Here’s the translation of the provided text into American English:

Chinese tech giants like Alibaba, Tencent, and ByteDance are leading a race to secure supplies of accelerators for artificial intelligence, as rumors of new restrictions from the U.S. grow.

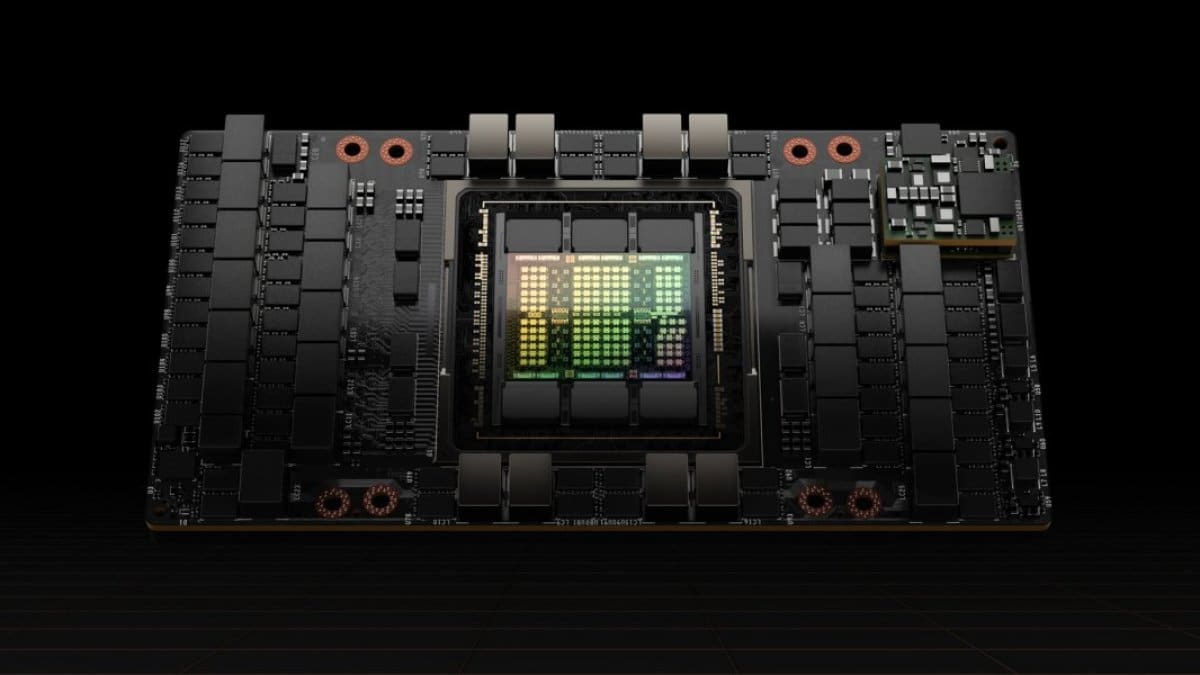

China continues to bet heavily on artificial intelligence. According to specialized media reports, during the first quarter of 2025, the leading tech companies in the country collectively spent around $16 billion on the purchase of NVIDIA H20 chips, the most advanced GPU legally available for its market. The volume of purchases reflects both the rise of AI in the country and the geopolitical uncertainty surrounding future access to this technology.

A Limited but Essential Chip

The H20 model was specifically designed by NVIDIA to comply with export controls imposed by the United States. Although its performance is far from matching that of the new Blackwell generation—up to 15 times superior according to internal sources—it has become the reference point in the Chinese ecosystem due to its legal availability and sufficient power to deploy models like DeepSeek and other large generative AI systems.

Despite its limitations, some versions of the H20 are reportedly incorporating HBM3e memory, which would elevate its performance beyond initial estimates. However, the issues don’t end there: the global shortage of manufacturing capacity—NVIDIA has reportedly not secured sufficient production from TSMC—has caused bottlenecks. It is estimated that many orders may not be delivered until the last quarter of the year.

The Race Against Time

The geopolitical context adds pressure on buyers. The fear of new restrictions from the U.S., which could further tighten export conditions for advanced chips, has spurred purchases. According to industry sources, the Chinese government itself has advised major tech companies to moderate their acquisitions to avoid exacerbating the diplomatic situation.

Against this backdrop, companies like Alibaba, ByteDance, and Tencent are strengthening their data centers and accelerating their AI training capabilities, aware that future access to high-end hardware may depend more on politics than on market demand.

What Comes After the H20?

Despite its success in China, the H20 model may have a limited lifespan if developments elsewhere in the world continue to accelerate. If all orders are not eventually fulfilled due to new sanctions, NVIDIA could face the problem of having to reallocate a non-competitive inventory to other markets, perhaps at reduced prices.

Meanwhile, some sources claim that the company is already working on an evolution of the H20 that combines better performance with regulatory compliance. One thing is certain: the race for leadership in artificial intelligence is not just fought in algorithms but also in the chips that make them possible.

A Global Paradox

The case of the NVIDIA H20 illustrates one of the great paradoxes of the current landscape: while AI is presented as a cutting-edge technology for global progress, its development and access are increasingly conditioned by technological fragmentation and geopolitical tensions. The race for chips is ultimately a race for digital sovereignty. And in this race, every quarter can make a difference.

Source: MyDrivers