The Chinese company Tencent has put a brake on the growing euphoria surrounding NVIDIA after its successful GTC 2025 event. Despite the unprecedented technological showcase by the American company, its stock value has dropped by more than 5% in recent days. The reason seems to be market skepticism and signals coming from China, where companies like Tencent are showing that the future of artificial intelligence (AI) does not necessarily involve accumulating more and more GPUs.

Optimization vs. Raw Power

James Mitchell, Tencent’s Chief Operating Officer, has made it clear in his statements: the industry has moved past the belief that each new generation of language models (LLM) requires an order of magnitude more GPUs. In Mitchell’s own words:

“There was a period last year when it was believed that each new generation of LLM required an order of magnitude more GPUs. That period ended with the advancements demonstrated by DeepSeek. Now the industry, and we within it, are achieving much greater productivity in training LLMs with the existing GPUs, without needing to add more GPUs at the pace that was previously expected.”

The emergence of DeepSeek, offering free access to AI models that match or exceed the performance of American solutions with less infrastructure, has been a game-changer in the sector. Meanwhile, Tencent with its Hunyuan Turbo S model has shown that optimization and resource efficiency can make a significant difference.

China Bets on Efficiency and Reduced Spending

In the same vein, Mitchell has emphasized that Chinese tech companies spend less on capital investment (CapEx) relative to their revenues compared to their Western counterparts. However, this more restrained spending policy is not negatively impacting their results. On the contrary, it is resulting in better resource management and a more intelligent use of available hardware.

“Chinese companies generally prioritize efficiency and the effective use of GPU servers, and that does not necessarily negatively impact the final effectiveness of the technology they are developing. The success of DeepSeek symbolized and solidified that reality,” Mitchell stated.

The Market Reacts with Skepticism

The reaction of investors to NVIDIA’s GTC 2025 is a clear indicator that the market is beginning to question the model based on raw power and massive hardware consumption. The uncertainty over whether it will really be necessary to continue acquiring GPUs at the frantic pace that had been forecast weighs on the company’s stock price.

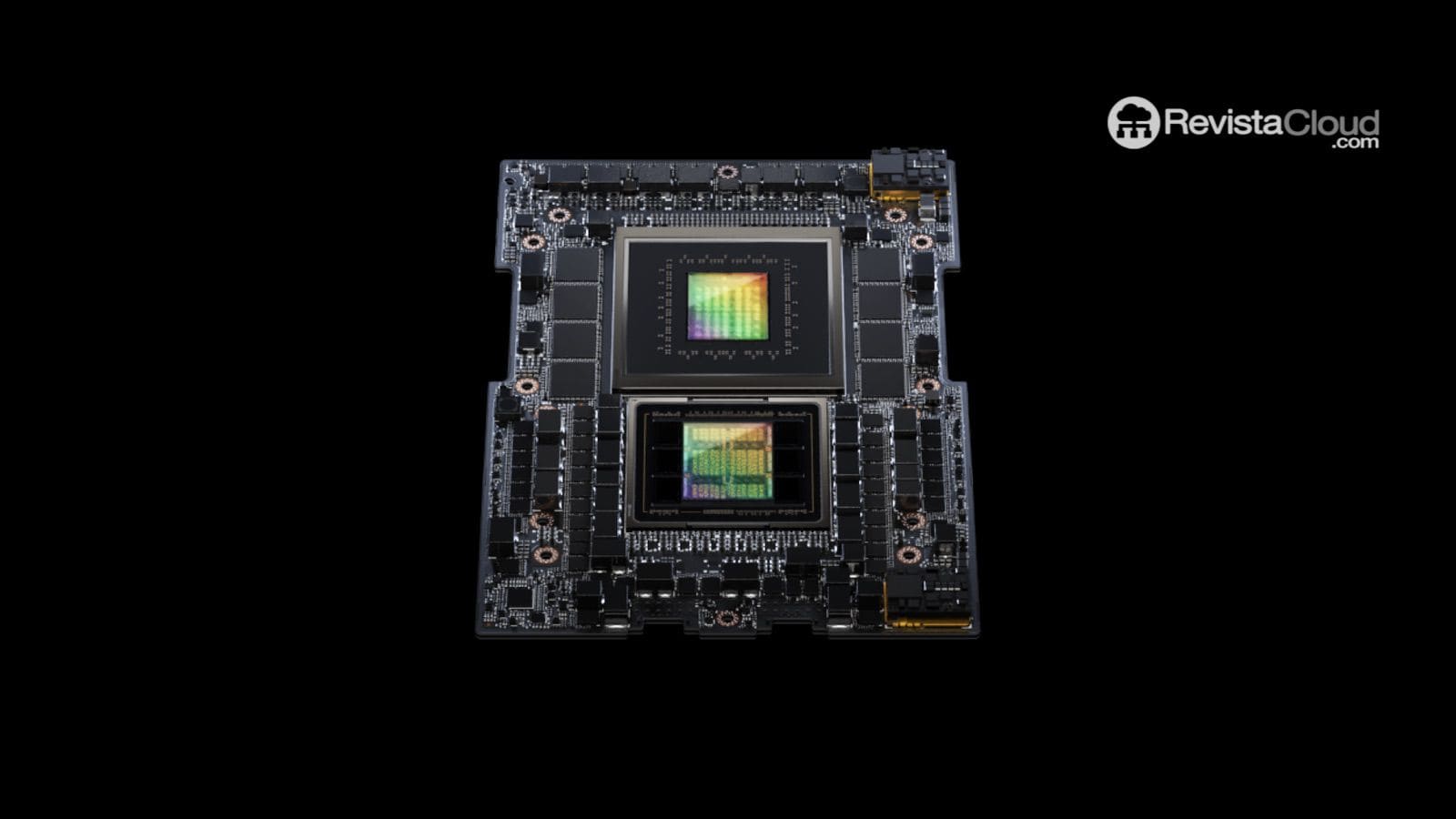

NVIDIA, which has invested over $150 billion to expand its production capacity and provide solutions for training increasingly complex models, could find itself in a less favorable scenario if the industry opts for the path of efficiency. The “bubble” of GPU-based AI could be showing its first signs of fatigue.

For now, China has shown that it is possible to compete and win in the AI race without following the consumerist model predominant in the United States. The near future will tell if the focus on optimization will shift raw power as the dominant strategy.