delay, the government gains time to roll out the system more gradually. Companies gain breathing room to plan investments and avoid last-minute rushes. However, there’s also a risk that many will “look the other way” until 2026, leaving everything for the final moment.

Impact on the business fabric: relief but also uncertainties

For thousands of SMEs and freelancers, the news is a mix of relief and resignation. On one hand, the sense of an “imminent wall” disappears: there will no longer be a need to switch software or overhaul processes within a few weeks. On the other hand, it reinforces the notion that the tax regulations have become a labyrinth that’s difficult to navigate, changing dates, criteria, and requirements too often.

Some parts of the business community also fear that the delay to 2027 is merely a patch that doesn’t address underlying issues: regulatory complexity, scarce technical resources in small enterprises, and poor coordination among administrations, tech providers, and consultants.

Meanwhile, the message to those who have already prepared—using electronic billing systems and tools compatible with Verifactu—is also complex: their efforts are acknowledged, but the moment their investment becomes a widespread competitive advantage is delayed.

The next extension? Connected V16s watch nervously

The government’s moves regarding electronic invoicing have reignited another tech debate: the connected V16 beacons, which must replace emergency triangles in vehicles and are, in principle, to be mandatory starting in 2026, as recalled by the DGT and Guardia Civil.

Within the sector, there are jokes that “the next announcement will be that connected V16s also won’t be mandatory on time” if industry, drivers, or the technical frameworks aren’t ready. No official changes have been announced yet regarding this requirement, but the example of electronic invoicing shows that no tech schedule is set in stone.

The pattern repeats: the state pushes for accelerated digitalization, but the realities of SMEs, freelancers, and citizens force a reconsideration of deadlines and approaches. The key will be finding the right balance between control, security, and manageable bureaucracy.

What should SMEs and freelancers do now?

Beyond the headline of the delay, experts agree on a clear message: use this extra time to prepare, not to let your guard down.

- Review with advisors and providers what billing software is currently in use.

- Evaluate solutions that are already compatible with future electronic invoicing standards and Verifactu.

- Train administrative and accounting staff on the new digital processes.

- Take advantage of aid and deductions related to digitalization when calls open.

The paradox is that well-implemented electronic invoicing can save time, reduce errors, and enhance financial control. But managing it under a tight deadline and without proper support can turn it into an additional problem.

FAQs about the new mandatory electronic invoicing deadline

When will electronic invoicing be mandatory for companies in Spain?

With the new delay, the general obligation shifts to January 1, 2027, according to the Ministry of Finance’s schedule. After that date, electronic invoicing will be standard in B2B transactions, with very limited exceptions as defined in final regulations.

From when will electronic invoicing be mandatory for freelancers?

Self-employed workers will have an additional six-month window compared to companies. The current contemplated date is July 1, 2027, from which they must issue and receive electronic invoices in their dealings with other companies and professionals, according to the Law Crea y Crece and relevant regulations.

What is Verifactu, and how will it affect SMEs and freelancers once mandatory?

Verifactu is the system for instant submission of billing records to the Tax Agency through verified billing software. Practically, it will require invoices to be generated with certified programs ensuring their integrity and preventing sales manipulation. For SMEs and freelancers, this means updating or adapting their billing applications, but also benefits from a clearer framework to comply and avoid sanctions linked to dual-use software.

Can the start date for mandatory electronic invoicing be delayed again?

No one openly admits it, but postponing to 2027 shows that schedules can shift when technical, business, or political pressures are strong enough. If the technological infrastructure, software market, and the small business and freelancer ecosystem aren’t ready by the new dates, another adjustment cannot be ruled out. That’s why many advisors recommend using this extra time to advance digitalization rather than waiting until the last moment.