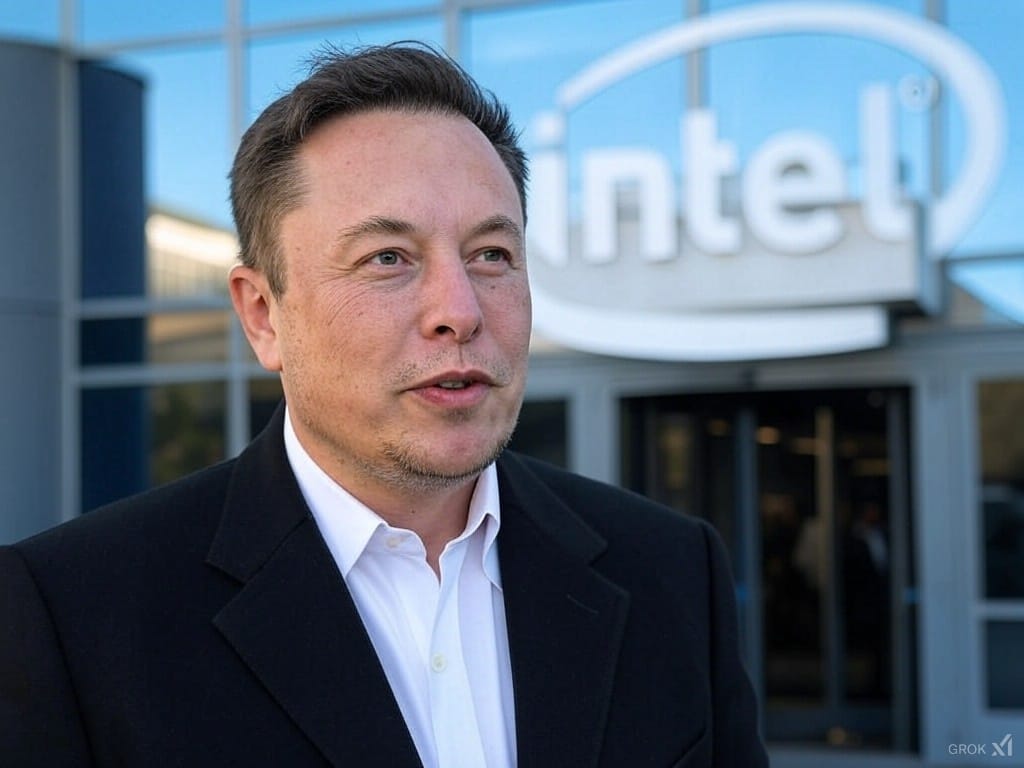

The global tech landscape is in turmoil following rumors that Elon Musk may be interested in acquiring Intel, one of the most iconic companies in processor manufacturing. According to industry sources, the mogul wouldn’t be the only contender, as companies like Qualcomm and Global Foundries have also expressed interest in a potential purchase. This move comes at a critical time for Intel, which is facing challenges in both the CPU market and its graphics card division.

Intel: From Undisputed Leader to a Company in Crisis

For years, Intel dominated the market for computer and laptop processors, setting standards with its Intel Core and Xeon CPU families. However, in the last decade, the company has lost ground to its main competitor, AMD, which has gained market share thanks to its Ryzen and EPYC processors, which outperform Intel in both performance and price.

In recent months, Intel has faced significant problems:

- Problematic Processors: The Core Ultra 200S has shown subpar gaming performance compared to previous generations, while the Core i9 from the 13th and 14th series have experienced stability issues.

- Decline in Sales of Arc GPUs: Though initially they promised to bring fresh air to the graphics market, Intel’s graphics cards have failed to convince the public.

- Losses in Its Foundry Services Division: Intel Foundry Services (IFS) has reported multimillion-dollar losses, increasing pressure on the company.

Elon Musk’s Interest and the Race for Intel

According to a report from SemiAccurate, there is a 90% likelihood that Intel will be acquired. Among those interested are Elon Musk, along with Qualcomm and Global Foundries, who may compete in a possible bid.

Musk, known for his disruptive moves in companies like Tesla, SpaceX, and more recently Twitter, may see Intel as an opportunity to expand his footprint in the tech industry. However, his track record with acquisitions has generated mixed opinions. The most recent example is Twitter, where Musk implemented massive layoffs and significant business model changes, leaving many employees and analysts questioning his approach.

On the other hand, Qualcomm, a leader in mobile technology, and Global Foundries, focused on semiconductor manufacturing, may also view Intel as an opportunity to diversify their operations and solidify their positions as key players in an increasingly competitive market.

The Impact of Rumors on the Market

The rumors surrounding the potential acquisition of Intel have not gone unnoticed. The company’s shares experienced a significant increase of 10% in a single day, rising from $19.67 on January 16 to $21.49 on January 17. This surge comes after months of sustained declines, with a cumulative loss of 40% over the last 6 months and 54% over the past year.

Although the market has reacted positively to the rumors, many analysts warn that an acquisition may not be the definitive solution for Intel. According to Christopher Danely, a Citibank analyst, a purchase by Musk could destabilize the company even further, given his history of radical restructuring.

An Uncertain Future for Intel

Despite the rise in its stock price, Intel faces an uncertain path ahead. Once the pillar of technological innovation, the company now struggles to remain relevant in a rapidly changing market. A potential acquisition, whether by Musk or another entity, could mark a new chapter in its history but also raises questions about its ability to regain the trust of consumers and strategic partners.

Meanwhile, the tech sector watches closely for the next moves, aware that any decision regarding the future of Intel will have significant repercussions in the global semiconductor industry.

Reference: El chapuzas informático, wccftech, and X. Image generated with Grok.