China has just made another strategic move in the AI semiconductor war. The startup Zhonghao Xinying, also known as CL Tech, claims to have mass-produced its own specialized AI chip, a TPU called Chana, which aims to become a local alternative to Nvidia’s GPUs and Google’s TPUs.

The company, based in Hangzhou, asserts that its General Purpose Tensor Processing Unit (GPTPU) Chana can deliver up to 1.5 times the performance of an Nvidia A100, while reducing power consumption by around 30% and lowering computational costs per unit to approximately 42% of the US GPU for equivalent workloads with large models.

Although the A100 is now considered an “older” generation compared to the H100 or the new Blackwell family, this move is significant: in a context of strict US export restrictions, having a competitive, domestically developed accelerator based entirely on Chinese intellectual property has become a national priority for Beijing.

From Silicon Valley to Hangzhou: the “boomerang” talent behind Chana

Zhonghao Xinying was founded in 2018 by Yanggong Yifan, an engineer educated at Stanford and the University of Michigan, with direct experience designing several generations of Google’s TPUs (v2, v3, and v4). Alongside him is co-founder and CTO Zheng Hanxun, a graduate of the University of Southern California with previous chip design experience at Oracle and Samsung R&D in Austin, Texas.

Both exemplify the profile of a Chinese engineer who trained and worked for years in Silicon Valley and, amid growing technological tensions between the US and China, decided to return to establish local champions in critical sectors like AI computing. Yanggong has publicly stated in interviews that he saw the “inevitability” of an open technological war and that AI computing infrastructure would become “the central battlefield.”

What does Chana really bring compared to Nvidia’s GPUs?

Chana is presented as a GPTPU: a custom ASIC designed from scratch for neural network workloads, in contrast to Nvidia’s general-purpose GPUs adapted for training and inference. Practically, this means sacrificing versatility to maximize efficiency in the most common AI model calculations.

According to Zhonghao Xinying itself, the chip:

- Provides up to 1.5× the performance of an A100 under similar workloads.

- Consumes about 30% less energy in those scenarios.

- Reduces computational cost per unit to around 42% of Nvidia’s GPU.

The company also emphasizes that Chana has been developed with completely proprietary IP cores, a customized instruction set, and an internally built compute platform, without relying on foreign technological licenses. The promise is clear: architectural independence and thus less exposure to sanctions or intellectual property restrictions.

However, key pieces are missing in the puzzle. Critical details like the manufacturing node, memory bandwidth, or results from standard benchmarks such as MLPerf have not been disclosed. Most importantly, the comparison is made against a 2020 GPU, not the latest Nvidia chips like the H100 or Blackwell family.

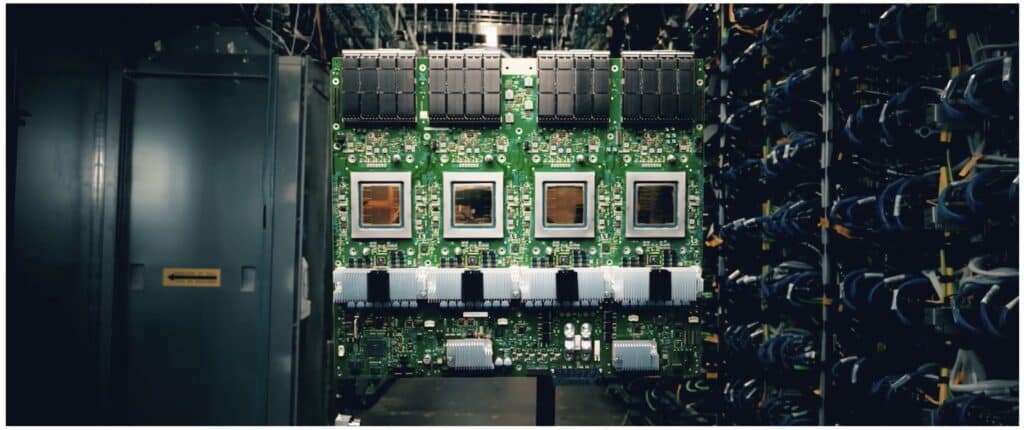

Taize: a cluster for billion-parameter models

Beyond the chip itself, Zhonghao Xinying has presented Taize, a computing platform that interconnects 1,024 Chana units into a single cluster. According to the company, this infrastructure is designed to train foundational models at the trillion-parameter scale, competing with systems like GPT-4, Claude, or Gemini.

At this stage, the startup aims to replicate the model of large hyperscalers: not just selling chips, but offering a complete ecosystem of hardware, software, and orchestration tools. The question is whether it can attract enough critical mass of clients in an environment where most frameworks, libraries, and tools are deeply optimized for CUDA and Nvidia GPUs.

Google, Meta, Anthropic… and global pressure on Nvidia

The launch of Chana comes at a time when Nvidia’s hegemonic position is being challenged from various fronts. Google has shifted strategy, moving from offering its TPUs only through Google Cloud to negotiating direct chip sales to clients like Anthropic and Meta, who could host these accelerators in their own data centers.

For China, the situation is even more delicate. US export restrictions have limited access to Nvidia’s high-end GPUs, forcing companies and the government to accelerate the development of local solutions. Chana thus joins a growing list of Chinese alternatives — from proprietary GPUs to specialized ASICs — intended to meet domestic AI computing demand amid a partial “de-Americanization” of critical hardware.

Real numbers: revenue, profits… and initial losses

Beyond the technological narrative, Zhonghao Xinying is already moving relevant figures. Documents prepared for its corporate operation with Tip Corporation, a listed component manufacturer in Shanghai, show that the company earned 485 million yuan (about $68.4 million) in 2023, with a net profit of 81.3 million yuan. In 2024, sales rose to 598 million yuan and profit to 85.9 million.

However, the first half of this year reflects the less glamorous side of rapid growth: just 102 million yuan in revenue and losses of 144 million yuan, mostly attributable to heavy investments in R&D, commercial expansion, and the acquisition of Tip itself.

The startup has also committed to an IPO by late 2026 or triggering a share buyback clause. Meanwhile, Tip Corporation’s stock increased from around 30 yuan to nearly 140 yuan following news of the acquisition plans, reflecting market expectations for Zhonghao Xinying’s AI business.

A real breakthrough, but still far from top-tier status

Technologically, Zhonghao Xinying’s achievement is undeniable: China now has a mass-produced own TPU, based on local architecture and IP, designed for large models and scalable to over a thousand accelerators. This was unthinkable just a few years ago.

Nevertheless, the gap with “top-tier” remains substantial. The comparison with the A100 makes it clear that this is still aligned with Nvidia’s 2020 generation, while the cutting-edge market is already looking toward Blackwell and upcoming chips from Google, AMD, and hyperscale giants. The lack of details on manufacturing nodes and foundry partners also raises questions about production capacity and scalability.

Beyond chips, there’s the challenge of building a mature software ecosystem — including compilers, optimized libraries, frameworks, and tools. Without this, attracting major clients away from CUDA and established providers will be difficult. Over the next two years, Chana and Taize will need to prove whether they are niche players for the Chinese market or genuine global competitors.

FAQs about Zhonghao Xinying, Chana, and the AI chip war

What exactly is Zhonghao Xinying’s Chana TPU?

Chana is a GPTPU (General Purpose Tensor Processing Unit) chip, an ASIC accelerator specifically designed for neural network workloads. Unlike general-purpose GPUs, it’s optimized for matrix and tensor operations typical of training and inference in large-scale AI models.

How does a TPU like Chana differ from a Nvidia GPU for AI?

Nvidia GPUs are highly versatile parallel processors suited for graphics, AI, scientific simulation, and general computing. In contrast, TPUs like Chana sacrifice some of that versatility to gain efficiency: higher performance per watt and lower cost per operation in repetitive AI calculations. However, this specialization makes them more dependent on specific software and tools.

Is it true that Chana outperforms Nvidia?

Zhonghao Xinying claims Chana delivers up to 1.5 times the performance of the Nvidia A100, with 30% lower power consumption and computational costs around 42% of that GPU’s. But, since the A100 is from 2020 and no independent benchmarks have validated these figures, these claims should be viewed with caution.

Why is Chana important for China’s AI strategy?

US export restrictions limit China’s access to Nvidia’s most advanced GPUs. Having a domestically developed TPU based on local IP and mass production enhances China’s technological sovereignty in a critical area: infrastructure for training and running large AI models. If Zhonghao Xinying succeeds in scaling production, building an ecosystem, and acquiring clients, Chana could be a key component in reducing reliance on foreign hardware in Chinese data centers.

Sources: Asia Business Outlook, Xataka, Tom’s Hardware, TrendForce, MachineYearning.io, Reuters, The Information (via Reuters), financial documentation related to the Tip Corporation acquisition.