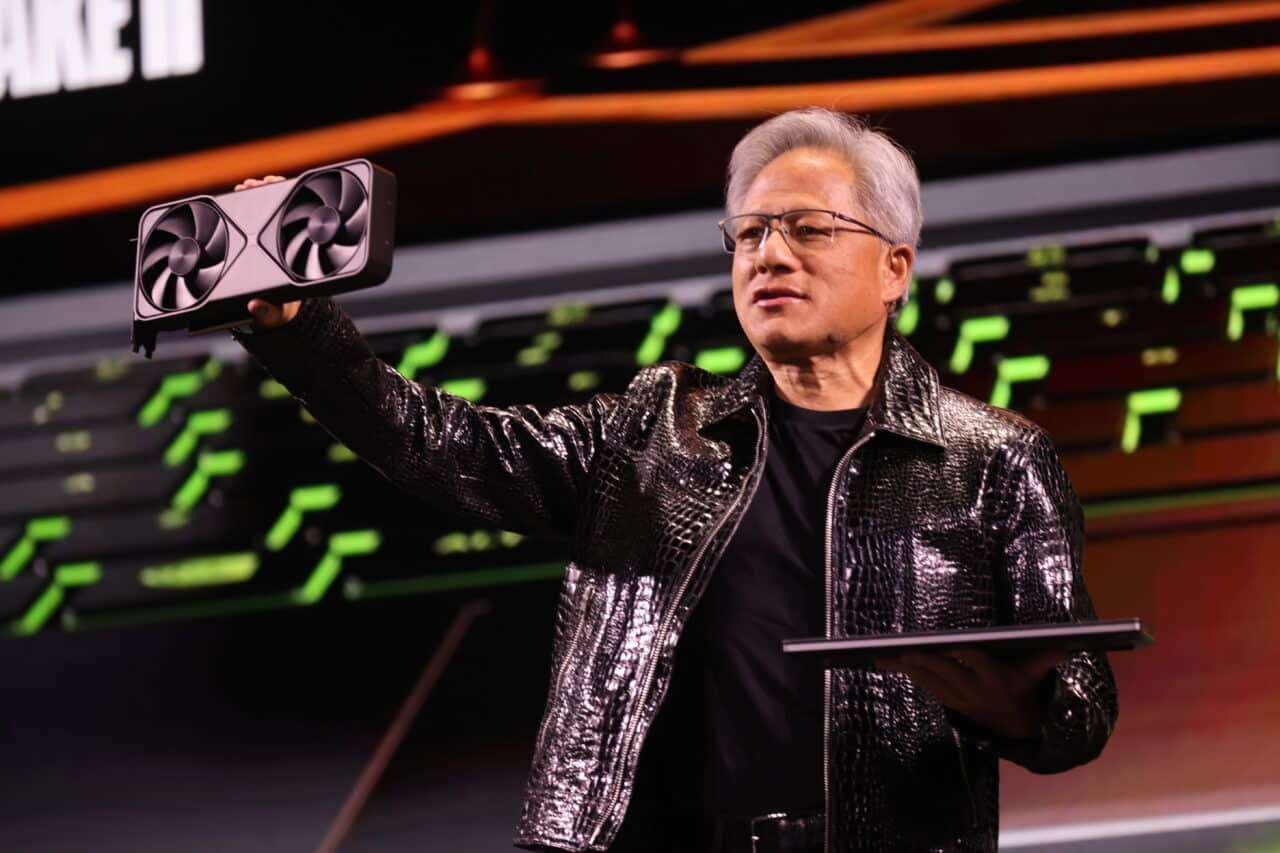

Few phrases ignite a Silicon Valley conversation like the one attributed to NVIDIA CEO Jensen Huang, claiming an imminent victory by China in the AI race. The statement —“China is going to win the AI race”— reported by Financial Times and amplified around the world, was followed hours later by a clarification: China would be “nanoseconds away from the United States,” and “it’s vital for America to run faster and attract developers worldwide.” The pendulum swung from defeat to caution, but the core message remained: the leader in the planet’s most coveted hardware warns of a structural imbalance that can’t be fixed with speeches alone, but requires cheap energy, smart regulation, and well-directed talent.

The response was immediate. In Washington, because the statement comes from the executive of the company that supplies more than 80% of the data center GPUs; in the industry, because few companies feel the pulse of global computing demand like NVIDIA; and in Beijing, because it aligns with a strategy of technological self-sufficiency, accelerated by US export restrictions and supported by broad industrial policies.

The context behind the headline

Huang didn’t speak from a defeatist perspective. He approached it from risk management. His thesis, presented frank and direct, combines three layers:

- Energy: The cost of powering training and inference farms is today the most influential macro variable for scaling AI infrastructure. Huang emphasizes that China has the advantage of significantly lower energy costs, to the extent that leading tech firms receive subsidies of up to 50%. Such a differential not only reduces training costs: it enables aggressive CapEx, shortens payback periods, and cuts the payback period for each new data center.

- Regulation: While the U.S. has intensified control over the export of advanced chips (including GPUs adapted to Commerce Department regulations), China is deploying a more flexible policy to attract capital, streamline approvals, and prioritize deployments. In practice, less administrative friction means faster project execution.

- Value chain: The restrictions on certain GPUs don’t dampen demand; they shift it. Huang points to local alternatives that are already showing muscle — Huawei Ascend, Biren — which could re-balance the global market in 2–3 years if Beijing maintains its investment pace and technological replacements mature.

Adding to these three axes, Huang highlights another, more cultural one: the human factor. According to him, Chinese developers adopt quickly, optimize training frameworks, and create applications tailored to their economic environment — a cycle of learning, development, and application that could transform China into a faster innovation hub, capable of retaining talent and attracting entire communities. Hence his nuance: “The U.S. has to run faster.”

Strategic warning or backpedaling?

The clarification by NVIDIA — China “nanoseconds away”— softened the initial fatalism and aligned the message with a more realistic outlook: leadership isn’t lost by decree nor won in a quarter; it’s built or diluted based on interlinked decisions involving energy, regulation, talent, and supply chain. But the shock has already worked. Coming from the actor that drives the AI era — in market share, software ecosystem, and execution capacity — the warning carries two layers:

- Industry: if the U.S. slows down its deployment capacity (energy bottlenecks, regulatory hurdles, technician shortages), demand will find alternative providers. In that scenario, hardware ceases to be a de facto monopoly and becomes a multipolar oligopoly.

- Geopolitics: the more technological cooperation windows close, the more countries will be motivated to expand their local bets. In the medium term, this leads not to less AI but to more fragmentation.

Energy, rules, and people: the three vertices of Huang’s “triangle”

1) Energy: Computing doesn’t grow without electrons

The AI race isn’t just a story of chips; it’s primarily one of megawatts, terawatt-hours, and substations. The U.S. faces a perfect storm: data centers demanding gigawatts, aging electrical grids in some states, and lengthy permission cycles. On the other hand, direct subsidies and a cheaper energy mix provide China with an autopista to grow capacity predictably.

The implicit message from Huang is simple: without competitive prices and reliable supply, the U.S. might win the chip design battle but lose the deployment war.

2) Regulation: Rationale speed vs. Paralyzing bureaucracy

Huang isn’t advocating for a “free-for-all.” His words are better understood as a critique of the bureaucracy suffocating quick decisions. In AI, time-to-market and time-to-capacity are compounded advantages: each month of delay worsens the ROI for the entire stack. China, aware of this, acts accordingly: streamlining procedures, aligning incentives, and protecting strategic sectors.

And Europe? NVIDIA’s CEO reflects a sector concern: if the continent overregulates without a commensurate energy and talent strategy — and without legal certainty for investments — it risks losing capabilities and projects to others. The goal of protecting rights and mitigating risks isn’t incompatible with facilitating testing, deployment, and scaling.

3) Talent: Winning developers is as crucial as selling GPUs

Surprisingly, software is once again a decisive factor. Winning the AI race involves winning over developers worldwide: providing frameworks, libraries, tools, and ease to build, optimize, and deploy models quickly and with quality. While the U.S. remains a reference, the gap narrows if the learning and deployment cycle is more seamless on the other side.

What if China keeps up the pace?

If Beijing consolidates functional local alternatives to Western GPUs — even if they don’t match their absolute parity — the market could re-balance in 2–3 years:

- Domestic demand met by local suppliers.

- Software ecosystems better adapted to language, regulation, and market needs.

- Talent attraction for those working in global providers who may find opportunity and speed in domestic projects.

This scenario isn’t a game over for the U.S.; it’s a warning: leadership will depend on execution capacity, costs, and talent. Not just on the headline of being “first.”

What if the U.S. moves faster?

competitive energy, pro-innovation regulation without shirking responsibilities, and talent acquisition through platforms and frameworks that facilitate building more and better. In short: reducing frictions so each new idea moves from lab to data center in weeks, not quarters.

The U.S. retains decisive advantages: venture capital ecosystem, universities, talent clusters, and an industry that continues to lead in chip design and software. The race isn’t lost; it’s competitive.

Europe, between opportunity and the threat of irrelevance

The continent appears as the third vertex of a demanding triangle. The AI Act aims to balance protection with innovation; however, the market warns: without cheap energy, regulatory certainty, and fast permit processes, investments will suffer. The question isn’t whether Europe should regulate but how: clear rules, regulatory sandboxes, incentives for design and deployment, and an industrial policy that connects universities, businesses, and data centers.

What Huang Really Said (Between the Lines)

Beyond the headline, NVIDIA’s CEO left three operational messages:

- Time is the scarcest resource: if a country slows permits, energy, or investment, another will accelerate.

- Hardware is necessary, but not enough: those who organize energy, rules, and talent effectively will win.

- The race is global and ongoing: today’s “nanoseconds” turn into years if correct decisions are delayed and supply chains fragment.

The subsequent nuance doesn’t erase the original warning. Nor does it amount to a capitulation. The coexistence of both messages — alarm and ambition — accurately reflects the moment: AI has become geopolitics of infrastructure. And industry leaders know that their future depends not only on technical excellence but also on the playing field they compete on.

Frequently Asked Questions

Did Huang really say “China will win the AI race”?

Yes, that phrase was reported by Financial Times and echoed by tech media. Hours later, NVIDIA clarified the message: China was “nanoseconds from the U.S.” and “America must run faster and attract developers worldwide.” The headline and clarification frame the message as a strategic warning, not defeatism.

What advantages does Huang say are pushing China?

Three levers: cheaper energy (with subsidies up to 50% to hyperscalers and leading tech firms), more flexible regulation that reduces deployment friction, and a industrial policy focused on technological self-sufficiency. Plus, local hardware alternatives (Huawei Ascend, Biren) and a developer ecosystem that iterates rapidly.

How do US export restrictions impact this race?

They don’t eliminate demand; they reorient it. By limiting certain GPUs, Washington pressures to protect technological advantage but also encourages local substitution and may slow down its ecosystem if bottlenecks form. The risk is a multipolar market where some demand is met without U.S. providers.

What role does Europe’s AI Law play?

Europe seeks to balance rights and security with innovation. Industry warns that without competitive energy costs, fast permit processes, and legal certainty, the continent could lose projects and capabilities. Smart regulation, sandboxes, and industrial policies accelerating design and deployment are key.