The trade agreement prevents a 15% tariff on high-precision lithography tools, essential for technological leadership and industrial sovereignty in chip manufacturing.

In a strategic move crucial for the global semiconductor industry, the United States and the European Union have signed a trade agreement that exempts certain products considered strategic from tariffs, including semiconductor fabrication equipment. This decision directly benefits manufacturers like the Dutch company ASML, a leading provider of extreme ultraviolet (EUV) and deep ultraviolet (DUV) lithography tools, as well as major chipmakers such as Intel, TSMC, Samsung, and Texas Instruments.

Announced this week by the European Commission and the U.S. administration, the pact establishes a framework of “zero percent tariffs” on key products like aircraft, chemicals, generic medicines, semiconductor machinery, natural resources, and critical raw materials.

“We also agreed on zero tariffs for several strategic products. This includes all semiconductor equipment,” stated the European Commission in an official release.

Why is ASML so important in this agreement?

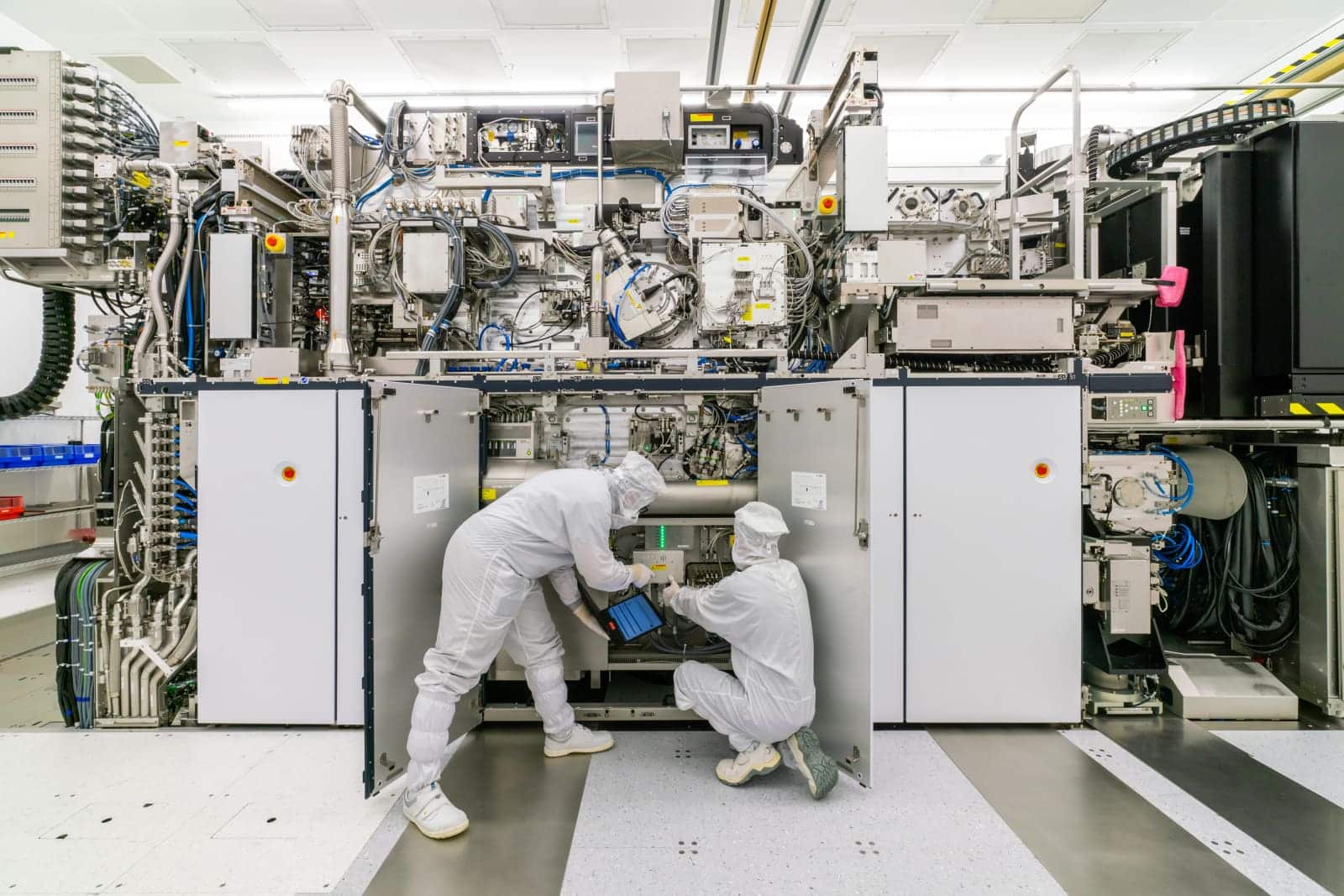

Based in the Netherlands, ASML is the only manufacturer worldwide capable of producing High-NA EUV lithography equipment, vital for fabricating advanced chips below 3 nanometers. Its machines are crucial for maintaining Moore’s Law and ensuring the competitiveness of manufacturers operating within the United States.

Recent reports indicate that the average cost of an advanced immersion DUV tool (used in sub-10 nm processes) is around $89.6 million, while an EUV machine can reach $265 million depending on its configuration. If the 15% tariff had been applied, costs could have increased by as much as $13 million extra per DUV tool and $40 million per EUV machine, significantly raising expenses for expanding facilities like Intel’s in Ohio or Samsung’s in Texas.

The exemption: a boost to the U.S. chip industry

This agreement provides financial relief for America’s technological reindustrialization plans, which have invested billions through the CHIPS Act. Avoiding these tariffs helps preserve the economic viability of building new advanced factories on U.S. soil, maintaining competitiveness against Asia.

Had tariffs been applied, the additional costs could have forced some companies to reconsider their plans for advanced production outside Asia, directly impacting the geopolitical goal of reducing dependency on China and Taiwan for technology.

TSMC, Samsung, and Intel: the main beneficiaries

The direct impact of the deal affects all major manufacturers reliant on ASML equipment. For example, Intel has already confirmed plans to install High-NA EUV systems in its new factories, and barrier-free access to these technologies strengthens its strategy to compete with TSMC.

Additionally, Samsung and TSMC—both establishing facilities in the U.S.—also benefit from this favorable tariff framework. While their core operations are still primarily in Asia, expanding their activities in North America requires access to cutting-edge tools without fiscal penalties.

Geopolitical context: chips, energy, and transatlantic cooperation

The agreement comes at a time of heightened trade tensions among major technological powers. While the U.S. restricts China’s access to cutting-edge technology, it is also deepening industrial ties with the EU. The pact not only includes tariff exemptions but also contemplates European investments of “hundreds of billions of euros” in the U.S. energy sector, reflecting broader strategic cooperation.

Including natural resources and critical raw materials in the deal suggests a shared roadmap to secure supply chains amid increasing global vulnerabilities related to the scarcity of essential components.

Conclusion: a pragmatic step in a highly strategic market

The tariff exemption for European-made semiconductor equipment—especially ASML’s—is not only about reducing costs for U.S. manufacturers but also strengthening the transatlantic axis in the race for technological sovereignty. By removing barriers at the most delicate link in the value chain—the lithography machinery—the agreement sets the foundation for a more robust and sustainable industrial collaboration.

As the technological rivalry intensifies, decisions like these make the difference between reliance on external sources and building a self-sufficient ecosystem capable of leading the next generation of microchips. And ASML, quietly operating from Eindhoven, remains a key player in this global landscape.