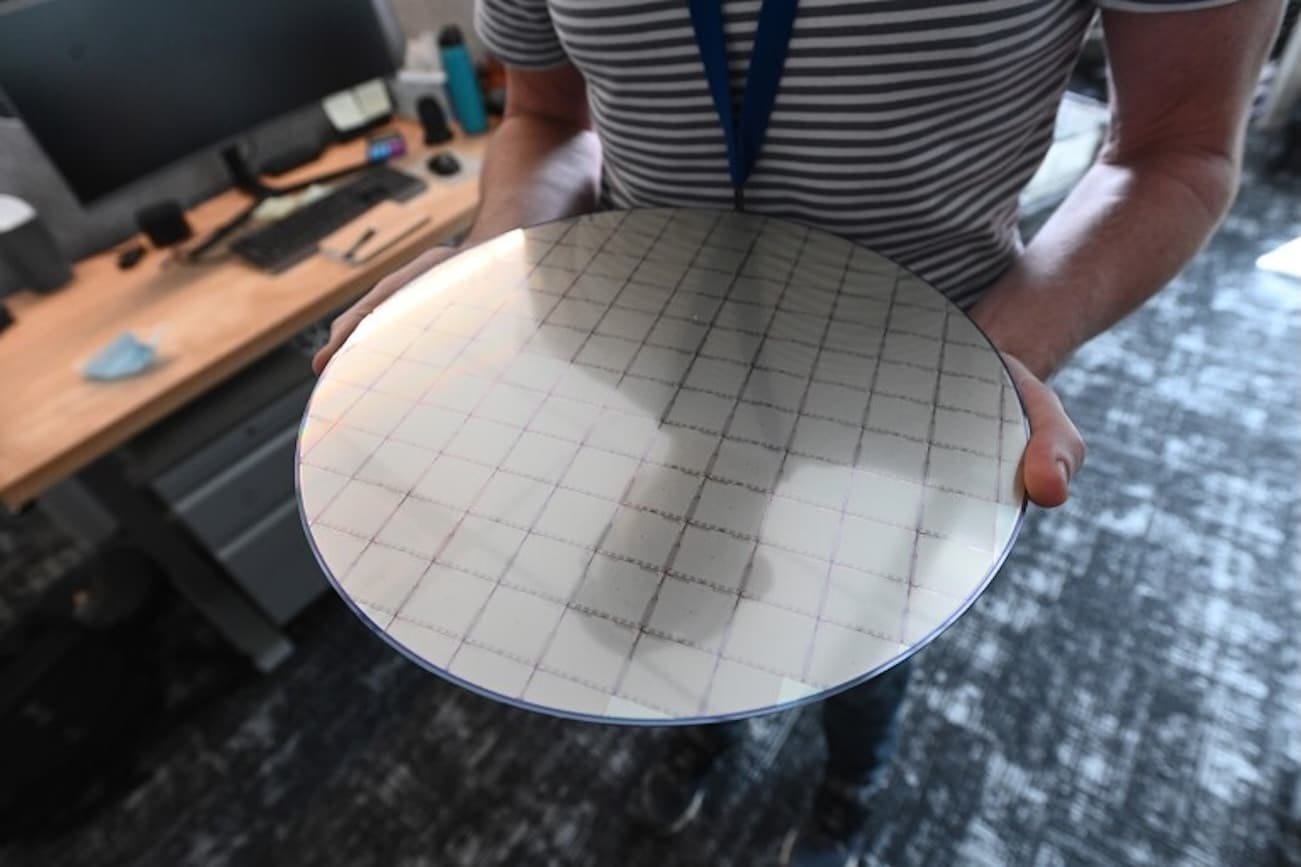

According to a report from Morgan Stanley, Nvidia is on track to consolidate its dominance in the Artificial Intelligence (AI) processor market, reaching 77% of global wafer consumption by 2025. The company will increase its share from 51% in 2024 by utilizing 535,000 300mm wafers, underscoring its advantage in the sector.

Nvidia’s Supremacy in AI

As Nvidia scales its production at an unprecedented rate, competitors like AMD, AWS, and Google will see their wafer consumption shares decrease. AMD, for instance, will drop from 9% to 3%, despite their GPUs MI300, MI325, and MI355 receiving allocations of between 5,000 and 25,000 wafers. AWS will fall from 10% to 7%, while Google will decrease from 19% to 10%, with their TPU v6 using 85,000 wafers and AWS’s Trainium 2 and 3 totaling 46,000 wafers.

A Growing Billion-Dollar Market

The total AI wafer market is expected to reach 688,000 wafers by 2025, with an estimated value of $14.57 billion. However, some experts believe this figure may underestimate actual demand, as TSMC generated $64.93 billion in 2024, with 51% coming from high-performance computing (HPC) segments, which include AI GPUs and data center CPUs.

Key Factors in Wafer Demand

The primary driver of wafer consumption growth in AI comes from Nvidia’s B200 GPU, which will require 220,000 wafers and generate $5.84 billion in revenue. Other models such as the H100, H200, and B300 reinforce the company’s dominant position, all manufactured using TSMC’s 4nm process technologies and with die sizes of up to 850 mm².

Impact on the Semiconductor Industry

Intel, Tesla, Microsoft, and Chinese manufacturers hold minimal shares in this market. Tesla, for instance, uses wafers for its Dojo and FSD chips, but its demand is limited due to its specialized focus. Microsoft, with its Maia 200 chips, still relies heavily on Nvidia GPUs for AI training and inference.

The key to Nvidia’s dominance lies not only in demand but also in its ability to secure large production volumes at TSMC, capturing a significant portion of the Taiwanese foundry’s advanced logic and packaging CoWoS manufacturing capacity. With this landscape, competition will struggle to challenge its position in the immediate future.