Apple, AMD, and NVIDIA Increase Orders in the U.S. Amid Tariff Pressure; TSMC Raises Prices by Up to 30%

The tariff strategy driven by former U.S. President Donald Trump is already having collateral effects on the global tech sector. According to DigiTimes, several U.S. companies, including Apple, AMD, and NVIDIA, have been forced to reinforce their commitment to domestic manufacturing, particularly through TSMC at its Arizona plant, due to new tariffs imposed on semiconductors made outside the United States.

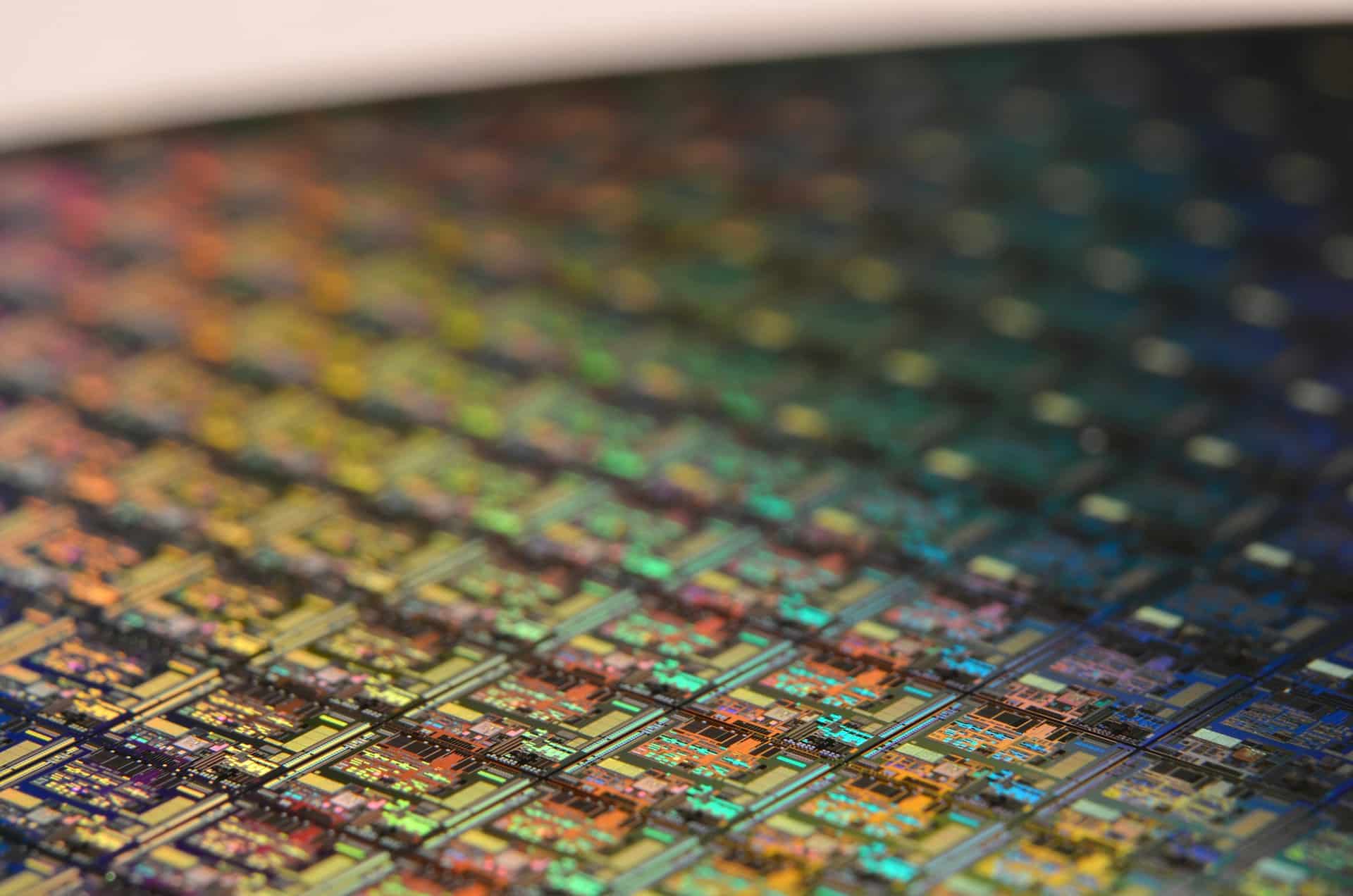

So far, high production costs on U.S. soil had slowed the aggressive expansion of orders at the TSMC Arizona factory, which operates using 4 nm technologies. However, the announcement of a new round of tariffs by Trump—who has earned the nickname “tariff nuclear war”—has accelerated domestic production capacity demand among tech giants.

TSMC Raises Prices and Customers Accept

The monthly capacity of TSMC’s U.S. plant is estimated to be between 20,000 and 30,000 wafers. With a sudden increase in orders and the urgency to meet new trade requirements, TSMC has raised its foundry service prices by up to 30%. Despite the increased costs, clients like Apple, NVIDIA, and AMD have accepted the new fees as part of the cost of adapting to the new industrial policy driven from Washington.

NVIDIA and AMD Double Down on ‘Made in USA’

NVIDIA recently announced that its Blackwell chips, produced using a 4 nm process, are already being manufactured in Arizona, and they are collaborating with companies like Amkor and ASE Group for the packaging and testing phases. Additionally, their assembly partners, such as Foxconn and Wistron, are preparing their factories in Texas to start mass production of artificial intelligence servers in the next 12 to 15 months. NVIDIA’s medium-term goal is to build AI infrastructure in the U.S. worth up to $500 billion.

Meanwhile, AMD has made its intention to manufacture more AI chips on U.S. soil public. In recent statements from Taiwan, CEO Lisa Su revealed that their new “Venice” processor, based on the fifth-generation EPYC architecture, is the first high-performance chip to use TSMC’s 2 nm node and has already been successfully validated on U.S. soil.

And Apple? The Cupertino giant is also joining the movement, albeit more discreetly. According to industry sources, it has started increasing its orders at TSMC Arizona and has expressed its commitment to domestic production to meet potential regulatory requirements.

A Necessary Shift Due to Washington Pressure

This reorientation of the industry is not voluntary but forced by the political landscape. The Trump administration relies on laws like the International Emergency Economic Powers Act (IEEPA) and Section 232 of the Trade Expansion Act, which give it broad authority to impose trade measures under the premise of national security. This has compelled major tech companies to act quickly and pragmatically.

Impact on Production and Forecasts for TSMC

The direct consequence is an improvement in the financial performance forecast for TSMC. Although its operating costs in the U.S. remain significantly higher than in Taiwan, the price increases and strong demand are mitigating the risk of losses. The second quarter of 2025 is expected to see a 10% quarter-over-quarter growth in revenue, with the gross margin remaining close to 58.5%.

Despite the short-term optimism, some analysts warn of a potential demand exhaustion in the second half of the year, which could force a revision of the 25% growth forecasts for the entirety of 2025.

TSMC is set to provide more details on its strategy during its upcoming financial conference on April 17, where key announcements related to capacity expansion and responses to political volatility in the U.S. are anticipated.

Source: Digitimes