The ongoing technological tensions between the United States and China are once again affecting NVIDIA, this time with the alleged halting of production for their H20 GPU—a chip specifically designed to comply with US export restrictions to the Chinese market. According to an early report from The Information, the company has instructed some suppliers to pause ongoing work related to this model, indicating a strategic shift amid an increasingly hostile political climate.

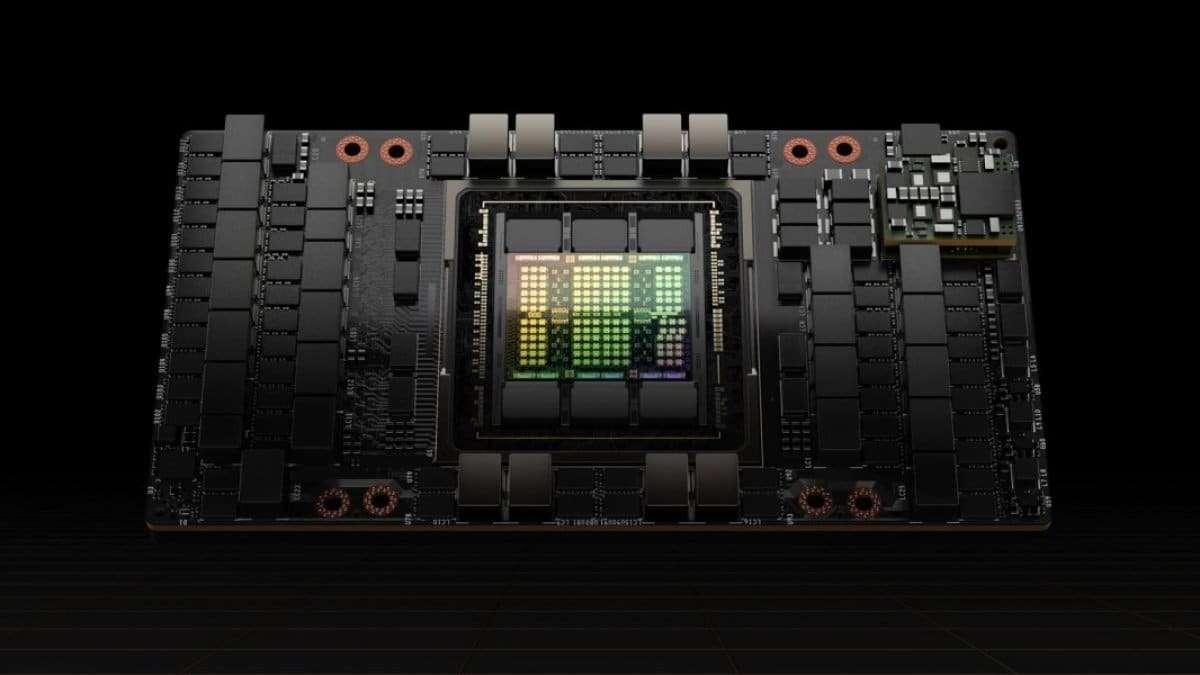

A Chip Born from Sanctions

The H20 was developed in 2023 as a modified version of NVIDIA’s high-end GPUs, tailored to meet Washington’s limits on the export of advanced semiconductors to China. Its creation aimed to maintain NVIDIA’s market presence in a region that, until recently, contributed significantly to its revenue—around 13% of total sales in the fiscal year ending January 2025, approximately $17 billion.

Furthermore, the company estimated that its annual business opportunity in China could reach $50 billion, explaining the effort to keep a viable product in the face of restrictions.

A Blow from the White House and a Costly One

Recent history shows a rollercoaster of regulatory decisions surrounding the H20. In April, the Trump administration tightened export controls, imposing licensing regimes that effectively blocked NVIDIA’s shipments to China. This forced the company to drastically cut down its accessible market in China, resulting in inventory losses of around $4.5 billion in the fiscal quarter ending in April, and missing out on an estimated $8 billion in potential revenue.

Although the White House softened its stance in July, permitting shipments to resume in exchange for NVIDIA conceding 15% of its Chinese sales to the U.S. Treasury, the landscape had already shifted dramatically.

Political Rejection in Beijing

The Chinese Communist Party’s Politburo has hardened its stance in recent months, expressing concern over reliance on U.S. technology stacks. In this context, multiple Chinese government agencies are reportedly discouraging local tech companies from purchasing H20 GPUs, citing cybersecurity risks and the potential for “backdoors” embedded within the hardware.

The pressure extends beyond mere recommendations—industry sources suggest broad prohibitions on the use of this chip in strategic sectors, which would severely limit its commercial appeal.

Preparing for the B30

Meanwhile, NVIDIA is working on its next-generation chip, the B30, which is expected to inherit the Blackwell architecture and could replace the H20. However, whether this new product will overcome the political and regulatory hurdles in an increasingly adversarial environment in China remains uncertain.

The challenge is significant: China remains the second-largest semiconductor market globally, both in volume and investment capacity. Loss of trust from Beijing could not only cut NVIDIA’s revenues but also accelerate local efforts to develop native alternatives driven by companies such as Huawei and Biren Technology.

Implications for the Global Tech Sector

NVIDIA’s decision underscores a broader dilemma: how geopolitical tensions are reshaping supply chains and advanced chip markets. The U.S. aims to restrict China’s access to cutting-edge semiconductors to curb its progress in AI and supercomputing, while China seeks to bolster its technological sovereignty and reduce reliance on foreign suppliers.

The stakes are no longer just economic; they are strategic. Dominating the most powerful chips equates to leading in AI, impacting critical sectors including defense and biotechnology.

FAQs

Why did NVIDIA develop the H20 GPU for China?

Because U.S. export restrictions prevented them from selling their top-tier GPUs, so H20 was created as a compliant, adapted version to maintain a presence in the Chinese market.What losses has NVIDIA suffered due to restrictions?

In the quarter ending April 2025, NVIDIA lost about $4.5 billion worth of inventory and missed out on up to $8 billion in potential revenue.What does the Chinese Politburo’s rejection imply?

That Beijing is seeking to reduce dependence on U.S. chips, potentially translating into outright bans and increased support for developing local semiconductor industries.What can we expect from NVIDIA’s upcoming B30?

The B30 could replace the H20 and keep NVIDIA competitive in AI, but its success in China will likely depend more on political factors than technological capabilities.